PAST WEEK'S NEWS (JANUARY 29 – JANUARY 02, 2024)

The Treasury is maintaining its previously announced increment in long-term bond issuances for February through April. It doesn't currently anticipate needing further hikes over the next few quarters based on projected borrowing needs, providing some relief to bond markets that paint a bleak picture historically. However, the amounts issued will still be record highs. Meanwhile, the Fed's potential balance sheet adjustment could ease pressure on the Treasury's borrowing needs going forward. Overall, the exact timing of initial 2024 rate cuts seem less prioritized for longer-term investors than the expected 200-bp extent of easing over the full cycle.

Germany's GDP shrank 0.3% in the fourth quarter, incited by falling domestic spending and high inflation, especially energy costs, that could prompt another round of recession. Output has stalled over the past four years, which moves business leaders to urge Chancellor Scholz to reform the industry for global competition. Suggested reforms are cheaper electricity, modern infrastructure, and tax changes to aid struggling sectors. Approaching lower inflation by mid-2024 should let the ECB cut interest rates to relieve distressed industries like construction. Upcoming Germany's CPI should confirm a potential rate cut in its next meeting in March, which most central banks are expected to cut by then.

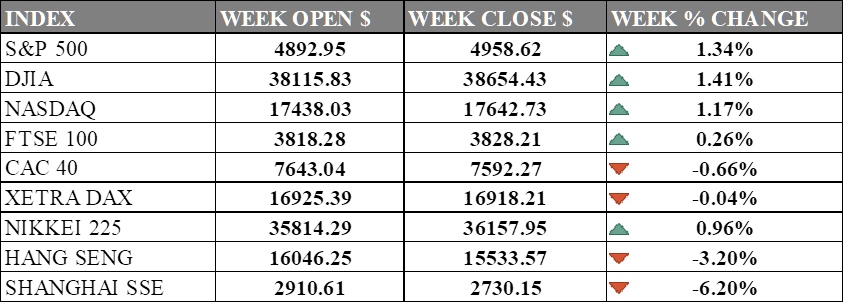

INDICES PERFORMANCE

The major U.S. stock indexes ended mostly higher last week, establishing new all-time highs albeit hawkish rhetoric as investor priced in March rate cut. The S&P 500 advanced 1.34% to close at 4958.62, up from its open of 4892.95. The Dow Jones Industrial Average rose 1.41% to finish at 38654.43 compared to its starting point of 38115.83. The tech-heavy Nasdaq jumped 1.17% to 17642.73 after opening the week at 17438.03. The optimism is driven by robust economic data, leading to a preference for trading in a strong economy with a lower possibility of rate cuts. The yield increase on the 10-year Treasury note did not hinder the equity market rally, as the MSCI World Index also reached record highs alongside the S&P 500.

In Europe, the major indexes were mixed. The UK's FTSE 100 rose 0.26% to close at 3828.21 compared to its open of 3818.28. France's CAC 40 fell 0.66% to end the week at 7592.27 after opening at 7643.04. Germany's XETRA DAX slipped 0.04% to settle at 16918.21 from its starting point of 16925.39. The head of surveys at ifo, Klaus Wohlrabe, mentioned that current attacks on commercial shipping in the Red Sea haven't significantly impacted raw material supplies, but potential further disruptions may arise due to transport route lengths and ongoing rail strikes in Germany.

Asian indexes were also mixed on the week. Japan's Nikkei 225 rose 0.96%, closing at 36157.95 versus its open of 35814.29 in tandem to US stock following positive earnings reports from Meta and Amazon, coupled with relief from the US Federal Reserve's decision to delay rate cuts. Hong Kong's Hang Seng fell 3.20% to finish at 15533.57 from its starting level of 16046.25. China's Shanghai Composite dropped 6.20% to close at 2730.15 compared to its open of 2910.61 marking its worst week in five years amid panic selling and forced liquidation of trades. Despite policy support from authorities, the market continued to slide, with concerns about forced liquidation of derivatives and margin trading contributing to investor pessimism, prompting calls for more defined policies to stabilize the market.

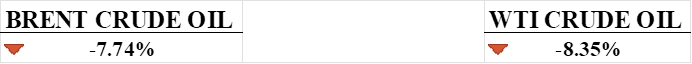

CRUDE OIL PERFORMANCE

Crude oil plunged, its steepest fall since November, dragged down by double threats: flagging demand and a soaring dollar. A surprisingly strong US jobs report prolonged monetary tightening narrative, amplifying dollar strength and making oil pricier for foreign buyers. China's economic decline further dampened demand, while receding geopolitical tensions in the Middle East removed a key price support. However, robust employment offers a glimmer of hope, suggesting potential future demand resilience. Despite this, the immediate outlook for crude remains cloudy, pressured by a confluence of headwinds.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. worker productivity exceeded expectations, growing at a 3.2% annualized rate. Despite a rise in unemployment benefit applications and layoffs, the labour market is gradually easing, contributing to the Fed's confidence in lower interest rates to address inflation concerns later in the year.

China's manufacturing sector continued its growth streak in January, according to the Caixin PMI, reaching 50.8. Despite the positive trend, concern in economic recovery and employment pressures persist, urging calls for targeted fiscal measures as the government remains conservative in additional support.

What Can We Expect from The Market This Week

S&P Global Services PMI: A benchmark that considers factors such as new orders, output, employment, and delivery times, serves as a crucial tool for financial and corporate professionals to comprehend economic conditions and make informed decisions. Previous figures are an improvement at 51.4, and consensus is that it will be better.

ISM Non-Manufacturing PMI: A key economic gauge monitoring the health of non-manufacturing sectors, remained steady at 50.60 points in December. Released on the third business day of each month, it serves as a crucial tool to assess the expansion or contraction of the U.S. economy in both the manufacturing and non-manufacturing realms.

RBA Interest Rate Decision: Conducted eight times a year by the Reserve Bank of Australia, it determines whether to adjust the current cash rate target of 4.35%, set in November 2023. This decision is influenced by factors such as inflation, economic growth, and employment rates, with the RBA aiming to maintain a stable financial system and issue the nation's currency.

US 10-Year Note Auction: The upcoming note auction is expected to influence global markets, impacting stock and bond yields. The event's outcome, driven by factors like the Federal Reserve's monetary policy, inflation expectations, and investor demand for duration, is closely monitored, especially following recent weak auctions in December and November 2023, with January historically showing a "seasonally positive" trend for 10-year supply demand.

China CPI January: The decline in consumer prices for the third consecutive month gave a bleak outlook on the 2nd largest world economy, with consensus standing at -0.5%. This ongoing disinflationary trend suggests a need for significant monetary policy easing to stimulate demand and underscores the imperative for policymakers to address the challenges posed to China's economic recovery.