Stocks Performance (U.S. Stocks)

Wall Street was coming off a strong weekly performance. Equity markets worldwide advanced this week as signs of economic recovery were reported in Europe, China and the U.S. Stocks received a boost from improving labour markets in the U.S. on the hope that the U.S. Congress will soon agree on a new stimulus package.

Within the communication services sector, Walt Disney (NYSE: DIS) surged 11% after reporting a surprise quarterly profit and posting strong subscriber numbers for its streaming platform. Facebook (NASDAQ: FB) gained 6%, as investors chased the stock higher in a momentum trade.

In other well-received corporate news, Microsoft (NASDAQ: MSFT) resumed talks to acquire TikTok, and Novavax (NASDAQ: NVAX) provided an encouraging vaccine update on a Phase 1/2 trial for healthy adults ages 18-59.

By sectors, the most outperformed weekly stocks were led by Transportations at 5.28%, followed by Producer Manufacturing at 4.84%, Commercial Services at 4.56%, Industrial Services at 4.33%, and Consumer Services (3.97%). Meanwhile, the weakest sectors were from the Consumer Non-Durables sector (0.59%), Utilities (0.62%), Health Technology (1.15%), and Retail Trade sector (1.34%).

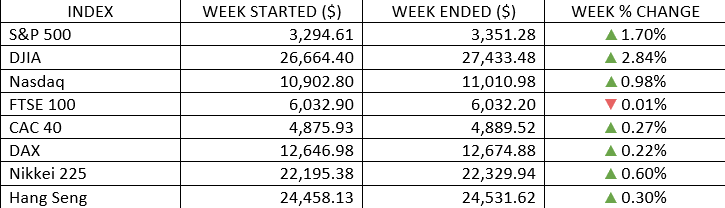

Indices Performance

Stocks recorded solid gains for the week, pushing the technology-heavy Nasdaq Composite Index to new highs and lifting the S&P 500 to within roughly 1.2% of its February record peak.

All major equity markets in Europe also advanced, as economic data showing improvement.

Oil Sector Performance

Crude oil prices pushed higher. The brightening demand outlook and a decline in stockpiles lifted crude oil to a five-month high.

Market-Moving News

Gold Record

Gold prices climbed above $2,000 per ounce on Tuesday for the first time and stayed above that threshold for the rest of the week. Bullion price has recently been driven higher by concerns about the coronavirus pandemic, the global economy, and U.S. dollar volatility.

Jobs Recovery

U.S.’s labour market continues to heal, although at a slower pace. The government reported the economy added 1.8 million jobs in July, trailing the 4.8 million jumps in June and the 2.7 million increase in May. Those big gains came on the heels of a record, pandemic-driven loss of 20.8 million jobs in April.

Earnings Silver Lining

While investors are expected to see the largest quarterly decline in earnings since 2009, the earnings season that’s now in its final phase is looking better than had been expected when it started in mid-July. Based on results through Friday, FactSet projected an earnings decline of about 34% for companies in the S&P 500, compared with the 44% drop that analysts had projected at the start of earnings season. Strong earnings reports from healthcare and communication services companies provided a positive catalyst.

Index Pushing Higher

S&P 500 recorded its fifth positive week out of the past six, moving within 1% of its record high set less than six months ago, and the NASDAQ surpassed its record set in the previous week. The NASDAQ topped the 11,000-point threshold for the first time on Thursday. The milestone came less than two months after the index first eclipsed 10,000, driven higher by strong recent results from many technology stocks.

Stimulus Gridlock

Stocks’ weekly gains came despite a rise in anxiety over the lack of conclusive progress toward an additional congressional package targeting the coronavirus and its economic impact. Talks between White House officials and Democratic leaders ended Thursday without a breakthrough, and the impasse appeared to deepen on Friday.

Bitcoin Rally

The cryptocurrency bitcoin has been on a tear, rising around 25% over the past three weeks to its highest level in 12 months. Bitcoin was trading around $11,500 on Friday.

Other Important Macro Data and Events

Congressional negotiations over a fifth coronavirus relief bill further stalled as Democrats and Republicans struggle to reach terms.

The likelihood of more fiscal stimulus briefly pressed government bond yields lower. U.S. Treasuries declined modestly this week. The 2-yr yield increased three basis points to 0.13%, and the 10-yr yield increased two basis points to 0.56%. The U.S. dollar Index increased 0.1% to 93.41.

Lower interest rates, in turn, helped boost the price of gold above US$2,000 an ounce for the first time to $2,072.50.

This week's economic data continued to depict a rebounding labour market. Nonfarm payrolls increased by 1.763 million in July, the unemployment rate improved to 10.2% from 11.1% in June, and weekly initial claims decreased by 249,000 to 1.186 million for its lowest level since March.

In addition, data from the ISM showed U.S. manufacturing activity and non-manufacturing activity continue to expand in July.

All major equity markets in Europe also advanced. Manufacturing PMIs and industrial production beat expectations across the eurozone, especially in Germany, Italy and Spain. The gains marked the first manufacturing expansion for the region in one and a half years. Most Asian markets climbed after China’s private sector manufacturing PMI rose to a near-decade high. Japan stocks outperformed after the country’s manufacturing PMI was revised up to a six-month high.

What We Can Expect from the Market this Week

Democrats and the White House remained far apart on key relief provisions and were unable to strike a deal. Treasury Secretary Mnuchin said he will recommend to President Trump signing executive orders that extend the eviction moratorium and enhanced unemployment benefits.

The Q2 earnings season will start to wind down with less than 3% of companies in the S&P 500 reporting results.

Chinese stocks will likely see further pressure next week in reaction to the U.S. imposing sanctions on Chinese officials, including Hong Kong Chief Executive Carrie Lam, because of their role in suppressing political freedom in the territory.

Important economic news coming out this week including job opening on Monday, inflation and federal budget on Wednesday, weekly unemployment claims and import/export prices on Thursday, and retail sales along with consumer sentiment on Friday.