PAST WEEK'S NEWS (JUNE 26 – JUNE 30, 2023)

Apple has become the first publicly traded company to reach a market value of $3 trillion, and the first to end a trading day above that mark. The milestone was achieved after Apple's shares rose to a record price of $193.97, resulting in a market capitalization of $3.05 trillion. This accomplishment is particularly noteworthy given the challenging economic conditions and funding difficulties faced by the tech industry. The surge in Apple's stock price can be attributed to the success of products like the Apple Vision Pro and strong quarterly earnings. This achievement sets a new benchmark for the technology sector and demonstrates the power of innovation and strategic execution. Apple's stock has risen 49% year-to-date, contributing to the Nasdaq's best first-half performance in four decades.

The Supreme Court has rejected President Joe Biden's student loan forgiveness program, blocking millions of borrowers from receiving up to $20,000 in federal student debt relief. The Biden administration plans to pursue an alternative pathway to provide some student debt relief, but details have not been released. In the meantime, borrowers can still seek federal student loan forgiveness through existing programs and a new income-driven repayment plan. Student loan payments are set to restart in October, but there will be a 12-month on-ramp period to help borrowers transition back into repayment without facing penalties. It is expected to erase $200 billion from the wide market as debt repayment withdraw consumers ability to purchase.

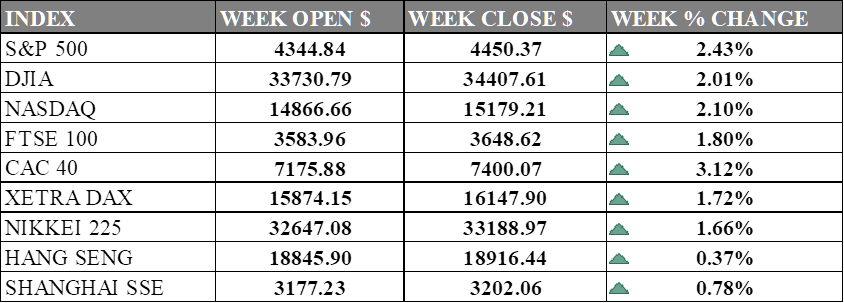

INDICES PERFORMANCE

Global stock markets had a positive week, with all nine indices ending higher than they started. The gains were driven by several factors, including easing inflation concerns, strong corporate earnings, positive economic data, and hopes for more fiscal stimulus in certain regions. The CAC 40 index in France had the highest percentage gain as Investors expressed their approval as new data revealed a decrease in inflation in France to its lowest point in 15 months, reaching 4.5% in June. Additionally, in the Eurozone, inflation dropped to its lowest level since January 2022, leading to positive reception from investors. The S&P 500 index in the United States followed closely behind with its most robust performance since 2019. Despite concerns among many investors about an imminent U.S. recession, the likelihood of it occurring seems to be continuously diminishing, raising uncertainty about the momentum of the stock market rally for the remainder of 2023.

On the other hand, the Hang Seng index in Hong Kong had the lowest percentage gain, along with the Shanghai SSE index in China as it bounced back from the losses observed in the previous two week. This upward movement was supported by widespread gains across various sectors, including basic materials, consumer goods, industrial companies, and financial institutions, leading to a robust rally. The NASDAQ index in the US had the highest absolute gain, benefiting from strong performance in technology stocks. The DJIA index in the US also saw significant gains across various sectors. The NIKKEI 225 index in Japan had a modest gain although Japan witnessed its first decline in industrial output since January, with a month-over-month decrease of 1.6%. This contraction exceeded the predicted consensus of a 1% drop.

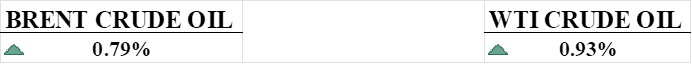

CRUDE OIL PERFORMANCE

July brings anticipation and speculation to the crude oil market. The Saudi oil minister plans additional output cuts to raise prices, potentially reaching highs of $90 per barrel for Brent. The upcoming OPEC seminar, barring coverage from major news outlets, will provide insights into the Saudis' plans. Expectations for the second half of the year include significant production cuts by Saudi Arabia, leading to higher oil prices. The Federal Reserve closely monitors economic indicators, and while GDP growth remains positive, concerns about inflation may prompt another interest rate hike in July.

OTHER IMPORTANT MACRO DATA AND EVENTS

The decline of inflation in the eurozone persists, with expectations for Eurozone CPI to decrease to 5.5% in June, marking a drop from 6.1% in May and slightly below the consensus forecast of 5.6%. Headline inflation has reached its lowest point since January 2022.

The US Core PCE Price Index, the Fed's preferred inflation measure, decreased in May, while the euro strengthened. The index dropped to 4.6% year on year, slightly lower than April's 4.7%, matching the consensus. On a monthly basis, it fell to 0.1% from 0.4%. Despite the decline in inflation, market rate pricing remains largely unaffected, as the CME FedWatch tool indicates an 88% likelihood of a 25-basis-point rate hike.

The United States' first-quarter gross domestic product (GDP) was revised upward to 2%, driven by increased exports and consumer spending, according to data from the Bureau of Economic Analysis. Household spending rose at a strong pace of 4.2%, the highest rate in nearly two years. However, the government's measure of economic activity, gross domestic income (GDI), fell at a 1.8% pace, indicating a second consecutive decline.

What Can We Expect from The Market This Week

Manufacturing PMIs: The US, Germany, and the UK are set to report on their manufacturing costs, which make up a significant portion of the worldwide economy. Manufacturing is expected to recover as inflation is moderating, as evidenced by the PCE Price Index reported last week and market rebound following its announcement.

RBA Interest Rate Decision: The Reserve Bank of Australia is expected to raise its rate by 25 basis points to 4.35% as its inflation rate is running high at 5.6% in June.

FOMC Meeting Minutes: The minutes will provide a clue as to the confidence of its members to either continue rate hikes or hold its rate as the PCE Price Index reported slowing inflation but still in safe positive territory, a soft landing that the Fed had hoped for.

Job Reports: The US is anticipating multiple economic data on the labour market, such as Nonfarm Payrolls, JOLT Job openings, the unemployment rate, and others. The condition of the labour market will be a guiding light for the interest rate decision in late July.

Crude Oil Inventories: The manufacturing sector is one of the biggest consumers of crude oil, and the current inventory paired with data from manufacturing will move the oil market in a volatile fashion.