PAST WEEK'S NEWS (March 10 – March 14)

U.S. inflation came in lower than expected, with prices rising slowly as the economy displayed signs of moderation while some even called for recession; now the main market is almost 10% lower from the peak. The Federal Reserve will likely scrutinise these figures closely when weighing how President Trump's proposed policies might reignite pricing pressures across the economy. While housing costs keep pushing overall inflation higher, these costs were partially neutralised by falling transportation and energy expenses as oil prices are at multi-month lows. Considering this favourable data, market participants still forecast the Fed will maintain current interest rates at its upcoming March meeting.

President Trump has recently laid out plans to build metals refining facilities on military bases to reduce U.S. dependence on China, which dominates critical minerals production needed for defence and technology. His executive order would appoint a critical minerals czar and expand permitting processes while pursuing a deal with Ukraine to access its rich mineral deposits, including gallium, graphite, and lithium. This initiative could significantly strengthen the U.S. defence manufacturing sector by securing domestic supply chains for fighter jets, submarines, and advanced electronics while reducing vulnerability to China's export restrictions on rare minerals. Trump's strategy links Ukraine support to mineral access and peace concessions, potentially reshaping both international relations and the global minerals market, giving the U.S. A greater negotiating power in its semiconductor dominance.

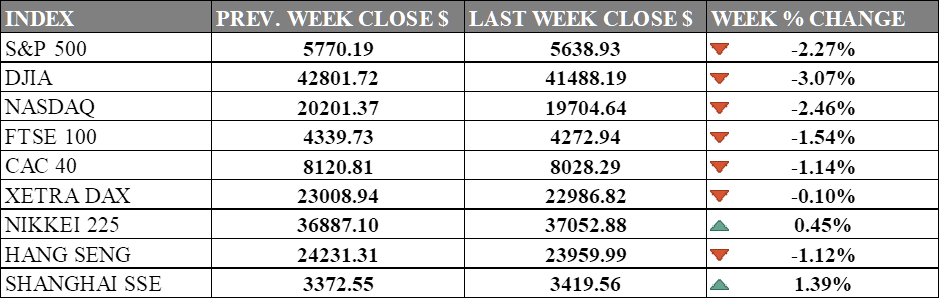

INDICES PERFORMANCE

Wall Street ended the week with continued losses. The S&P 500 fell by 2.27%, closing at 5638.93, reflecting broad market weakness. The Dow Jones Industrial Average (DJIA) experienced a sharper decline of 3.07%, finishing at 41488.19, showing vulnerability amid market volatility. Meanwhile, the Nasdaq decreased by 2.46%, closing at 19704.64, as the tech-heavy index faced heavy selling pressure. Falling consumer confidence, rising jobless claims, and slowing price growth has raised the market volatility index to fearful..

European markets showed mixed results. The UK's FTSE 100 declined by 1.54%, closing at 4272.94, reflecting broader market profit-taking. France's CAC 40 experienced a decline of 1.14%, ending at 8028.29, while Germany's XETRA DAX fell slightly by 0.10%, closing at 22986.82. European market have been running well past few weeks from its announcement of a huge defence spending but that fuel seem to have run out, although its overpriced currency right now could push it higher if there is no changes in trump tariff.

Asian markets displayed mixed trends. Japan's Nikkei 225 gained 0.45%, closing at 37052.88, showing resilience despite tech sector performance declines in the U.S. In contrast, Hong Kong's Hang Seng Index weakened, falling by 1.12%, finishing at 23959.99. In mainland China, the Shanghai Composite Index posted a gain of 1.39%, ending at 3419.56. China market once again was raised by stimulus aimed at improving household income and supporting birth rate.

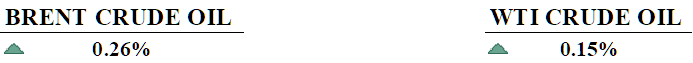

CRUDE OIL PERFORMANCE

Crude oil prices rebounded slightly last week, with West Texas Intermediate (WTI) and Brent futures posting their first gains in weeks, supported by a recovery in U.S. stocks and a weaker dollar. Geopolitical tensions remained a key driver, as hopes for a swift resolution to the Ukraine conflict faded after Russia's reluctance to accept a proposed ceasefire, alongside ongoing sanctions on Russia and Iran affecting market sentiment. OPEC maintained its 2025 growth estimate at 1.45 million barrels per day, while the International Energy Agency reduced its forecast to 1.03 million on escalating trade tensions, and the U.S. Energy Information Administration projected a moderate 1.3 million increase. OPEC+ is planning to gradually increase production starting in April, potentially adding to global inventories, though sanctions on major producers like Venezuela, Iran, and Russia could constrain output. Goldman Sachs lowered its 2026 price forecasts for Brent to $68 per barrel and WTI to $64 per barrel, citing slower demand growth and higher OPEC+ supply as bearish factors. Meanwhile, the market is closely watching U.S. efforts to replenish the Strategic Petroleum Reserve (SPR) and the impact of tightened sanctions on Russian oil exports, which could further shape price trends in the near term..

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. consumer sentiment fell to 57.9 in March from 64.7 in February, with inflation expectations rising to 4.9% for the next year and 3.9% over five years, the highest since 1993. Tariffs were cited by 48% of respondents as a key factor driving prices up.

U.S. producer prices rose 3.2% annually in February, down from 3.7% in January, while monthly PPI remained flat at 0.0% versus 0.6% prior. Weekly jobless claims fell to 220,000, and job growth remained strong, with an average of 191,000 jobs added since September.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: The FOMC continues to balance the need to stimulate growth and limit inflation, now with the effects of trade disputes and tariff policies. The March meeting is expected to see the Fed maintaining rates, remaining in a cautious wait-and-see approach in response to mixed signals from inflation data, employment trends, and market expectations.

BoJ Interest Rate Decision: Analysts predict rates will remain unchanged for now but could rise to 0.75% later in the year due to signs of demand-driven inflation as factors including a 0.3% rise in producer prices in January and 3.1% annual growth in bank lending suggest growing economic momentum. Market expectations are influenced by Keidanren’s Masakazu Tokura on demand-led price growth, bond purchase speculation, and global factors like trade tensions and China’s economy.

SNB Interest Rate Decision: The market is divided between a 25 basis point cut to stimulate its slowing economy or a hold to preserve monetary policy flexibility given the volatile market. This move will not only impact the the Swiss franc but also shifts in monetary policy as central banks worldwide buying into safety.

BoE Interest Rate Decision: The Bank of England faces mounting pressure as tariffs and inflation disrupt the UK economy, forcing policymakers to balance growth and rising prices. After a 25-basis-point rate cut in May, markets now expect a total of 56 bps in reductions by December, but uncertainty lingers as inflation remains high and economic growth slows.

Eurozone CPI: Preliminary data shows inflation eased to 2.4% in February 2025, but persistent core inflation and global trade risks complicate the ECB’s monetary policy decisions. Markets remain volatile as investors assess the ECB’s stance in retaliation to economic stagnation and inflationary pressures.