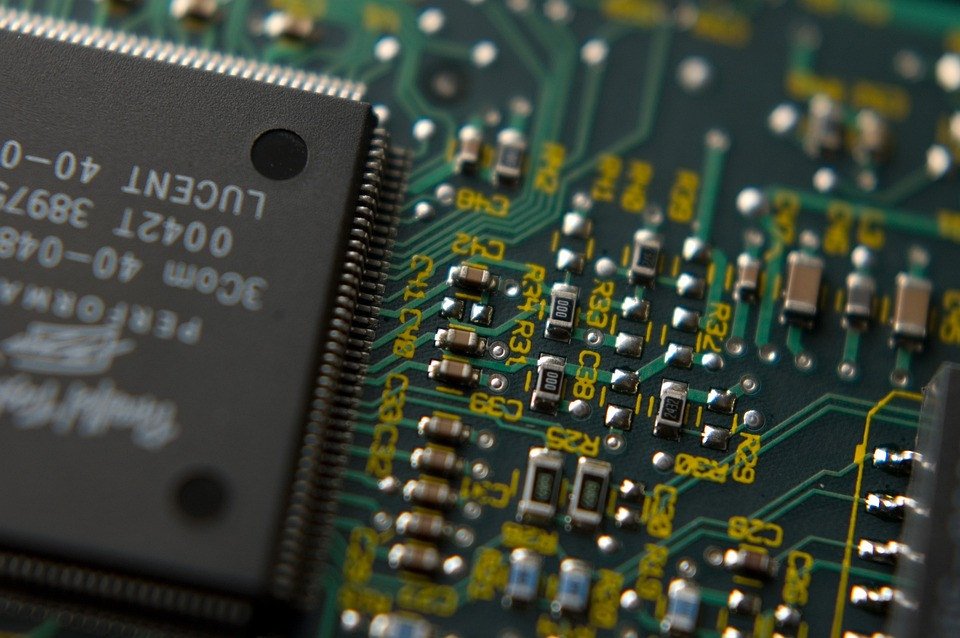

Semiconductors are the new commodities that will determine a country's future. Pragmatic Semiconductor's CEO has called for the UK government to invest in the industry to prevent firms from moving abroad. The Institute of Physics and the Royal Academy of Engineering warn the UK government to secure the future of the semiconductor industry by providing financial support and encouraging education on related topics. Meanwhile, the Dutch government plans to restrict semiconductor technology exports for national security reasons, affecting ASML Holding NV's ability to service over $8 billion worth of machines sold to China.

EQUITY

US markets stay muted after a hectic trading day yesterday with mixed performance across three main indexes. ADP nonfarm employment reported higher than consensus, indicating that the data-driven Fed will increase the rate further and faster. However, construction jobs suffering could point towards a slowing asset creation economy and higher inflation if demand is not curbed.

GOLD

Gold prices were muted on Wednesday, despite a volatile trading session in the evening due to floods of volume in the market. Traders are weighing their expectations as the Fed is being vague about its next action. In spite of the debt-based fiat, many have turned their heads towards the traditional metal, especially in this new age of gold-backed digital currency.

OIL

The oil market has been experiencing tight price ranges, largely influenced by weak economic data from China, hawkish signals from the Fed, and a potential showdown between the US and OPEC. Brent oil futures saw a slight rise, while West Texas Intermediate crude futures fell slightly. Traders remain cautious about a global recession and reduced demand from China, which has resulted in the market being somewhat stagnant.

CURRENCY

Federal Reserve Chairman Powell reaffirmed the message of higher interest rate hikes but stressed that the decision hinged on upcoming data. Investors are focused on Friday's job data and inflation next week to gauge the extent of the Fed rate hike. The exchange rate with other currencies was mostly steady, with the Canadian loonie falling after the Bank of Canada left its key overnight rate on hold after inflation data fell as forecasted.