EQUITIES

Asia-Pacific markets were higher in Wednesday trade. Japan’s Nikkei 225 led the gains advancing 2.12%. Korea’s KOSPI jumped 0.86%, Singapore’s Straits Times index up 0.81%, and mainland Chinese stock, the Shanghai composite at 0.03% higher.

Meanwhile, Hong Kong Hang Seng at retreated -0.03%, and Australia’s S&P/ASX 200 down 0.30%.

Overnight on Wall Street, the Dow Jones Industrial Average closed 554.98 points higher at 27,480.03. The S&P 500 rose 1.8% to finish its trading day at 3,369.16 while the Nasdaq Composite jumped 1.9% to close at 11,160.57. It was the second-best presidential Election Day performance for the S&P 500.

OIL

Oil prices gained about 2% as financial markets staged a broad recovery despite growing concerns that a second wave of the virus in Europe and the U.S. and rapidly recovering Libyan crude production have weighed on oil prices over the last couple of weeks.

Currently, Brent crude futures traded to $40.53 a barrel, while U.S. crude at $38.49.

On Monday, Brent closed at $39.71 per barrel, while WTI futures ended at $37.66 per barrel.

CURRENCIES

The dollar index, which tracks the greenback against a basket of major currencies, stood at 93.87, flat on the day. After recording a 1-month high on Monday, it shed 0.9% on Tuesday, the biggest daily drop since late March as traders had bet on a Biden victory.

The offshore Chinese yuan, seen as a currency that has much to lose if Trump wins due to his hawkish stance on China on trade and several other issues, fell 0.8% to 6.7362 to the dollar, hitting one-month low at one point. The Mexican peso fell almost 4% and last traded at 20.905 per dollar.

The Australian and Canadian dollar more than 1% at one point, last at $0.7090 and C$1.3218 against dollar, respectively.

GOLD

Gold ran into profit taking on Wednesday, losing earlier gains. Spot gold currently trading at $1,898.80 per ounce, while stands around $1,900.80 per ounce for gold futures. Previously closed at $1,908.50 and $1,910.40, respectively.

Silver trading at $23.80, platinum trading at $856.00 and palladium trading at $2,157.00.

ECONOMIC OUTLOOK

Global equity markets traded cautiously on Wednesday as all eyes is on the outcome of the U.S. presidential election. Current results showing former Vice President Biden leading.

Australia’s retail turnover fell 1.1% in September

New Zealand’s unemployment rate increased to 5.3% in the Q3, compared from 4% before.

China’s Caixin/Markit services PMI coming in at 56.8, growing in October.

Crude stockpiles fell by 8 million barrels last week to about 487 million barrels, the American Petroleum Institute showed on Tuesday.

To date, number of confirmed worldwide cases for COVID-19 pandemic has surpassed 47.404 million affecting 213 countries and territories around the world and 2 international conveyances, recording more than 1.213 million fatality globally.

TECHNICAL OUTLOOK

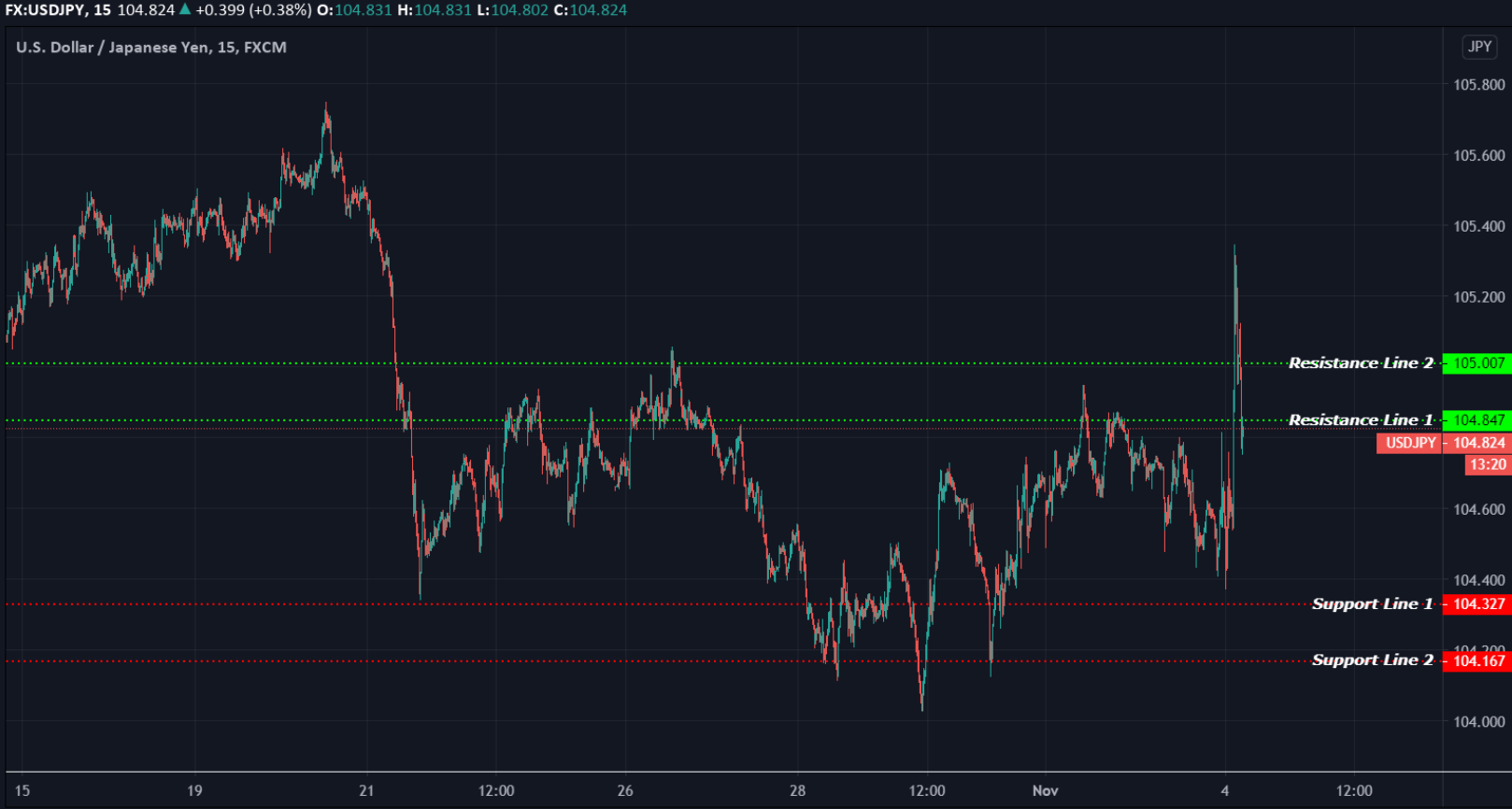

[USDJPY]

Important Levels to Watch for Today:

- Resistance line of 104.847 and 105.007.

- Support line of 104.327 and 104.167.

Commentary/ Reason:

- The dollar spiked up earlier in the day to 105.341 to 1-week high, before pulled back, last traded at 104.835.

- A rally in U.S. stock indexes is negative for the yen since it reduces safe-haven demand for the yen. However, the yen still has a safe-haven appeal on the risk of U.S. political uncertainty after today's U.S. election.

- On online meeting earlier today, BoJ Governor Haruhiko Kuroda said the central bank will work closely with financial authorities to help keep currency moves stable, adding he was watching on how the outcome of the U.S. presidential election could affect markets.

- Kuroda also said on that he saw no need to change the central bank’s monetary policy framework for the moment.