PAST WEEK'S NEWS (August 1 – August 7, 2022)

Stocks cooled off in the week, with market participants largely retained the positive mindset that prevailed throughout July. Equity markets have staged an impressive rally since the mid-June lows, aided by weaker commodity prices, easing inflation expectations, and lower bond yields.

The cautious start to the week starts with a sizable drop in oil prices on demand concerns, and saber-rattling by China in front of a visit to Taiwan by House Speaker Pelosi. U.S. House of Representatives Speaker Nancy Pelosi’s trip to Taiwan infuriated Beijing, which held live-fire drills in the waters around the self-ruled island and imposed sanctions on Pelosi and her immediate family and cutting back on cooperation with the U.S. on certain matters like climate change initiatives. Market got over the selling hump on Wednesday, which proved to be the big difference in making last week another winning week.

WTI crude prices slumped below $90 per barrel, which undercut the energy sector, which was the worst-performing sector. Meanwhile the best-performing sectors were the information technology, consumer discretionary and communication services sectors.

A much stronger-than-expected jobs report revived investor concerns that the Federal Reserve will need to maintain an aggressive pace of interest rate hikes to tamp down high inflation.

Earnings performance carried the mantle of providing better-than-expected results, which was good enough to keep buyers interested, as second-quarter profits at companies in the S&P 500 were expected to increase 6.7%, based on companies that have reported so far and forecasts for firms that haven’t yet released earnings, according to FactSet. That’s up from the 5.8% rise that had been projected at the end of the previous week. About 87% of companies had reported results as of Friday.

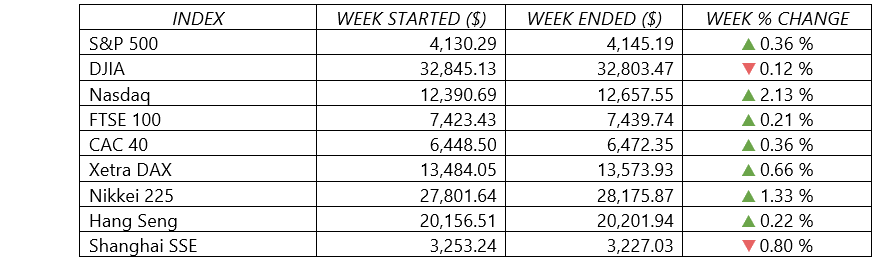

Indices Performance

The major U.S. indexes finished mixed overall. The NASDAQ gained more than 2%, the S&P 500 and the Dow were little changed, and growth stocks generally outperformed their value counterparts.

China’s stock markets eased as geopolitical tensions, mortgage boycotts, and tepid economic data kept buyers on the sidelines.

Crude Oil Performance

There was another sizable drop in oil prices last week even though OPEC+ said it was going to raise output in September by 100,000 barrels per day versus July and August when it increased its production quota by 600,000 barrels per day.

The price of WTI crude prices slumped below $90 per barrel for the first time since the Russia-Ukraine war began in February, settling Friday at $89 per barrel for an overall decline of more than 10% for the week.

Oil prices have been whipsawed between concerns about supply as Western sanctions on Russian crude and fuel supplies over the Ukraine conflict have disrupted trade flows, and rising worries that central bank efforts to tame surging inflation may trigger a recession that would cut future fuel demand.

Other Important Macro Data and Events

In the U.S. economic outlook, the latest monthly employment gain marked a milestone, as the U.S. economy recouped the 22 million jobs lost in the initial months of the pandemic nearly two and a half years ago. Friday’s payrolls report from the Labor Department showed employers added 528,000 nonfarm jobs in July, more than double consensus expectations of around 250,000, and May and June estimates were revised up by a combined 28,000.

The unemployment rate also returned to its February 2020 pre-pandemic level. Unemployment slipped to 3.5% from 3.6%. Job gains were widespread, with leisure and hospitality, professional and business services, and health care showing notable hiring.

While the strength in the labour market is good news for the economy, it is bad news for the Fed, as it implies that more rate hikes are needed to cool the still-tight labour market and ease inflation. Friday’s stronger-than-expected jobs report added to the selling pressure on prices of government bonds, sending yields sharply higher as expectations for Fed policy recalibrated higher. The yield of the 10-year U.S. Treasury bond climbed to around 2.84% on Friday, up from 2.64% at the end of the previous week.

With inflation continuing to surge, the Bank of England meanwhile raised interest rates by 50 basis points, the biggest increase in 27 years. The central bank expects inflation to remain “very elevated” through 2023 and to recede in two years’ time to its 2% target. It forecast that a recession lasting five quarters would begin this winter.

Core eurozone government bond yields ended broadly level. Yields fell early on due to a rise in tensions between the U.S. and China over Speaker of the House Nancy Pelosi’s arrival in Taiwan. However, hawkish commentary from Federal Reserve officials helped drive yields up again ahead of some key U.S. data releases.

What Can We Expect from the Market this Week

Important economic data being released this week will be centered around inflation in the U.S. Investors may get a better grip on how the Federal Reserve's tightening cycle will play out after inflation data pours next week in with the consumer price index, producer price index, and an update on unit labour costs all due in.

The July CPI report is expected to show a slight moderation in the headline number to +8.7% YoY from +9.1% in June. Core CPI is seen rising 0.6% on a month-over-month comparison. The PPI is forecast to show a 0.3% increase for July, in a deceleration from the 1.1% pace in June. Excluding food, energy and trade services, PPI is expected to increase by 0.4% month-over-month. Economists think the price reports may support some of the peak inflation discussion but will also support the consensus view that the Federal Reserve will raise the target interest rate by 75 points at the September meeting.

Now, Fed officials are indicating that they expect the target interest rate to be lifted to a 3.50% to 4.00% range by the end of the year. However, the bond market isn't reflecting that level quite yet, even after Treasuries sold off on Friday after the blowout July jobs report arrived. If the inflation reports were to surprise to the upside, speculation of an inter-meeting rate hike by the Fed could be stirred up and lead to some bigger moves in the bond market.

Another important economic data being released this week include the productivity and unit labour costs, wholesale inventories, federal budget, consumer sentiment, and export and import prices. For oil market players, the market report by IEA and OPEC monthly report is awaited.

Some of the notable companies heading into the earnings confessional meanwhile includes Tyson Foods, Take-Two Interactive, Disney, and Rivian Automotive as while the J.P. Morgan Auto Conference is expected to include some intriguing updates, including several from electric vehicle players.

As is always the case, there is no certainty about which path the economy and markets will travel. But assigning probabilities to the different outcomes can help set appropriate expectations and inform opportunistic portfolio adjustments. While the daily swings in markets can be uncomfortable, sticking to one's investment plan is often the best approach. With the best- and worst-performing days often found near one another, as has been the case this year, getting in and out of the market can create missed opportunities. After all, compounding over time is the most powerful tool investors have when it comes to achieving long-term goals.