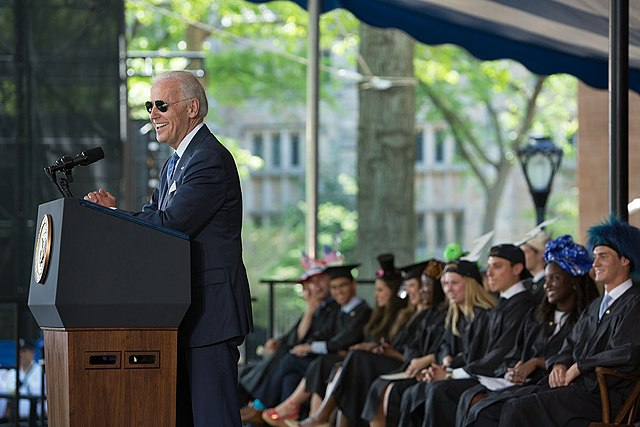

Never give up; never back down. The Biden administration announced a major overhaul of income-driven repayment plans for federal student loans. The new plan aims to provide relief to millions by cutting monthly payments in half to 5% of discretionary income, preventing unpaid interest from causing balances to grow, and forgiving loans in 10 years instead of 20–25. The changes come as part of President Biden's efforts to deliver student debt relief through regulatory action after his broad cancellation plan was blocked in court. Officials say the repayment overhaul will cut lifetime payments by 50% on average for black, Hispanic, Native American, and Alaska Native borrowers. It is yet to be determined whether history will repeat itself or whether a presidential veto will be invoked, but some analysts suggest that student repayment will be a strong trigger for the recession.

EQUITY

Stocks traded unevenly on Tuesday as investors grew anxious about interest rates ahead of Fed Chair Powell's speech. Banks dragged down the broader market after credit downgrades, while retail took a hit as department stores like Macy's posted weak earnings. The tech sector was mixed going into Nvidia's closely-watched earnings report, with the chipmaker's guidance expected to set the tone. Microsoft proposed concessions to ease UK antitrust concerns over its Activision acquisition.

GOLD

Gold prices gained to $1900 on Wednesday as the dollar and yields retreated, stabilising the metal ahead of a symposium that may hint at interest rates. Prices extended a three-day rally Tuesday as yields slipped from 16-year peaks but stayed near 2007 highs. Traders now await the Jackson Hole speech for monetary policy clues after mixed signals from the Fed minutes.

OIL

Oil prices edged up slightly in Asian trading Wednesday as markets weighed concerns over weak demand from top importer China and potential further US rate hikes against tightening supply from OPEC+ cuts and declining US crude inventories. However, an expected resumption of Iraq-Turkey oil flows, economic weakness in China, and a stronger dollar could limit gains. Both WTI and Brent settled marginally lower Tuesday amid uncertain demand outlooks and signs of easing supply tightness.

CURRENCY

Asian currencies mostly edged higher on Wednesday as the region showed some economic resilience, but the dollar held steady near two-month peaks ahead of the Jackson Hole summit, which could signal the Fed's next policy moves. China tried to prop up the yuan after its slide to nine-month lows, though worries still loomed about the country's decelerating growth that has yet to show promise. Japan's yen stayed under pressure, with investors eyeing whether Tokyo would intervene.