PAST WEEK'S NEWS (October 13 – October 17)

As the U.S. government shutdown enters its third week, the economy is in an estimated $15 billion deficit per week, according to Treasury Secretary Scott Bessent. To maintain critical services during the impasse, President Trump signed an executive order directing the Pentagon to use "any funds appropriated by Congress" remaining from Fiscal Year 2026 to ensure 1.3 million active-duty military personnel receive their paychecks, addressing one of the most politically sensitive aspects of the shutdown. The administration has also repurposed $8 billion in military research and development funds for military payroll and is using tariff revenue to sustain the WIC anti-hunger programme for women, infants, and children. However, these stopgap measures may face legal challenges as experts question whether the administration is violating laws governing how and when the executive branch can redirect congressionally approved funding, while the shutdown continues to cause nationwide flight delays, IRS closures, and disruptions to federal services.

The breakthrough needed in U.S.–China trade war has collapsed spectacularly. Just weeks ago, optimism was high as American lawmakers left Beijing hyping a massive deal for China to buy 500 Boeing jets, a multi-billion-dollar order that U.S. Ambassador David Perdue called “very important to the president.” It would have been Boeing’s first major sale to China since Trump’s first term and a clear sign of thawing tensions. But on October 9th, everything changed. Beijing stunned Washington by imposing its strictest rare earth export controls, forcing foreign firms to seek Chinese approval for any product containing even 0.1% of Chinese-origin rare earths, effectively weaponizing its near-monopoly over 90% of the global supply. President Trump retaliated the next day, threatening 100% tariffs on all Chinese goods and restrictions on Boeing exports to China, accusing Beijing of trying to “clog the markets". Analysts say China’s timing was no accident. With a Trump–Xi summit approaching, Beijing appears to be tightening its grip on critical minerals to gain leverage. But experts warn the gambit may have backfired, pushing even a deal-driven White House past its breaking point and setting the stage for mutually assured disruption.

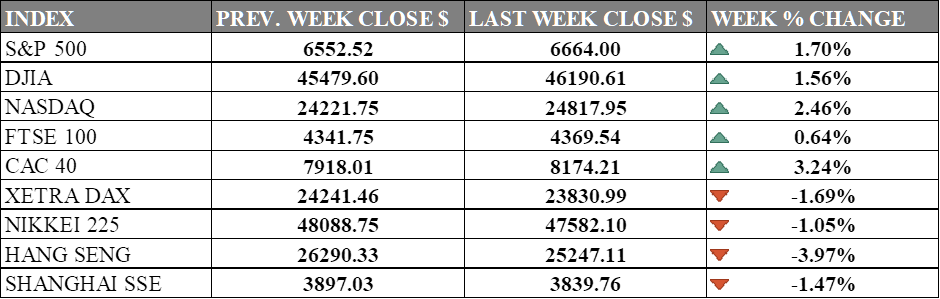

INDICES PERFORMANCE

Wall Street's major indices rebounded this week after the previous week's decline, with technology stocks leading the recovery. The S&P 500 rose 1.70% to 6,664.00, while the Dow Jones Industrial Average gained 1.56% to 46,190.61. The Nasdaq outperformed with a 2.46% advance to 24,817.95, as investors returned to growth stocks following the easing of trade tensions.

European markets showed mixed performance across the region. The UK's FTSE 100 posted a modest gain of 0.64% to 4,369.54, while France's CAC 40 surged 3.24% to 8,174.21, marking the strongest performance among major European indices. However, Germany's XETRA DAX bucked the regional trend, declining 1.69% to 23,830.99, as investors weighed domestic economic challenges.

Asian markets continued to face headwinds this week. Japan's Nikkei 225 slipped 1.05% to 47,582.10, giving back some of the previous week's strong gains as profit-taking emerged. Hong Kong's Hang Seng Index extended its losses with a sharp 3.97% decline to 25,247.11, reflecting persistent concerns over the regional economic outlook and deteriorating risk sentiment. China's Shanghai Composite fell 1.47% to 3,839.76, reversing the previous week's stability amid renewed pressure on mainland equities.

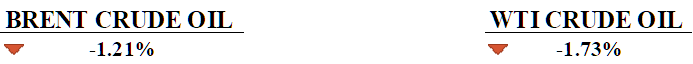

CRUDE OIL PERFORMANCE

Crude oil prices slipped for a third consecutive week, with Brent and WTI settling at $61.33 and $57.24 per barrel respectively, as geopolitical tensions eased and supply concerns mounted. The International Energy Agency warned of a growing global oil supply glut in 2026, while U.S. crude inventories rose by 3.5 million barrels to 423.8 million with lower refinery utilization and record-high production of 13.636 million barrels per day. Even with a temporary ceasefire in Gaza and plans for a Trump-Putin summit on Ukraine, analysts cited rising trade tensions between the U.S. and China as a key risk to global growth and oil demand. Citi’s bearish forecast of $50 Brent was dismissed by some as a narrative shift rather than a new outlook, given OPEC+ restraint and steady Chinese demand. A fire at BP’s Whiting refinery added localized pressure, spiking Midwest gasoline prices by up to 20 cents per gallon.

OTHER IMPORTANT MACRO DATA AND EVENTS

The U.S. budget deficit decreased by $41 billion driven by record tariff revenue and lower education spending, though higher healthcare, retirement, and debt interest costs limited progress toward fiscal sustainability.

China's inflation fell deeper in September with weak consumer demand and prolonged deflation, with both CPI and PPI dropping as stimulus measures fail to spark a sustained recovery.

What Can We Expect from The Market This Week

US CPI: The September inflation report has been delayed due to a government shutdown and is now scheduled for release on Friday. The most recent data showed annual inflation accelerating to 2.9%, the highest since January 2025, driven by food and energy prices.

Canada CPI: Canada's August inflation data showed price is at healthy level of 1.9%, slightly above July's 1.7% but still below the Bank of Canada's 2% target, with forecasts expecting September to remain around or just above 2%.

UK CPI: The Kingdom's prices held steady at 3.8% annual rate, maintained from July to August and the highest level since January 2024, with economists forecasting September inflation to rise to 4%, well above the Bank of England's 2% target.

UK Retail Sales: Consumption in the kingdom is 2.3% higher in September, according to the British Retail Consortium, slowing from 3.1% growth in August, potentially due to budget tax rises and economic pressures. Food sales drove purchases, while clothing sales were slower due to mild weather.

US Existing Home Sales: The National Association of Realtors report shows August sales remained somewhat flat, falling 0.2% to a seasonally adjusted annual rate of 4.00 million units, continuing to hover near multi-decade lows with mortgage rates still above 6%.