The price development of Facebook shares (NASDAQ: FB) in fiscal year 2019 regained momentum after a sharp decline in the second half of 2018. The stock is currently trading for around $186 with a 52-week trading range of $123 to $208. Speculators, predominantly derived from hedge funds, believe that there is room for positive development in the coming days/weeks in the price of Facebook shares and that the potential of the company will in no way be affected by the historically highest sanction. So far, it has been imposed on Internet companies for the illegal handling of personal data.

The number of daily active Facebook users has risen to 1.59 billion in the second quarter of 2019, up 8% YTY. FB mobile revenue increased to 94% of total ad revenue compared to 91% in the same period last year.

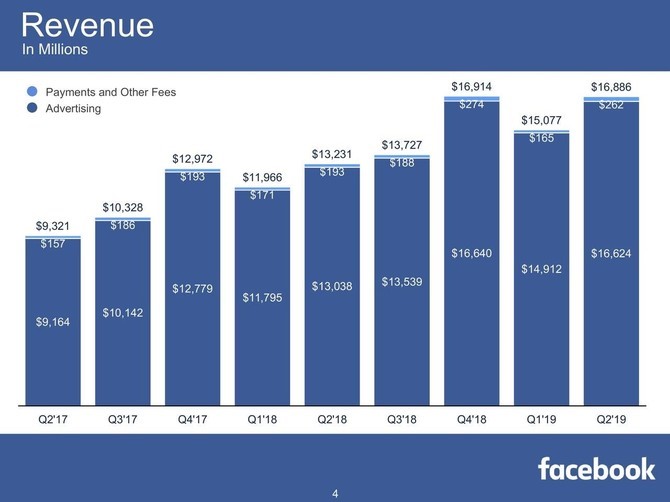

With an increase in the number of users per day and advertising revenue, Facebook’s consolidated revenue grew 28% year on year in the second quarter. Adjusted earnings increased from $1.74 per share over the previous year to $1.99 per share.

“We had a strong quarter and our business and community continue to grow,” said Mark Zuckerberg, Facebook founder, and CEO. “We are investing in building stronger privacy protections for everyone and on delivering new experiences for the people who use our services.”

Despite the strong growth in Facebook stock prices, further positive development is supported by a strong evaluation of the company based on the significant increase in financial results. Its shares are traded at about 22 times the profit in line with the industry average. The company expects further growth in the upcoming two quarters this year, which could help increase the dynamics of stock prices.