PAST WEEK'S NEWS (August 26 – August 30, 2024)

Nvidia, the AI kingmaker, set records with $30 billion in Q2 revenue, but its shares fell 9% in after-hours trading after missing forecasts for next quarter. Data centre revenue grew to $26.3 billion, but doubts over potential growth slowdowns and capacity issues remain. The company's gross margin slipped to 75.1% from 78.4%, with further shrinkage expected as costs rise and new projects fall out of VC's favour due to its profit horizon. Adding to the risk, Nvidia's next-gen Blackwell AI chips might face a three-month delay due to design flaws. However, things are looking up after Nvidia announced a $50 billion share buyback, expressing long-term confidence even as market sentiment wavers, especially in the AI business.

Super Micro Computer, a server maker and major AI player, was attacked by Hindenburg Research, that released a damning report alleging accounting manipulation, undisclosed related-party transactions, and potential sanctions evasion. The short seller's investigation, which spanned three months and involved interviews with former employees, highlighted the company rehiring executives involved in a previous accounting scandal and reverting to questionable practices, as well as issues surrounding the company's touted liquid cooling technology. The allegations come at a crucial time for Super Micro, whose stock has surged from $80 to around $550 per share due to its involvement in AI server production with Nvidia. The Hindenburg report has cast a shadow over its recent success, triggering Super Micro's stock to initially drop 8% before recovering to a 2% loss.

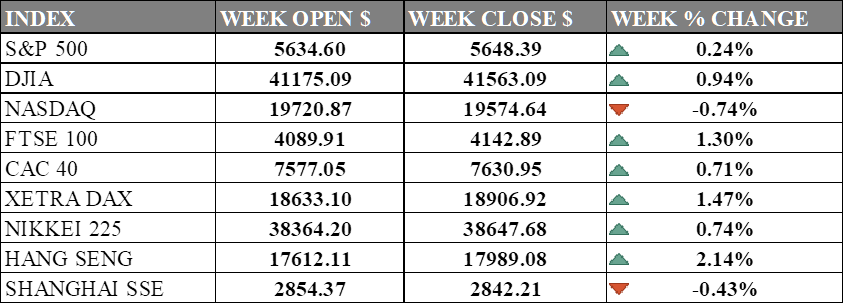

INDICES PERFORMANCE

Wall Street wrapped up a rather mixed week, with industrial in positive territory and tech slightly down. The S&P 500 rise 0.24% to close at 5,648.39. The Dow Jones Industrial Average saw a solid increase of 0.94%, finishing at 41,563.09, while the tech-heavy Nasdaq lost 0.74% to close at 19,574.64. These market upturns are largely attributed to continued optimism in the overall economic outlook, with investors showing confidence in underdog stocks' resilience rather than premium stock in changing market condition due to future rate expectation.

Across the pond, European markets also enjoyed positive momentum. The UK's FTSE 100 led the gains with a 1.30% increase, closing at 4,142.89. France's CAC 40 saw a 0.71% increase, closing at 7,630.95. Germany's DAX experienced a 1.47% rise, ending at 18,906.92. European markets benefited from the positive sentiment in global equities, with various sectors contributing to the overall gains.

Asian markets presented a mixed picture, though with generally positive results. Japan's Nikkei 225 saw a modest increase, rising 0.74% to 38,647.68. Hong Kong's Hang Seng Index posted a gain of 2.14%, closing at 17,989.08. However, the Shanghai Composite in mainland China experienced a slight decline, falling 0.43% to close at 2,842.21.

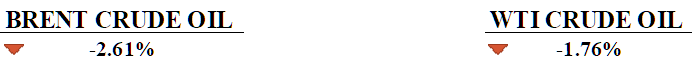

CRUDE OIL PERFORMANCE

Crude oil prices declined this week, with dark cloud over OPEC+ output rescinding voluntary cut starting in October and mixed signals on global demand. Market sentiment was further dampened by strong U.S. consumer spending, reducing the likelihood of a significant Federal Reserve rate cut, and a stronger dollar, which made oil more expensive for foreign buyers. Supply disruptions in Libya and Iraq offered some support to prices, but overall, the market remained under pressure due to ongoing concerns about global economic growth. Additionally, OPEC revised its forecast for 2024 oil demand growth downward, citing weaker-than-expected data, particularly from China. Despite these challenges, the possibility of a supply boost from OPEC+ continues to weigh heavily on market dynamics.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. consumer spending rose by 0.5% in July, suggesting strong economic momentum and arguing against a significant interest rate cut by the Federal Reserve. A rising unemployment rate and concerns over the labour market kept inflation moderate, aligning with the Fed's 2% target.

Euro zone inflation dropped to 2.2% in August, the lowest in three years, likely leading the European Central Bank to cut rates again next month. While lower energy prices drove the decline, rising service costs from the Olympics and wage increases show inflation pressures persist.

What Can We Expect from The Market This Week

Nonfarm Payrolls: a key indicator of U.S. economic health, saw a major downward revision, with 818,000 fewer jobs reported for the 12-month period ending in March 2024. Additionally, July 2024 saw a modest increase of 114,000 jobs, indicating a slowdown in job creation.

BoC Interest Rate Decision: BoC has started to cut its key interest rate since June as inflation is gradually easing and GDP has grown steadily. The Canadian dollar initially lost against the dollar but eventually gained as the dollar weakened.

JOLTs Job Openings: The latest JOLTS report shows that job openings remained stable at 8.2 million, with hires and separations also holding steady at 5.3 million and 5.1 million, respectively. However, there were notable regional variations, with job opening rates rising in two states and falling in two others, reflecting localised economic conditions.

ISM Manufacturing PMI: a significant contraction in the U.S. manufacturing sector, with a last reading of 46.8, the lowest since November 2023, with weaker new orders, production, and employment.

German Industrial Production: It saw a positive shift in June, increasing by 1.4% from the previous month slump of negative 3.1% growth with significant gains in the automotive and electrical equipment sectors. However, despite this monthly growth, the year-on-year comparison shows a 4.1% decline, an ongoing recovery in the industrial sector.