Stocks performance (U.S. stocks)

Stocks performance (U.S. stocks)

Though oil uncertainty is always in the market news, grouped by sectors, energy minerals sector is the most outperformed weekly stock by 10.84%, followed by health technology (3.20%) and consumer staples (1.66%) sectors. The weakest areas were the consumer durables (-7.66%), financial (-6.26%), transportation (5.35%) and distribution services (-5.17%) sectors.

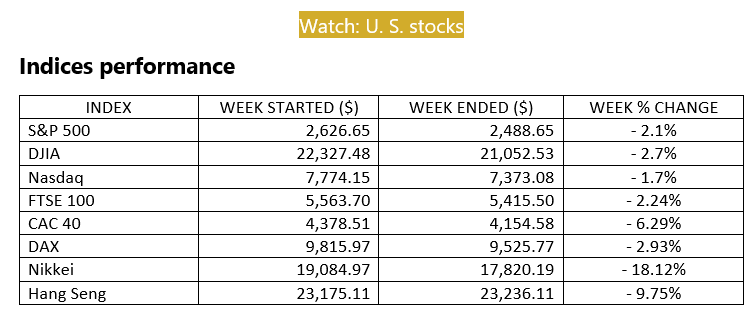

The stock market had its good days this week and its bad days. Unfortunately, the losses on the bad days outweighed the gains on the good days, so it was a losing week overall for the major indices.

Market finished the week with a surge, breaking a 5-week losing streak and posting its best weekly performance ever, back to the contract’s inception in 1983. The price rose more than $5 dollar at one point on Thursday, influenced by a statement from President Donald Trump stating that Russia and Saudi Arabia may cut oil production.

Market-moving News

Market-moving News

Oil Modest Comeback Latest week’s more than 30% rise in crude oil prices have been impressive. Prices were lifted by prospects of production cuts by the OPEC consortium of oil-producing countries and talk of a possible truce between Saudi Arabia and Russia. Although U.S. crude rose to about $28 per barrel as of Friday, the price was down nearly 54% year-to-date. Indices’ Bearish Quarter The first three months of 2020 marked the worst first quarter ever for the S&P 500 and the Dow. The S&P 500 dropped about 20%, the Dow tumbled 23%, and the NASDAQ sustained a relatively modest 14% decline. Relief Rally Stalls The market remains risky despite several rounds of Fed stimulus and congressional aid packages. Stock market’s positive momentum from the previous week’s gains dwindled as major U.S. indexes fell around 2% to 3%. Stocks had a hard time gaining traction as coronavirus cases continued to surge in the United States and most other countries, and the economic impact widened, and more nationwide lockdown implemented. More Pain to Come The loss of record 10 million jobs and unemployment rate spike suggests a coronavirus-fuelled recession will be deeper than initially thought and reveals several unforeseen weaknesses in the US economy that were already brewing before the crisis. Expectation of Oil Production Cuts Lifts Saudi Shares Saudi stocks, as measured by the Tadawul All Share Index, returned about 6.7% in the five trading sessions since the close of business on Thursday last week. Equities climbed during the week amid speculation that major global oil producers would be compelled by the recent collapse of oil prices to resume cooperative efforts to reduce production and stabilize the global oil market. U.S. oil prices hovered around $20 per barrel toward the end of March, compared with about $61 per barrel at the end of 2019. China's Stabilization China’s central bank acknowledges that its economy still needs support even as many citizens return to work following China’s surge in coronavirus cases. For the second time in less than a month, the People’s Bank of China on Friday lowered the amount of cash banks are required to set aside as reserves.

Other important macro data and events

On Thursday, oil prices surged after President Trump posted to social media that he had spoken with Saudi Crown Prince Mohammed bin Salman and suggested that Saudi Arabia and Russia would make a deal to reduce production by 10 million or even 15 million barrels. On Friday, oil prices extended their rally, as The Wall Street Journal reported that oil-producing nations would discuss the potential for at least a six million barrel-per-day production cut on Monday. U.S. participation in the discussion or in any resulting agreement is uncertain, though President Trump is expected to confer with U.S. energy company executives on Friday. However, the heavyweight producers have postponed a meeting set for today to discuss oil output cuts until Thursday. To date, number of confirmed worldwide cases for COVID-19 pandemic has now reached more than 1,274,000 today affecting 208 countries and territories around the world, recording more than 70,000 fatality globally.

What We Can Expect from The Market This Week

Meeting between OPEC and Non-OPEC that was scheduled for today (Monday) was postponed to Thursday. Given the delay in the OPEC meeting and rising tensions between Saudi Arabia and Russia, pessimism is expected to return to the crude oil markets for this week.

The two-week spike in jobless claims suggests a coronavirus-fuelled recession will be deeper than initially thought and reveals several unforeseen weaknesses in the US economy that were already brewing before the crisis. U.S. Labor Department’s reported a new record of 10 million Americans filed for unemployment. Those 10 million claimants make up about half of the 25 million nonfarm payrolls created since February 2010.

U.S. markets will be closed on Friday in observance of Good Friday.

What actions should investors take?

What not to do during a recession and bear market can be as important as what to do. Trying to time the market low is one of the most common mistakes an investor can make, and it's one of the easiest blunders to avoid. Precisely selling at the market peak and buying at the market bottom may seem like a good aspirational aim, but it is very hard to do. As we've witnessed in the last month of rapid market swings, pullbacks in the market are often accompanied in quick succession by strong rallies. Bad news like the March job numbers can receive a muted reaction by markets if pessimism is already priced into stocks. Instead of trying to time the market, we recommend employing a systematic approach to investing by taking advantage of market swings and investing at regular intervals, reducing both the emotional and timing aspects of decision-making. While it's impossible to control the economy or the markets, we can control our reactions and investment decisions by staying with a strategic investment approach before, during and after this trying time.