PAST WEEK'S NEWS (Mar 28– April 3, 2022)

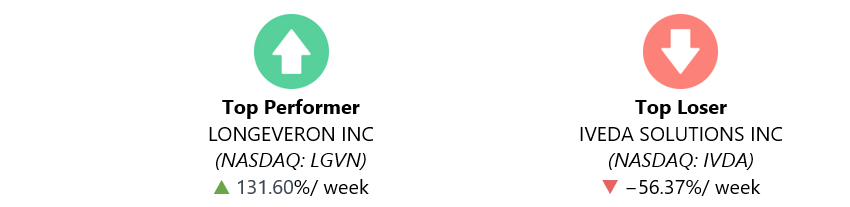

Longeveron Inc. shares are trading higher for the week after the company announced the publication of results from a Phase 1 trial testing Lomecel-B on patients with mild Alzheimer's disease met its primary endpoint. The data provided indications supporting further exploration of Lomecel-B, to potential slow cognitive decline and improve quality of life in patients with Alzheimer's.

Iveda Solutions, Inc. meanwhile was down, falling more than 50% to $3.77 as the company reported pricing of $8.0 million public offering, uplisting to Nasdaq and reverse stock split.

Stocks Performance

The major indexes ended mixed for the week, fluctuated over the week in apparent response to the evolving situation in the war in Ukraine, higher inflationary pressures, a potentially more aggressive Fed, and as investors took profits and rebalanced for quarter-end.

The first two days of the week saw a continuation of positive momentum, amid reported progress in ceasefire talks. The market retraced those gains over the next couple of days, though, as Russia refuted progress in talks with Ukraine. Mixed sentiment followed as data from the U.S. core PCE index for February showed sising to its highest level since 1983, with the March employment report fueled expectations for a more hawkish Fed.

The bond market also been closely watched after the 10-years and 2-years yield spread briefly inverted for the first time since 2019, raised concerns surrounding a Fed policy blunder. On Tuesday, the yield of the 2-year U.S. Treasury bond rose above the yield of the 10-year bond. Such an inversion is an indicator of concerns about short-term interest-rate increases as well as the possibility that a recession could loom ahead.

The week also marked the end of the first quarter. Overall, it has been a disappointing start to the year for investors. Looking back, the notable events during the quarter include global central banks starting to raise interest rates, bond yields moving significantly higher, oil prices breaking above $100/bbl, higher inflation, many equity markets suffering corrections and, on the geopolitical side, the invasion of Ukraine by Russia. It was a quarter of shock and awe.From a sector perspective, the cyclically sensitive stocks underperformed as investors girded for a slowdown in growth, led by financials, energy, and industrials sectors. While the defensive-oriented real estate, utilities, and consumer staples sectors outperformed with decent gains.

Indices Performance

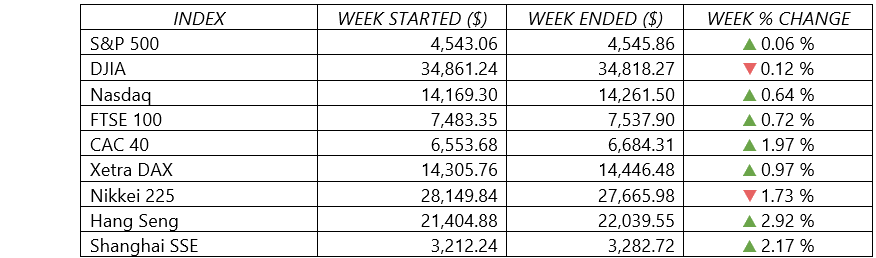

The major U.S. stock indexes faced some volatility for the week, started on a positive note but reversed course on Wednesday and Thursday, leaving the indexes little changed overall.

While the invasion in Ukraine continues, European equity markets have been responding very positively to any news of a potential negotiated end, gained ground in a choppy week of trading.

Japanese stock markets meanwhile fell over the week, as worries about global inflation and the impact of interest rate increases weighed on risk appetite. Chinese markets gained for the week, as investors anticipated that Beijing would step in to support more of the country’s economy and markets.

Crude Oil Performance

Both the benchmark contracts recorded their biggest weekly loss in two years, with the U.S. WTI retreated below $100 mark after the U.S. and other IEA nations said they will release oil from their strategic reserves to combat inflationary pressures.

U.S. President Joe Biden on Thursday announced a release of one million bpd for six months starting in May. That will be the largest release ever from the U.S. Strategic Petroleum Reserve (SPR). The announcement followed by the International Energy Agency meeting on Friday. The IEA said the volume will be made public this week.

On a related note, OPEC+ also agreed to increase its output targets by 432,000 barrels per day in May.

