Throughout the past century or so, gold has represented an asset which protects investors, corporations and countries against inflationary pressures.

Time and time again, the precious metal was used as a hedge against economic recessions and uncertainty, but this may not be the case in the modern era of volatility, high inflation and increasing pessimism.

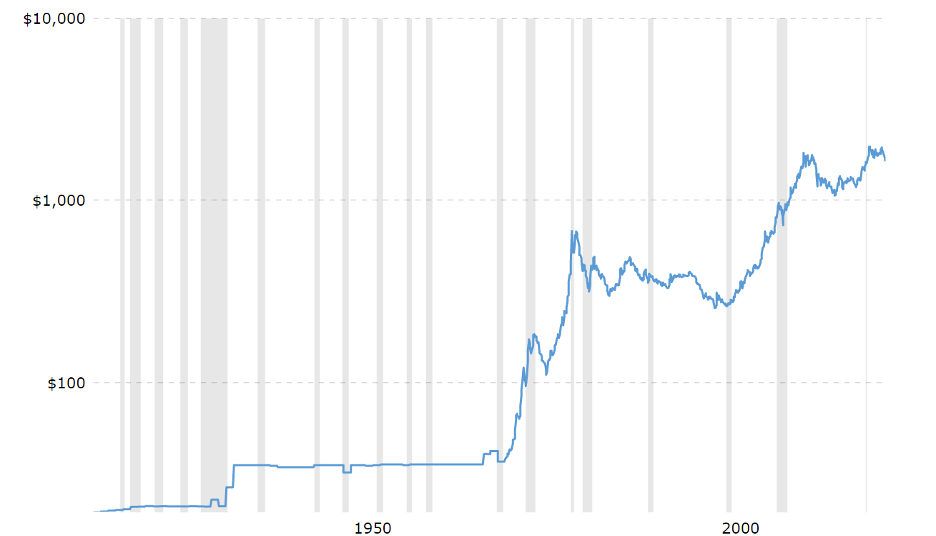

As seen in the chart above provided by Macrotrends, the price of gold relative to the U.S. dollar has been accelerating exponentially over the last hundred years, especially since 1975.

The grey areas represent recessions, and it can be noticed that the value of the bullion propels higher when economies are swimming in calamity. This is because gold is regarded as an asset which protects against macroeconomic contraction.

The Great Recession of the 1930’s, Dot-com bubble of the early 2000’s, the stock market crash of 2008 and the COVID-19 pandemic are all examples of economic recessions which witnessed the rise of the precious metal and the fall of dollar-backed assets such as equities, bonds, and real estate.

Is Gold Still a Safe Haven?

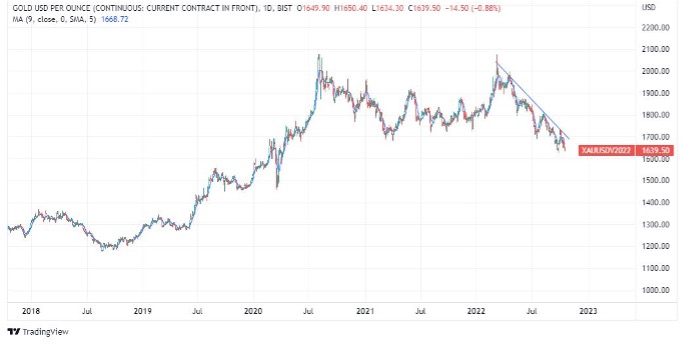

It’s not very easy to answer this question. The trajectory of gold has been downward-trending since the start of the year, as can be seen in the chart provided by TradingView.

Macropolitical unrest, growing pessimism and sky-high inflation has swayed investors away from dollar-backed assets, but gold as well. Typically, investors would go on a gold rush in times of fear and volatility, and head towards the yellow metal for safety.

Now, in the modern era of high pessimism and short-lived rallies, investors are skeptical to invest even in safe havens. The Japanese Yen, a currency regarded as a safe haven as well, has plummeted to 20-year lows at some point, and still isn’t seeing the brighter side of day.

So, what now?

Gold is gold, and bullion fanatics believe in the value and potential of gold as a final resort when things turn sour. Analysts believe that as markets begin to recover, gold may witness a surge in value once again.

The coalition between Brazil, Russia, India, China and South Africa (BRICS) plan to create a currency backed by gold, which is not linked to the U.S. dollar greenback. It’s meant to rival the USD amid macropolitical turmoil, and since nations believe in it, investors and traders will eventually follow suit.

It’s the time for gold to shine, sooner or later. Much of gold’s future direction would depend on what happens next in the Russia-Ukraine conundrum, China’s initiatives on ‘peacefully’ taking over Taiwan, and how red-hot inflation across many regions plays out in the coming months.

Prepared by team of Goldenbrokers