EQUITIES

Asian shares started cautiously on Monday. The Nikkei 225 and the Shanghai composite slipped -0.34% and -0.16%, respectively. Meanwhile, most of other indexes reverse earlier losses. Hong Kong’s Hang Seng index was little changed at 0.07%, South Korea’s KOSPI 0.68% higher, Australia’s S&P/ASX 200 gained 0.13% and Singapore’s up 0.20%.

U.S. financial markets are closed for the Labour Day holiday on Monday.

OIL

Fading optimism about demand recovery amid the coronavirus pandemic weighed the price. Brent crude futures traded to $42.31 a barrel, while U.S. crude at 39.30.

On Friday, Brent closed at $42.66 per barrel, while WTI futures ended at $39.77 per barrel.

CURRENCIES

The dollar rallied to its highest in a week at 93.242 against a basket of six major currencies on safe haven buying, but later retraced its gains as U.S. stock indexes recovered.

The dollar index was little changed on Monday at 92.87. Foreign exchange trading was likely to be subdued as U.S. financial markets are closed for the Labour Day holiday.

Among the Antipodean currencies, the Australian dollar edged lower to $0.6707, while the New Zealand dollar last traded at $0.7283.

GOLD

Gold currently trading at $1,936.30 per ounce, while stands around $1,942.30 per ounce for gold futures. Previously closed at $1,934.80 and $1,934.30, respectively.

Silver trading at $27.08, platinum trading at $900.00 and palladium trading at $2,195.00.

ECONOMIC OUTLOOK

Asian shares were on the defensive on Monday as investors grappled with sky-high valuations against the backdrop of a global economy in the grip of a deep coronavirus-induced recession while oil prices dropped sharply.

Oil prices dropped more than $1 a barrel, hitting their lowest since July, after Saudi Arabia made the deepest monthly price cuts for supply to Asia in five months. Asia is Saudi Arabia's largest market by region.

U.S.-China tensions anew, as U.S. President’s administration is considering imposing export restrictions on SMIC, China’s largest manufacturer of semiconductors, according to a Défense Department spokesperson. The stock plunged nearly 20% in early trade.

China’s exports in August rose, increasing by 9.5% from a year earlier, though imports dropped 2.1%, customs data showed on Monday.

To date, number of confirmed worldwide cases for COVID-19 pandemic has surpassed 27 million affecting 213 countries and territories around the world and 2 international conveyances, recording more than 887 thousand fatality globally.

TECHNICAL OUTLOOK

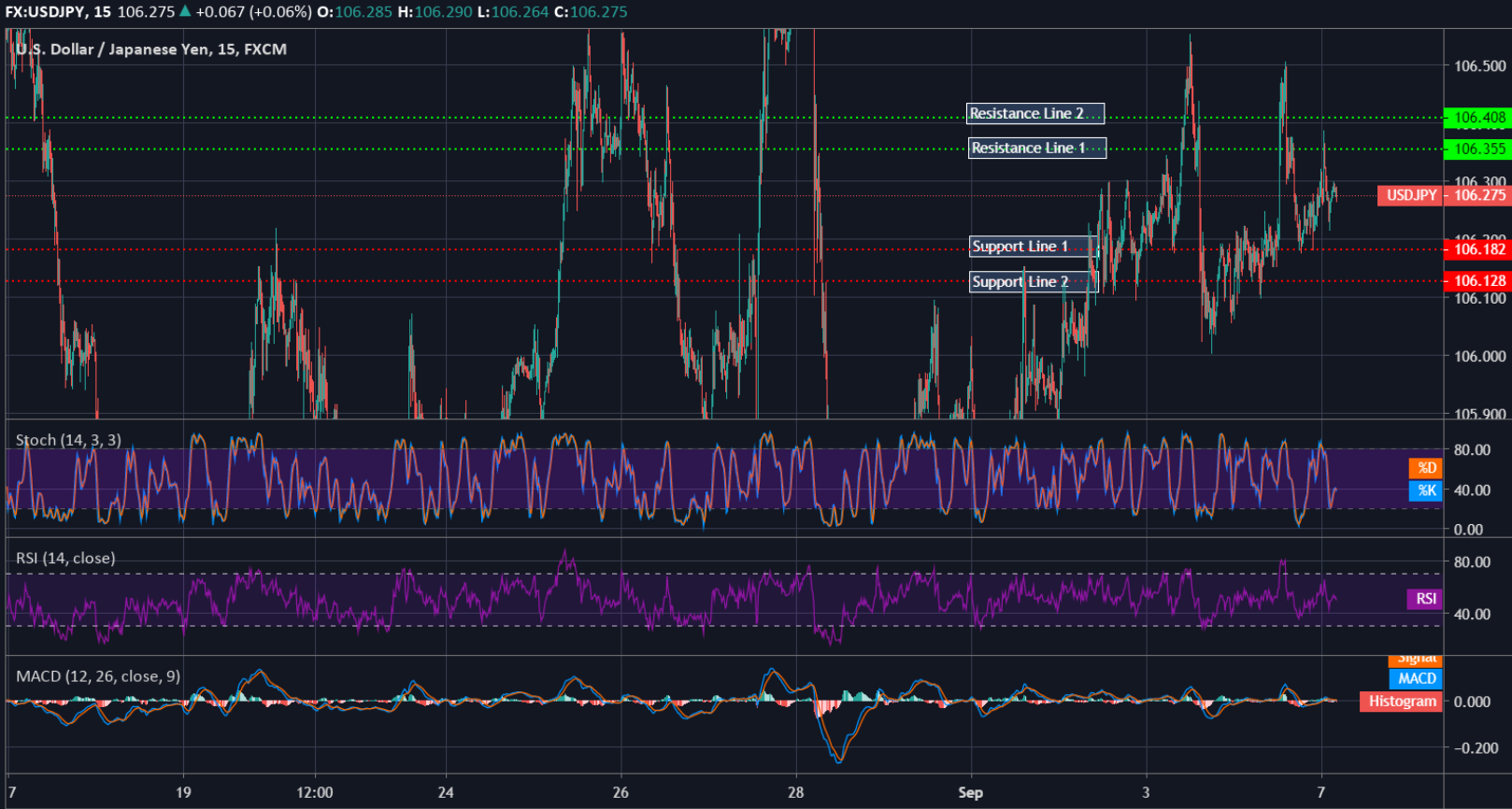

[USDJPY]

Important Levels to Watch for Today:

- Resistance line of 106.355 and 106.408.

- Support line of 106.182 and 106.128.

Commentary/ Reason:

-Against the yen, the dollar traded at 106.27.

-USD/JPY moved slightly higher on a Bloomberg report that said the BOJ at this month's policy meeting would acknowledge that Japan's economic slump has bottomed, rather than indicate optimism about the economic outlook.