PAST WEEK'S NEWS (APRIL 03 - APRIL 07, 2023)

The U.S. stock market saw a relatively narrow range in trading during the holiday-shortened week leading up to Friday's monthly jobs report, with the S&P 500 slipping slightly while the Dow added some gains.

The monthly jobs report showed a gain of 236,000 jobs in March, marking the 27th straight month of solid job growth, with unemployment dropping to 3.5% and wages rising moderately.

However, expectations are low for the Q1 earnings season, with analysts predicting average earnings decrease of 6.8% for S&P 500 companies compared to the same period last year.

Meanwhile, the price of gold extended its recent rise, trading as high as $2,037 per ounce on Thursday, up about 12% since its recent low on March 8.

INDICES PERFORMANCE

Most of the indices had a relatively flat week, with minor gains or losses.

The S&P 500, FTSE 100, and DJIA is the only indices that gain during the week, with all other indices suffer slight loss.

US Market are performing better than other after jobless claims reported higher, pricing in next Fed action in May. However, first quarter corporate profit are expected to drop 6.8% from the same period a year earlier.

China market fall over Taiwan tensions as report saying multiple warships surrounding the island performing military simulated precision strikes.

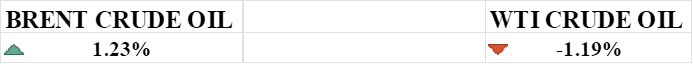

CRUDE OIL PERFORMANCE

OPEC decision to cut additional 1.16 million barrels per day that shocks the market sent price of crude that continues with short trading range as investor weighing the effect of supply shortage and the value of dollar as expectations of rate pause is nigh.

OTHER IMPORTANT MACRO DATA AND EVENTS

For the fourth time in five weeks, the returns on U.S. government bonds decreased, failing to build upon the progress made in the prior week. On Friday, the yield of the 10-year U.S. Treasury bond declined significantly to approximately 3.29%, which marks a substantial drop from its peak of 4.07% on March 2.

the price of gold has been steadily increasing, crossing the $2,000-per-ounce threshold on Tuesday and peaking at $2,037 on Thursday. This surge reflects a substantial rise of about 12% since the metal hit a recent low on March 8th.

the government reported a monthly increase of 236,000 jobs in the US, which is the smallest gain since December 2020. However, it is the 27th consecutive month of steady job growth. Additionally, unemployment went down to 3.5%, and wages moderately increased by 0.3% in March compared to February.

Low expectations loom over the earnings season as major banks begin reporting their first-quarter results. Analysts predict a 6.8% average earnings decrease for S&P 500 companies, marking the most significant decline since Q2 2020.

What Can We Expect Form The Market This Week

The US Consumer Price Index; excluding food and energy, increased 0.5% last month and 5.5% from a year earlier. The current consensus is 0.4% for March and 5.6% YoY.

Bank of Canada Interest Rate Decision: The BoC announced that it will hold the key interest rate at 4.50% for the first time in over a year on March 8th, 2023. Canada’s inflation rate has dropped to 5.2%, which is the largest deceleration since April 2020.

Crude oil inventories: The consensus for crude oil stands at -2.329M after a shocking drop at the end of March and slightly lower on April 5th.

Initial jobless claims: initial claims for state unemployment benefits dropped 18,000 to a seasonally adjusted 228,000 for the week ended April 1st, and the current expectation is 205,000, indicating a strengthening labour market.

Retail sales: retail sales fell more than expected last month and are expected to fall by the same amount this month. Slowing retail sales may affect GDP as slowing economies settle in.