Stocks Performance (U.S. Stocks)

Global stock markets were mostly lower last week. The decline was led by a sharp decline from soaring technology and Internet stocks. The retreat in equities comes after expectations of further stimulus measures, signs of economic recovery, and progress toward a COVID-19 vaccine combined to make August the best month for markets since April. The sudden return of investors’ cautiousness buoyed the U.S. dollar, which had dropped to a two-year low the previous week after the Federal Reserve’s announcement of continued accommodating monetary policy. The stronger dollar, in turn, pressured commodity prices, including oil and gold.

Early in the week, the momentum of heavyweights like Apple Inc., Alphabet Inc., and Amazon.com Inc. early in the week briefly boosted the S&P 500 and Nasdaq Composite Indices to record levels. This momentum also lifted the benchmark MSCI World Index to an all-time high.

By sectors, the most outperformed weekly stocks were led by Process Industries at 0.44%, followed by Utilities sector at -0.16%, Consumer Non-Durables at -0.51%, Health Services at -0.83%, and Finance sector (-1.20%). Meanwhile, the weakest sectors were from the Technology Services (-4.23%), Commercial Services (-4.17%), Energy Minerals (-4.12 %), and Retail Trade sector (-2.63%).

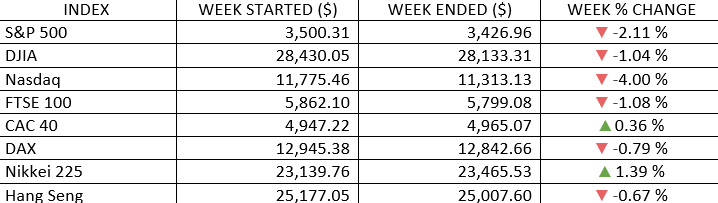

Indices Performance

The technology-heavy Nasdaq Composite Index suffered the largest losses, declining 4%, but has still produced significant gains on a year-to-date basis. The S&P 500 Index also remained positive for the year. Dow Jones Industrial Average slipped back into negative territory for 2020.

Before this last week, the S&P 500 advanced for four straight weeks, with technology stocks leading the index to a new record high.

In European markets, France outperformed after the announcement of a €100 billion stimulus plan. Japan was the best-performing developed market for the week. Investor sentiment for the country received a boost when Buffet’s Berkshire Hathaway Inc. made big investments in several Japanese trading companies.

Oil Sector Performance

Oil prices slipped, recording a weekly loss, as investors’ focus shifted to flat demand and ample fuel supplies, offsetting support from a weak dollar. Price dropped below the $40 per barrel mark for the first time in more than a month.

Market-Moving News

Rally Interrupted

The stock market’s five-week winning streak was snapped as the NASDAQ dropped more than 3% and the S&P 500 fell around 2%, with both indexes retreating from record highs. Technology stocks pulled the broader market down, reversing a recent trend.

Thursday Reversal

Stocks’ steady climb earlier in the week was interrupted on Thursday as the indexes falls. The declines came a day after the NASDAQ topped the 12,000-point mark for the first time and the Dow eclipsed 29,000 for the first time since February.

Jobs Still on the Mend

Combined with the roughly 9 million jobs added in the preceding three months, the 1.4 million jobs generated in August brings the labour market to about the halfway point in recovering the 22 million jobs lost in March and April. The unemployment rate dropped to 8.4%, the fourth monthly decline in a row.

Trade Gap Expansion

A monthly report showed that the U.S. trade deficit grew to its largest amount since 2008. The widening of the gap came as Americans’ appetite for foreign-made goods rebounded, while exports rose at a modest pace.

Oil Below $40

The week’s volatility extended to oil, as the price of crude dropped around 8%, below the $40 per barrel mark for the first time in more than a month.

Bitcoin Slides

The price of the cryptocurrency bitcoin fell around 10% for the week to around $10,600, the lowest level in more than a month. Though, YTD basis, it is up around 45%.

Other Important Macro Data and Events

The strength of the stock market has been supported to date by aggressive fiscal and monetary stimulus and stronger-than-expected economic indicators of future growth. The Department of Labor released data last week showing initial jobless claims coming in at 881,000, beating analysts' estimates. The economy also added 1.4 million jobs in August, with 10.1% growth in productivity. On the trade front, the U.S. deficit reached a 12-year high.

The U.S. economy posted its largest quarterly decline in GDP in the Q2, contracting by an annualized rate of 32%, more than triple the decline of the previous worst quarter post-WWII (Q1 1958) and four times larger than the worst quarter during the '08/'09 financial crisis

The Cboe Volatility Index, which measures investors’ expectations of short-term stock market volatility, climbed on Friday to as high as 38 in intraday trading, its highest level in more than two months. However, the so-called VIX remained far below its record closing high of around 83 set in mid-March of this year.

ECB under pressure to increase stimulus as eurozone falls into deflation. The eurozone consumer prices showed inflation of -0.2% in August, marking the first decline since May 2016.

What We Can Expect from the Market this Week

The strength of the stock market is expected to be supported by aggressive fiscal and monetary stimulus and stronger-than-expected economic indicators of future growth.

The Fed’s role may be the most important feature of whether the stock market is able to continue to make progress higher.

Important economic news coming out this week including consumer credit on Tuesday, job opening and labor turnover survey on Wednesday, weekly unemployment claims, PPI and Wholesale Inventories on Thursday, and CPI and Treasury’s monthly budget on Friday.