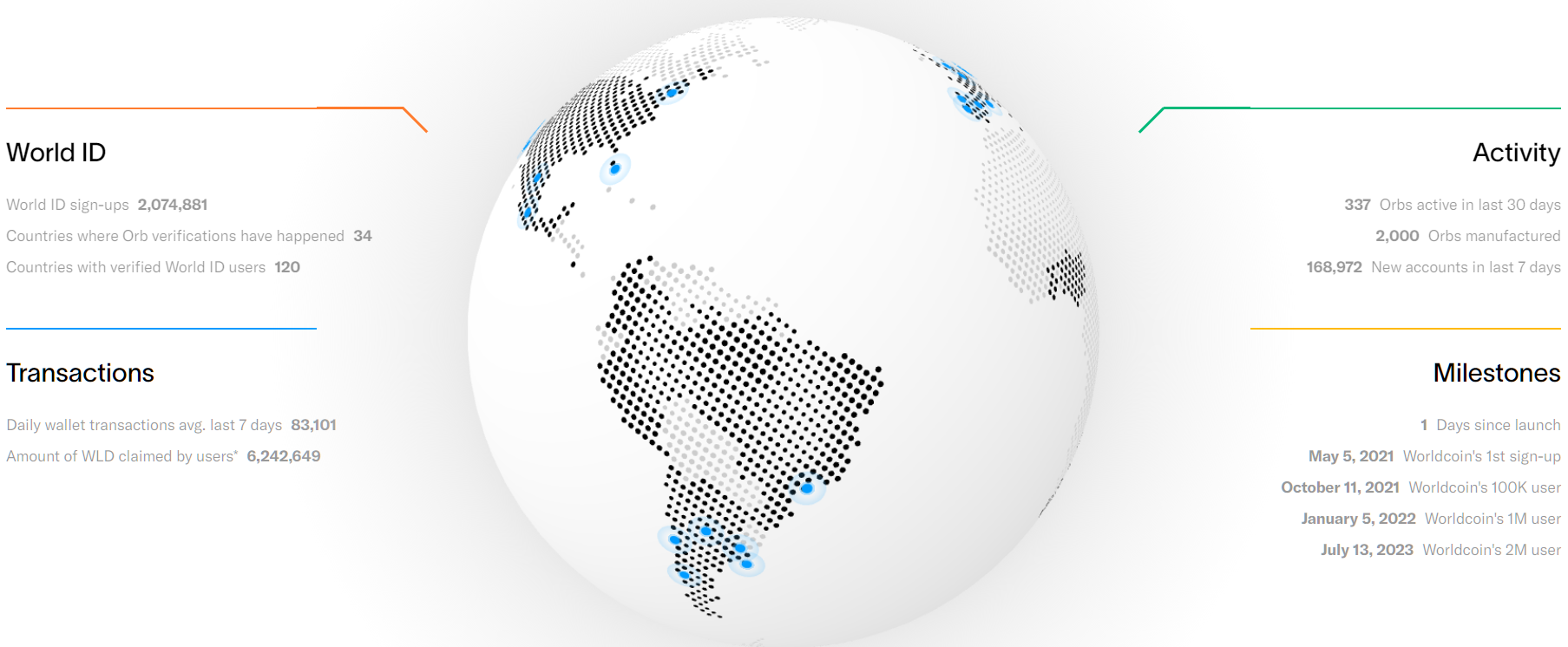

Worldcoin, a new project by OpenAI CEO Sam Altman, is scanning people's eyeballs globally in exchange for digital IDs and a promise of free cryptocurrency, but privacy advocates warn it could become a "privacy nightmare." Many users are intrigued by the futuristic technology and financial incentives, often overlooking privacy policies and regulators' concerns in their eagerness to get the free crypto tokens worth $2.5 on the open market. Though Worldcoin claims biometric data is secure, privacy groups caution that eye scans could increase state and corporate control over individuals. This little stunt not only garnered the attention of crypto players but may trigger concerns among regulators as to the complexity of the newly developed systems and regulatory framework around them.

EQUITY

The Nasdaq closed higher Tuesday after positive earnings from Alphabet and Microsoft on the AI craze, as Investors expect AI will offset slowing cloud growth. The Dow edged up for the 13th day in a row, though Boeing limited gains. Materials stocks rose as China pledged support for commodities, which saw metal prices rise. Hong Kong's exports and imports fell, and the government expects exports to face intense pressure soon.

GOLD

Gold held steady as traders awaited central bank meetings this week from the Fed, ECB, and Bank of Japan. The Fed is expected to keep rates in the 5.25%–5.50% range until 2024. The dollar and Treasury yields remain near multi-week highs, limiting gold's attractiveness. China's net gold imports via Hong Kong fell 29% in June to a 5-month low, reflecting a sluggish economic recovery in the top consumer market.

OIL

Oil prices eased slightly after hitting three-month highs after industry data showed an expected rise in U.S. crude stockpiles. However, losses were limited as the global oil supply tightened and China pledged economic stimulus. Further gains are expected this summer with tighter supplies.

CURRENCY

The U.S. dollar fell slightly on Tuesday ahead of major central bank meetings this week, having bounced back from 15-month lows last week thanks to a resilient U.S. economy and weakness in Europe. But with the Fed, ECB, and BOJ set to meet, forex volatility is expected to remain high as markets eagerly await any guidance on the monetary policy outlook. In a news report, the IMF advised the Bank of Japan to prepare for monetary tightening and move away from yield control.