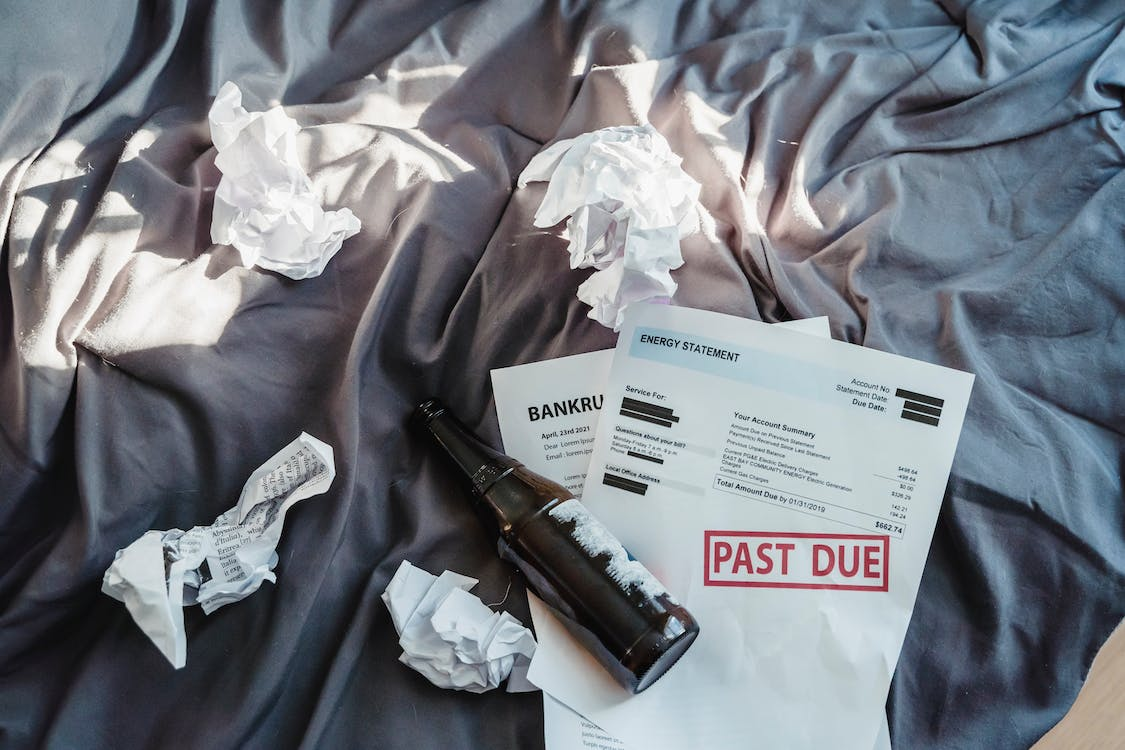

Sound the Alarm! Secretary Yellen of the US Treasury has come out and said that the US government may run out of money by mid-June due to low tax collections and hitting its $31 trillion debt ceiling. Without more borrowing, the government will default, leading to economic collapse. Republicans proposed raising the debt ceiling by $1.5 trillion until next year's end, cutting $130 billion in spending, and undoing Biden's policies, but the Democrats oppose it as the bill considered dead-on-arrival. With the Fed expected to increase interest rates, default risks are becoming closer to reality.

EQUITY

Investors are anxiously awaiting the outcome of the Fed's two-day meeting, where they will make a decision on interest rates on Wednesday afternoon, causing U.S. stocks to decline. They will also be on the lookout for any indications of the Fed's thought process ahead of the next meeting in June. Moreover, reports of weaker job openings and factory orders imply that the upcoming rate hike this month may be the last.

GOLD

In the early hours of Asian trade, gold prices held steady due to a surge in safe haven demand triggered by concerns about a potential banking crisis and uncertainty over the Fed's monetary policy ahead of its rate decision. The price of gold may receive a boost if the Fed indicates a potential pause or announces it, as higher interest rates increase the opportunity cost of holding the metal.

OIL

Asian trade saw stable oil prices before the Fed meeting. However, concerns about worsening economic conditions caused a 5% drop on Tuesday, keeping prices at a five-week low. Weak manufacturing readings and fears of low crude demand offset the positive news of a bigger-than-expected draw in US crude inventories. Renewed concerns over a US banking crisis, a potential debt default, and a drop in Chinese manufacturing activity worsened the situation.

CURRENCY

The US dollar fell due to a decrease in job openings and an increase in layoffs for the third consecutive month in March. This could aid the Federal Reserve in handling inflation, but investors are anticipating the Fed's to hike by a quarter-point. The euro also dropped as eurozone banks are decreasing credit and inflation is declining, supporting a smaller rate increase by the European Central Bank.