PAST WEEK'S NEWS (August 05 – August 10, 2024)

The Bank of Japan's deputy governor, Shinichi Uchida, has spared excessive volatility by stating that the BoJ will put brakes on interest rate hikes during unstable market conditions. This goes against what the governor, Kazuo Ueda, said last week after they surprisingly raised rates that made carry trades expensive, ensuing panic selling to cover their debt. Uchida stressed that they need to keep things as they are for now because markets are all over the place. He pointed out that a stronger yen and wild stock market swings would affect their decisions. When Uchida said this, it made the dollar jump against the yen and restored Japanese stocks. Some experts think this means the Bank of Japan might hold off on more rate hikes, wondering if they can really raise rates much if they're always watching how the market reacts.

Japanese stocks witnessed a dramatic rebound on Tuesday, following their worst single-day decline since the 1987 Black Monday crash. The Nikkei 225 index recovered over 8% to above 34,000, while the broader Topix index gained 8% to 2,410. This recovery came after both benchmarks had crashed more than 12% the previous day. Technology and AI-related stocks, such as Tokyo Electron, Advantest, and SoftBank Group, drove the rebound, though they were still below their mid-July highs. The yen's strength, that came from the yen carry trade, had pressured Japanese equities, but the currency's rally showed signs of easing after hitting 142 yen against the USD.

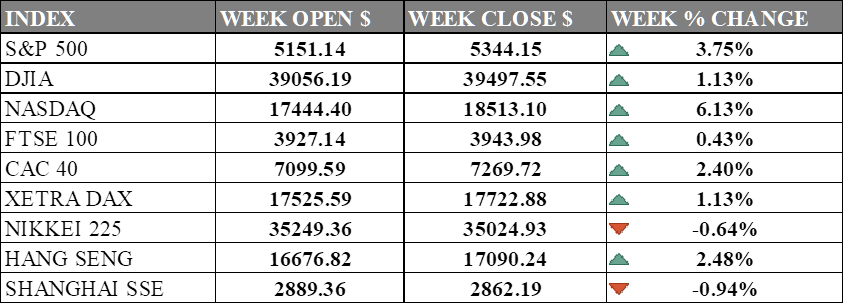

INDICES PERFORMANCE

Wall Street wrapped up an exceptionally emotional week, with all major U.S. indexes ending in positive territory after Monday bloodbath. The tech-heavy Nasdaq were the most affected, surging 6.13% to close at 18,513.10. The S&P 500 rose 3.75% to 5,344.15, while the Dow Jones Industrial Average saw a more modest increase of 1.13%, finishing at 39,497.55. These market upturns are largely attributed to renewed optimism that reverse carry trade have ended after dollar regained strength, with investors showing strong confidence in growth stocks.

Across the pond, European markets also enjoyed positive momentum. Germany's DAX saw a 1.13% increase, closing at 17,722.88. The UK's FTSE 100 experienced a modest 0.43% gain, ending at 3,943.98, while France's CAC 40 rose 2.40% to close at 7,269.72. European markets benefited from the positive sentiment in global equities, with various sectors contributing to the overall gains.

Asian markets presented a mixed picture. Japan's Nikkei 225 saw a slight decline, falling 0.64% to 35,024.93, a strong enough recovery after what is called to be the worst Monday in history since 1987. Hong Kong's Hang Seng Index, on the other hand, posted a strong gain of 2.48%, closing at 17,090.24. The Shanghai Composite in mainland China experienced a minor setback, dropping 0.94% to close at 2,862.19. Despite the mixed performance in Asia, the overall global market sentiment remained largely positive, driven by strong performances in the U.S. and European markets.

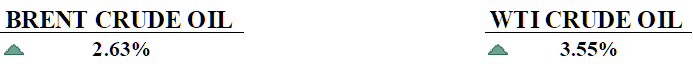

CRUDE OIL PERFORMANCE

In a positive turn for the oil market, crude prices settled higher on Friday, with Brent and WTI futures gaining over 2.63% and 3.55% respectively for the week. The rally was fueled by positive economic data, surefire of a rate cut next month, and growing tensions in the Middle East. China's slight improvement in inflation data and better U.S. jobless claims contributed to easing concerns about global economic slowdown and oil demand. Libya's declaration of force majeure at its Sharara oilfield added to supply constraints. However, the increase in U.S. oil rig count and reduced forecasts for domestic crude oil production in 2024 introduced some opposing signals to the market. Despite the week's gains, analysts caution that global oil demand growth needs to accelerate in the coming months to absorb the planned increase in OPEC+ supply, with potential downside risks if economic conditions deteriorate further.

OTHER IMPORTANT MACRO DATA AND EVENTS

China's consumer inflation rose to 0.5% in July while producer prices fell by 0.8%. Despite recent efforts by Beijing to boost the economy, including interest rate cuts, inflation remains weak amid high unemployment and a struggling property market.

U.S. jobless claims dropped by 17,000 to 233,000 last week, surprising analysts and adding to the uncertainty around the labour market as the Federal Reserve weighs its options. While claims fell, continuing claims edged up slightly, and the slowdown in job growth has sparked talk that the Fed might ease its policies soon.

What Can We Expect from The Market This Week

US CPI July: Highly-anticipated consumer inflation data is showing a steady decline as restrictive monetary policy hacks away at price increases and money circulation. Consensus is at 0.2% for July, higher than last month, which was 0.1% for the core CPI and -0.1% for the headline.

Japan GDP Q2: Japan’s economy is expected to grow at an annualised rate of 1.9%, citing higher business spending and strategic economic policies. The revised GDP data reflects increased capital expenditure and the positive impact of the Bank of Japan’s recent monetary policy adjustments.

China Industrial Production: The latest report suggests that production grew by 5.3% year-on-year in June, driven by increased activities in manufacturing, utilities, and mining. This steady growth, supported by government measures, contributed to a higher-than-expected GDP growth of 5.3% in Q1 2024.

Philadelphia Fed Manufacturing Index: Manufacturing showed a smaller decline to 5.6 from the previous month’s 13.9, indicating continued but slower growth in the manufacturing sector. Even with the decline in new orders and shipments, employment and prices paid remained positive, reflecting resiliency within the sector.

UK GDP Q2: The UK economy grew at a rate of 0.7% in the first quarter of 2024, above original expectations, according to recent adjustments to the country's GDP projections. Economic growth is expected to be strong at 0.6% for the second quarter as the country starts cutting rates.

.jpg)