PAST WEEK'S NEWS (JUNE 19 – JUNE 23, 2023)

The Wagner Group, a Russian private military contractor, initiated a rebellion against the government, alleging that the Russian military attacked their camp and killed fighters. The leader, Prigozhin, threatened retaliation and claimed his forces entered the Rostov region. The Russian authorities denied involvement, opening a criminal case against Prigozhin for inciting rebellion and urging Wagner fighters to detain him. However, Prigozhin announced a turnaround the next day, stating an agreement with the government to prevent bloodshed and investigate the incident. The rebellion challenged Putin's power and highlighted concerns about private military contractors' role and accountability in Russia and abroad.

The heads of the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve are considering making the capital rules stricter for banks with over $100 billion in assets. Three such banks failed recently and dragged the whole industry down, showing that banks of this size can cause financial stability problems due to both external and internal pressures. While some rules might apply to smaller banks, the majority of the new requirements will likely be for the largest global banks. In response, the banking industry, represented by the Financial Services Forum, says that it is concerned that strict requirements could limit lending and hurt the overall economy. The balance between stability and growth is a question the FIDC has to answer for the economy, as stricter lending will destroy more business than it should.

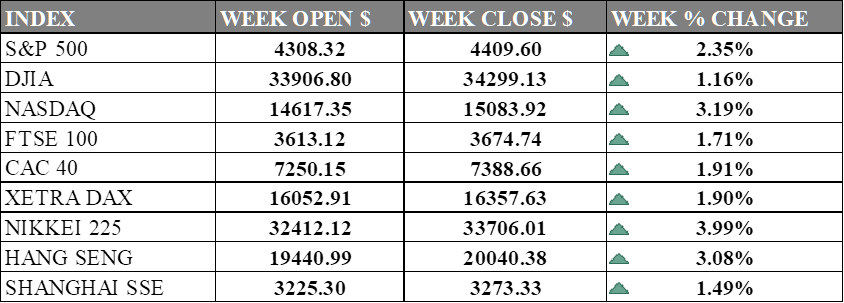

INDICES PERFORMANCE

The global stock markets ended the week lower amid rising concerns over slowing economies, interest rate hikes, and geopolitical tensions. The HANG SENG index suffered the biggest loss of -5.47% as disappointing tourism data pointed towards a weak economic recovery and slow government stimulus. The Nikkei 225 also dropped by -2.92% as Japan struggled with softening economic data and slowing global growth. The SHANGHAI SSE declined by -2.24% as China cut its key lending rates to support its economic recovery.

The European markets also closed lower as worsening economic data from participating countries, especially German Manufacturing PMI that went below expectations, as well as Eurozone Manufacturing PMI, which is a sign of a slowing economy. The Bank of England's (BoE) decision to surprise investors with a half percent hike and the Swiss National Bank's quarter basis point hike also affected the European market on a wider scale. The XETRA DAX, CAC 40, and FTSE 100 indices fell by -2.72%, -2.58%, and -2.45%, respectively.

The US markets also ended the week in negative territory as the Federal Reserve signalled that it may raise interest rates sooner than expected to combat inflation, which hit a 13-year high of 5% in May. Fed Chair Powell said “inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go,” suggesting additional action from the Fed in the form of more rate hikes or at the very least holding rates steady for longer. The NASDAQ, S&P 500, and DJIA indices lost -0.96%, -1.09%, and -1.40%, respectively.

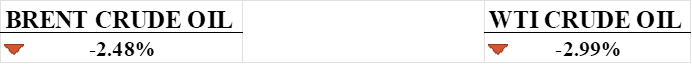

CRUDE OIL PERFORMANCE

The oil market is facing challenges despite OPEC's production cuts, with little impact on crude prices. The Saudis, aiming for oil prices at $80 per barrel or higher, need to exercise patience as central banks' actions, such as interest rate hikes or cuts, can influence global growth and oil demand. While global crude supply has already decreased due to OPEC cuts, the Saudis are willing to further reduce output. However, there are concerns about the success of these plans, as positive economic data may lead to inflation pressures and higher interest rates, impacting both economic growth and oil prices.

OTHER IMPORTANT MACRO DATA AND EVENTS

The Bank of England surprised markets by raising interest rates by 50 basis points, causing initial volatility in the currency market. Despite a brief surge, the pound stabilized against the dollar and euro. Market analysts expressed concerns about the negative impact of higher rates on the economy, with expectations of deteriorating economic data in the coming months.

The Swiss National Bank (SNB) recently increased inflation to 1.75% from 1.50% and indicated the likelihood of further rate hikes. However, the SNB attributed the falling inflation mainly to lower inflation on imported goods such as oil products and gas. Despite this, the SNB projects average annual inflation to be 2.2% for 2023 and 2024, and 2.1% for 2025, suggesting that the battle against inflation is ongoing. The next interest rate meeting on September 21 is expected to result in a 25-bps hike to 2.00%, with markets expressing optimism that the SNB is nearing the peak of its rates. Monitoring incoming inflation data will be crucial for understanding the SNB's future rate policy and its potential impact on the Swiss franc (CHF).

What Can We Expect from The Market This Week

US Durable Goods Order: Other than retail sales, durable goods orders are another important indicator in gauging consumers current spending habits, as less priority items would be forgone in a tight economy.

China Manufacturing PMI: China's economic recovery seems slower than investors had hoped, with an index below baseline indicating contraction. A higher PMI would result in higher crude oil demand and prices, as China is one of the largest oil consumers.

US New Home Sales: An interest rate pause had investors expecting much lower new home sales as the expectation of a lower rate later hurt demand more than expected, as high interest rates usually lead to a lower initial housing price.

Eurozone CPI June: The ECB is steadily raising interest rates in an effort to bring CPI down, which is still too far from its 2% target, which is currently at 6.1%. It is projected to reach a desirable level by 2025.

PCE Price Index: This benchmark is openly expressed as a favourite gauge used by the Federal Reserve to decide its next interest rate decision. Although prices are still increasing, a slower increase will eventually lower the year on year index to a desirable 2%.