PAST WEEK'S NEWS (August 15 – August 21, 2022)

A four-week winning streak for the market came to an end last week. A mixed releases of high impact global economic data, Fed talks, and quarterly earnings in the week contributed to some catalysts that added to that mindset. The market was also likely been seen as overbought on a short-term basis and due for a pullback.

Minutes released from last month's U.S. Federal Reserve meeting showed that policymakers agreed they needed to keep raising interest rates, although expressed concerns about lifting borrowing costs too fast and unduly weakening the economy. Stocks closed lower on Wednesday after investors assessed the minutes release.

There was a heavy economic drag throughout the week that served as a reminder that the market might have gotten ahead of itself with its rebound enthusiasm. Expectations for further aggressive moves to raise U.S. interest rates fuelled a decline in government bond prices, sending yields to the highest level in nearly a month. The yield of the 10-year U.S. Treasury bond pushing 3.00% on Friday, up from 2.85% at the close of the previous week, a testament to underlying inflation angst and a renewed headwind for many growth stocks that had logged big gains off the June lows.

The growth-oriented technology and communication services sectors underperformed, with the latter dragged down by a sharp decline in Facebook parent Meta Platforms. Bed Bath & Beyond was the epicenter of Friday's movement, plunging 40.5% in response to a report pertaining to the company's debt load. Target reported a sharp decline in earnings as shoppers continued to pull back on discretionary purchases. The winning standouts sectors were consumer staples, utilities, and energy.

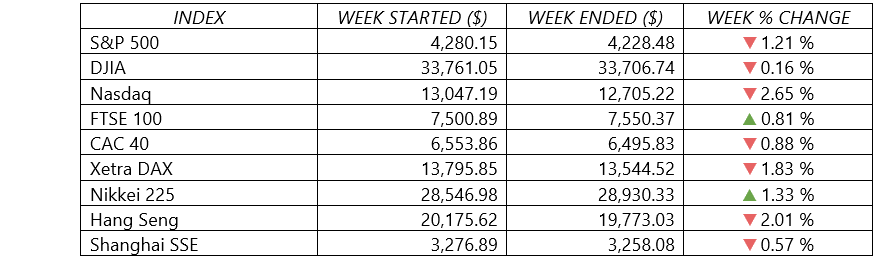

Indices Performance

A four-week winning streak for the U.S. market came to an end this week. The major U.S. stock indexes were little changed through most of the week before ended with a decline on Friday.

Shares in Europe pulled back amid renewed fears that central banks would need to tighten their policies aggressively to stamp out persistently high inflation. The UK’s FTSE 100 Index added slightly, as the UK pound depreciated against the U.S. dollar. A weaker pound lends support to the index as many of its companies are multinationals with overseas revenues.

Japanese shares were higher, with the Nikkei 225 Index breaching the psychological 29,000-point levels for the first time since January on Wednesday.

China’s stock markets posted a loss for the week in reaction to weak economic data and elevated levels of COVID cases, with drought conditions in parts of the country adding to the gloom.

Crude Oil Performance

Oil prices dipped for the week, as market participants weighed concerns over rising output, dampening fuel demand, Russian exports, and recession fears.

While bullish U.S. weekly data bolstered optimism for improved fuel demand for the near-term, lingering recession fears and a possible increase in output by OPEC+ limits oil price's upside.

In supply, Russia has started to gradually increase oil production after sanctions-related curbs and as Asian buyers have increased purchases, leading Moscow to raise its forecasts for output and exports until the end of 2025. Russia's earnings from energy exports are expected to rise 38% this year partly due to higher oil export volumes, in a sign that supply from the country has not been affected as much as markets originally had expected.

Meanwhile, the market is awaiting developments from talks to revive Iran's 2015 nuclear deal with world powers, which could eventually lead to a boost in Iranian oil exports.

Other Important Macro Data and Events

The U.S. dollar rally in the week, which its best weekly performance since June 12. The year-to-date strengthening of the U.S. dollar relative to the euro has brought the value of the two currencies to a near-parity level. On Friday afternoon, the value of a single euro fell as low as $1.0035. The last time the two currencies reached parity was five weeks earlier during intraday trading; prior to that, the last time was in late 2002.

The rise in the dollar also has been a headwind for gold, which shed 2.4% on the week.

Expectations for further aggressive moves to raise U.S. interest rates fuelled a decline in government bond prices, sending yields to the highest level in nearly a month. The yield of the 10-year U.S. Treasury bond rose to about 2.98% on Friday, up from 2.85% at the close of the previous week.

Core eurozone government bond yields rose following a double-digit increase in UK consumer prices and ECB official Isabel Schnabel’s comment that inflation could tick higher in the near term.

The UK’s headline inflation rate hit 10.1% in July—the first double-digit reading since February 1982—fuelled by sharply higher food costs. The year-over-year increase in consumer prices exceeded a consensus forecast of 9.8%. The core CPI also came in higher than expected, rising to 6.2%.

Meanwhile in the Eurozone, inflation in the 19 countries rose at an annual 8.9% rate last month, the highest level since the currency was created in 1999.

By comparison, the latest monthly U.S. inflation reading was 8.5%.

Some upward surprises in the week’s of U.S. economic data may have fuelled rate fears, even as they offered hope that the economy would avoid a recession.

Retail sales proved more resilient than expected in July, rising 0.7% once the volatile gas and auto segments were excluded. Industrial production was also strong, rising 0.6% in the month, roughly twice consensus expectations. And weekly jobless claims ticked lower, came in at 250,000 last week, breaking the three-week uptrend in new claims.

On the downside, housing data remained weak. Sales of existing homes fell for the sixth consecutive month in July as a recent rise in mortgage rates continued to weigh on the U.S. housing market. Sales fell 5.9% versus the previous month and 20.2% relative to July 2021, according to the National Association of Realtors.

Japan's GDP product expanded by an annualized 2.2% in the Q2 of 2022, according to the Cabinet Office’s preliminary reading, released on Monday, though still missed consensus expectations of 2.5% growth. More positively, Japan's industrial production rose by more than anticipated in June, increased by a seasonally adjusted 9.2% in June, bettering initial expectations of 8.9%.

Inflation in Japan continued to remain above the 2% target, influenced by higher fuel prices and a weaker yen. Core CPI increased to 2.4%, from 2.2% the previous month. This was in line with consensus expectations. Core inflation has now exceeded the central bank's 2% target for four consecutive months.

What Can We Expect from the Market this Week

With the next U.S. Federal Reserve meeting just over a month away, investors worried about the pace of further interest-rate increases. Investors and economists will turn their attention to the Rocky Mountain town of Jackson Hole, Wyoming, where the U.S. Federal Reserve will hold its annual three-day economic policy symposium beginning Thursday, August 25. Fed Chair Jerome Powell is among the featured speakers.

The tone from Powell could shift investor sentiment if he reiterates that the risks of inflation are more significant than the risk of a hard landing for the U.S. economy. The Fed is still anticipated to raise the target range for the federal funds rate by 50 or 75 points in September and follow with 25 or 50 points hikes in November and December. Fed watchers are also looking for more details on the Fed's balance sheet reduction strategy.

Important U.S. economic reports being released this week include new home sales, durable goods orders, Q2 GDP, PMI readings, and the closely-watched PCE price gauge.

Earnings reports will pour in from the consumer and tech sectors again, with Dollar Tree, Dollar General, Nvidia, Zoom Video, and Salesforce.com were some of the headliners.