PAST WEEK'S NEWS (April 19 – April 25, 2021)

Stocks Performance (U.S. Stocks)

Global stock markets came under pressure from renewed worries that rising global COVID-19 cases will delay the full recovery of economic activity, while the U.S. stocks finished slightly lower in a week marked by consolidation activity and heated tax discussions.

Global COVID-19 infection rates jumped to all-time highs, driven by a surge in the developing world, especially India and Brazil, raising concerns as several countries moved to impose new travel restrictions and movement control order. The growing pessimism overshadowed mostly positive economic data and better-than-expected corporate earnings reports. The dimmer outlook for growth pressed government bond yields and oil prices lower.

As virus news kept a pressure on stock prices, White House propose to increase capital gains tax. The week started bullish before Bloomberg on Thursday reported that President Biden was planning on proposing increasing the capital gains tax rate from 20.0% to 39.6% for those earning $1 million or more.

Advancing sectors were led by Health Technology sector at 1.92%, followed by Health Services at 1.83%, Distribution Services (1.82%), and Commercial Services at 1.47%. Meanwhile, the energy sector led the declining sectors, as rising crude inventories and talk of potential sanctions relief in Iran nuclear talks added to the pressure on oil prices, down -1.82%, followed by Retail Trade at -1.10%, Consumer Services (-0.84%), and Consumer Durables sector (-0.71%).

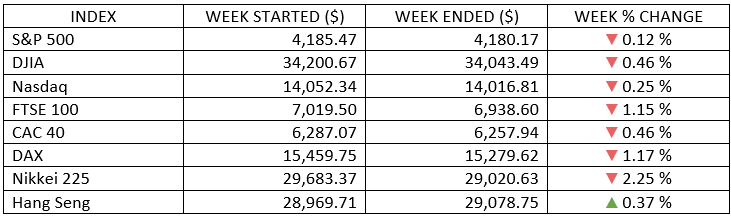

Indices Performance

The major stock indexes finished the week slightly negative. For the S&P 500 and the Dow, the modest setback snapped a 4-week string of gains that had pushed the indexes to record highs.

Most European markets were lower. The ECB kept its interest rates unchanged and confirmed a significantly faster pace of bond purchases, as it had previously announced. ECB President Christine Lagarde warned that the near-term outlook was still uncertain. Sentiment was set back further when the US State Department boosted its “Do Not Travel” guidance to about 80% of countries worldwide, including most of Europe.

Japan equites was among the weakest major markets, as the government planned another state of emergency which could push the country back into recession.

Oil Sector Performance

Oil prices edged lower as rising U.S. crude inventories and talk of potential sanctions relief in Iran nuclear talks added to the pressure on crude.

Market-Moving News

Market Finished Slightly Lower

Despite mostly positive economic indicators and strong earnings results, the major stock indexes were slightly negative. For the S&P 500 and the Dow, the modest setback snapped a 4-week string of gains that had pushed the indexes to record highs.

Tax Worries

U.S. stocks’ biggest move of the week came on Thursday, when the S&P 500 dropped more than 1% in less than an hour. The drop was triggered at least in part by reports that President Biden is considering a proposal to sharply increase capital gains tax rates for wealthy taxpayers—news that added to what had already been a choppy week for stocks.

Housing Strength

Sales of new U.S. single-family homes jumped nearly 21% in March—more than most economists had expected. New home sales were boosted entering the typically busy spring buying season by a shortage of previously owned houses on the market.

Conflicting Signals

Investor sentiment was buffeted by pandemic-related news. On one hand, U.S. health officials debated whether to resume use of a vaccine that was sidelined over an extremely rare side effect; on the other, COVID-19 cases spiked in some countries, and India on Thursday reported the world’s biggest one-day rise in new infections.

Upbeat Earnings

Earnings season continued to exceed expectations. Profits at companies in the S&P 500 were expected to rise 33.8% as of Friday, based on the roughly one-quarter of companies that have reported so far and forecasts for upcoming reports, according to FactSet. That rate would mark the highest year-over-year earnings growth since the Q3 of 2010, when growth was 34.0%.

Bitcoin Stumbles

It was an unusually volatile week for bitcoin, as the price of the cryptocurrency fell below $50,000 on Friday after climbing to $62,000 just a week earlier. Much of the weekly decline came during a span of about 20 minutes. Bitcoin crossed $60,000 in March for the first time after starting 2021 at around $29,000.

Other Important Macro Data and Events

The dollar turned lower for the week. Against a basket of major currencies, the index slipped -0.77% to stay at 90.83. EUR/USD advanced 0.96%, USD/JPY declined -0.83%, GBP/USD rose 0.28%, and USD/CHF slipped -0.64%.

U.S. Treasury yields modestly decreased as the Biden capital gains tax news supported demand for less risky assets.

President Biden is considering a proposal to sharply increase capital gains tax rates for wealthy taxpayers. The tax hike would be used to fund some of the measures in Biden’s American Families Plan, which could be formally proposed in the following week and may involve free community college tuition, child-care subsidies, and other health- or education-related spending.

Economic data and figures suggested the U.S. economy was picking up steam. The weekly initial claims fell to a new post-pandemic low at 547,000, new home sales surged to its highest annual rate (1.021 million) since August 2006. April PMIs was stronger than expected and the Conference Board’s Leading Index jumped more than forecast.

The Q1 earnings reports continued to beat expectations for the most part.

Eurozone PMI stronger than expected, as the IHS Markit PMI rose to a nine-month high of 53.7 in April, up from 53.2 in March. Business activity in the manufacturing sector rose to a record high, and the services portion of the economy unexpectedly returned to growth, despite the introduction of new restrictions aiming to curb the coronavirus’ spread.

The ECB kept its main policy measures unchanged and restated its determination to keep borrowing costs low, saying it would maintain its recently increased pace of bond purchases until the eurozone’s economy is firmly on the path to recovery.

Bitcoin stumbled as the price of the cryptocurrency fell below $50,000 on Friday after climbing to $62,000 just a week earlier. Much of the weekly decline came during a span of about 20 minutes. Bitcoin crossed $60,000 in March for the first time after starting 2021 at around $29,000.

What Can We Expect from the Market this Week

The possibility of rising inflation, tax anxieties, geopolitical tensions, and market imbalances to spark periodic pullbacks in equities as we advance, supporting the case for well-balanced portfolio allocations across a broad mix of equity and fixed-income asset classes.

With recent market movements that seem to follow the near-term headlines, we’d advise investors to continue investing in a disciplined manner. Choose an asset allocation that is diversified and suited to your risk tolerance. For those unable to digest short term pullbacks, it is perhaps better to reassess one’s risk tolerance and rebalance the investment portfolio accordingly.

Important economic data being released this week include personal income and expenditure, GDP, and the inflation deflator.