A truce in Yemen also sparked hopes that supply issues in the Middle East could abate. The United Nations has brokered a two-month truce between a Saudi-led coalition and the Houthi group aligned with Iran for the first time in the seven-year conflict. Saudi oil facilities have come under attack by the Houthis during the conflict, adding to supply disruption from Russia.

Demand concerns in China, the world's top oil importer, persist as its most populous city, Shanghai, has extended COVID-19 lockdowns.

Other Important Macro Data and Events

Portions of the Treasury yield curve inverted over the week, which is a viewed as a harbinger for a recession between 6-24 months after the inversion. By week's end, the 2-yr yield was up 14 basis points to 2.43%, and the 10-yr yield was down 11 basis points to 2.38%. Though according to some, correlation between an inversion and a looming recession may not necessarily hold, as investors appeared to be favouring longer-dated Treasuries due to signals that the Fed may hike official short-term rates by 50 basis points in May.

The U.S. dollar index meanwhile increased 0.2% to 98.56, as foreign exchange investors were seeking refuge against market uncertainties. The yen on the spotlight for the week as it weakened to its lowest level in over six years against the U.S. dollar, on expectations of divergent monetary policy between the BoJ and other major central banks.

Core eurozone bond yields fluctuated over the week but ended the period roughly level. Higher-than-expected inflation data boosted expectations for further interest rate increases and drove yields higher. The move reversed as optimism over Russian-Ukrainian peace talks faded and ECB chief economist Philip Lane said that the ECB should be ready to revise policy should macroeconomic conditions deteriorate significantly. UK gilt yields fell in line with U.S. Treasuries, which declined on geopolitical tensions and fears of a recession.

In economic news, the week brought several closely watched reports, most of which came in roughly in line with consensus expectations. The most prominent may have been the March nonfarm payrolls report, which showed that job gains fell somewhat below expectations at 431,000 versus 490,000. The unemployment rate fell to 3.6% from 3.8%, and wage growth rose to 5.6%.

PCE inflation meanwhile rose to the highest annual level since 1983. Core inflation came in at 5.4% for February, slightly below expectations of 5.5%. While inflation continues to run hot, the indicators continue to come in at or slightly below expectations, which may signal that the markets have started to price in higher inflation appropriately.

Meanwhile in Europe, the preliminary estimates showed that the eurozone’s annual inflation rate soared to a record 7.5% in March, compared with 5.9% in February. The increase was driven mainly by the upsurge in energy prices. The unemployment rate dropped to a record low of 6.8% in February, as the economy continued to recover from the lifting of coronavirus lockdowns.

The UK economy grew more quickly than previously thought in the Q4 of 2021, with the rate of expansion revised higher to 1.3% from the previous estimate of 1%. However, the increase was mainly due to coronavirus-related activity in the health sector.

China’s PMI for manufacturing and services lagged forecasts and fell into contraction in March as outbreaks of the omicron variant of the coronavirus across the country led to lockdowns and disrupted industrial production. Shanghai saw a renewed COVID-19 outbreak with more than 32,000 cases reported in the past month, the biggest spread of infection in China since it first appeared in Wuhan.

Russia’s war against Ukraine continued, though there were hopes for a diplomatic end to the conflict based on what one Russian representative deemed “constructive” ceasefire negotiations on Tuesday between the warring parties in Istanbul, Turkey. Negotiations appear to have brought some very preliminary mutual understanding on a few issues, including discussions on Ukraine’s adoption of a permanent neutral and non-nuclear status, as well as agreement on Ukraine’s application for European Union membership.

President Vladimir Putin signed a decree stipulating foreign buyers must pay for Russian natural gas in rubles from April 1 onward, raising concerns about possible supply disruptions in Europe and the potential economic implications. The G-7 countries unanimously rejected the directive. Germany said it would continue paying for Russian energy in euros and set in motion an emergency plan for rationing natural gas in case deliveries cease or are curtailed.

What Can We Expect from the Market this Week

Investors will keep watching for the latest developments in the war headlines, hawkish U.S. monetary policy, shifts in Chinese economic policy, ongoing uproars in commodity markets, as well as facing new challenge with an inverted yield curve.

Headline inflation will likely climb even higher in the next one to two months, as the recent moves higher in oil and commodity prices have not yet been reflected in inflation measures.

Against that backdrop, next week's release of the minutes of the last Federal Reserve minutes will be watch very closely for the line of thinking on rate hikes and plans to shrink the balance sheet. Economic reports of note due in also include updates on factory orders, consumer credit, PMI prints, trade balance and jobless claims.

Earnings nearly grind to a halt with another few weeks to go until Q1 reports roll in.