PAST WEEK'S NEWS (Dec 6 – Dec 12, 2021)

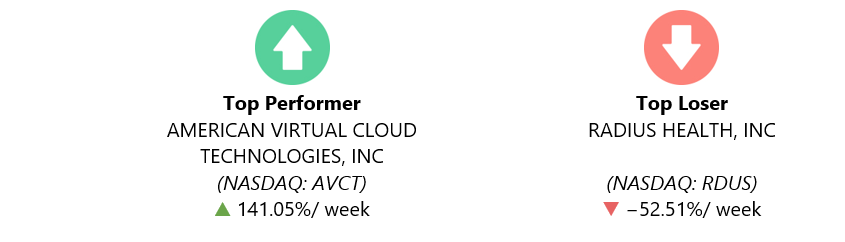

American Virtual Cloud Technologies skyrocketed for the week after announced a new partnership with Braidio. The partnership is for an 80,000-user telehealth application and a pet wellness application by a premier veterinary hospital system in the U.S., servicing over 25,000 customers. That saw it projecting revenue to grow “from $14.3 million in 2020 to approximately $18.8 million in 2021 and in excess of $37 million in 2022.”

The stock of Radius Health tumbled after the company presented a disappointed follow-up data for its experimental breast cancer treatment.

Stocks Performance

The major indexes in Asia, Europe, and the U.S. ended the week in green as market overcame concerns about the Omicron variant. Most of gains were registered in the first two days of the week on optimism that the Omicron variant wasn't as bad as originally feared. The markets continue to affirm by news on Wednesday that preliminary studies by Pfizer and its European partner BioNTech showed that a booster shot of their vaccine was effective against the new variant.

Most sectors ended the week with gains over 2.0%. Information technology sector was the strongest performer with more than 6% gain, as solid gains in Apple pushed the market capitalization of the company near $3 trillion. Shares of consumer discretionary, financial firms and utilities lagged but still recorded gains.

Indices Performance

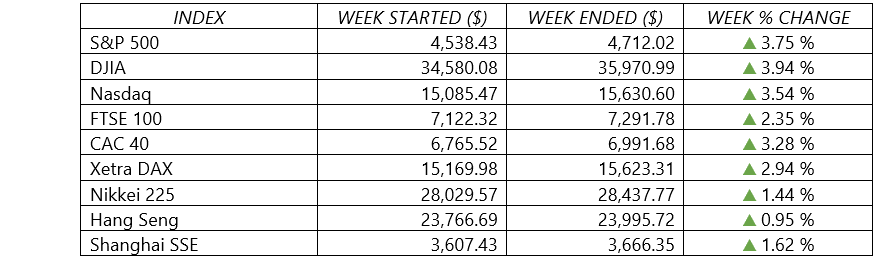

Major U.S. indexes ended the week higher, with the S&P 500 rallied and recorded its best weekly gain since February. The Dow Jones Industrial Average and Nasdaq Composite also rose more than 3.5%.

Shares in Europe also rebounded as fears about the Omicron COVID-19 variant and its potential economic implications subsided.

Chinese stock markets rose for the week after the central bank cut the reserve requirement ratio (RRR) for banks and November factory gate inflation cooled, easing inflation concerns. However, worries about property sector defaults and the withdrawal of more U.S.-listed Chinese companies dampened sentiment after ride-hailing app Didi Global said it would delist from the New York Stock Exchange earlier this month.

Crude Oil Performance

U.S. crude oil prices rose to snap a five-week string of weekly declines, as concerns eased about the impact of Omicron COVID-19 variant. Gains also helped by the fall in inventories.

Crude inventories fell by 240,000 barrels in the week to Dec 3 to 432.9 million barrels, though less than expectations for a 1.7-million-barrel drop. Meanwhile U.S. gasoline stocks rose by 3.9 million barrels in the week, compared with expectations for a 1.8-million-barrel rise, data cited from the EIA.

Other Important Macro Data and Events

Markets seemed to react favourably to the week’s economic news, including the hot consumer inflation data. The November CPI, reported Friday, rising 6.8% YoY, the biggest jump since 1982. While rising energy costs deserved part of the blame, price increases were broad-based—the core rate, excluding food and energy, rose 4.9%—suggesting wage pressures alongside supply chain issues. Both increases however, were roughly in line with expectations.

Initial claims for unemployment benefits continued to fall to the lowest weekly levels in decades, while job openings remained historically high, providing further evidence of the nation’s tight labour market. The government reported on Wednesday that there were 11 million openings at the end of October, with nearly 5 million more open positions than people seeking work.

Debt ceiling deal - A week after reaching a short-term agreement to avoid the U.S. government shutdown, lawmakers approved a measure that allows the Senate to raise the nation’s debt ceiling through a simple majority vote. That measure was expected to lead to separate votes in the House and Senate to raise the debt ceiling before December 15, avoiding a potential default of the government’s debt obligations.

Prices of government bonds fell, sending yields higher. The yield of the 10-year U.S. Treasury bond climbed to around 1.49% on Friday, up from 1.34% at the end of the previous week of trading. Despite its latest rise, the 10-year yield remains far below a recent high of 1.68% on November 24.

The dollar index recorded its seventh consecutive weekly rise.

GDP in the UK expanded 0.1% in October, slowing from 0.6% in September, as the construction industry shrank due to rising costs and supply disruptions, according to official figures.

European nations imposed stricter coronavirus controls - The UK imposed its so-called Plan B, which includes guidance to work from home, mandatory mask wearing for most indoor venues, and certification of vaccination status. Denmark and Norway also tightened their measures, following similar moves in Germany, Italy, France, and Ireland. Poland made vaccines mandatory for public sector workers. In Austria, national lockdown had been lifted on Sunday but that restrictions would still apply to unvaccinated citizens.

Gold and silver prices recorded fourth straight weekly fall. Platinum recorded its first weekly rise in four.

What Can We Expect from the Market this Week

At its two-day meeting scheduled to conclude on Wednesday, the FOMC meeting sits front and centre with Chairman Jerome Powell already hinted at a Congressional hearing that it is expected to speed up the pace of tapering asset purchases. The so-called taper proposal to begin reining in the Fed’s $120 billion in monthly bond purchases is a response to the recent persistence of high inflation. Traders will be watching the dot plots for 2022 and 2023, as well as looking for how Omicron risk factors into the rate and tapering equations.

Other economic calendar, events being released this week include the PMI composite, the Fed Funds Rate, retail sales growth, reports on producer price inflation and industrial production.

The earnings calendar is light, although Rivian Automotive (NASDAQ: RIVN) and Expensify (NASDAQ: EXFY) jump into the earnings confessional for the first time ever.