PAST WEEK'S NEWS (OCTOBER 30 – NOVEMBER 03, 2023)

In the last FOMC meeting on Wednesday, The Federal Reserve held interest rates steady, pausing rate hikes for the third time this year as it monitors progress on inflation. Rates are still high though, keeping borrowing expensive while savings can earn good returns. Mortgage rates above 8% make homebuying more costly and realtor anxious as there is less seller and buyer in the market. Credit card debt stays high with rates around 20%. High-yield savings and CDs offer 4-5% returns to grow savings. The Fed is data-driven on rates, holding for now but may hike again if needed to control inflation.

Elon Musk's new AI company xAI has unveiled Grok, an AI assistant inspired by sci-fi and meant to have more personality and accuracy than competitors. Grok is currently in beta testing and only available to select users. It will eventually be offered through Musk's X Premium+ service for $16/month. In initial tests, Grok outperformed rivals like ChatGPT in certain math and coding tasks, though larger models still did better. xAI says Grok is the best in its class of 33B which means better and faster performance for less training data compared to Meta’s LLAMA 70B and even larger GPT-4. Analyst suggest that an integrated language model AI will enable social media sites to combat misinformation faster and more efficient.

INDICES PERFORMANCE

The major U.S. stock indexes ended higher last week amid optimism over slowing inflation and strong corporate earnings reports while stabilizing interest rate policy expectations in the next few months. The S&P 500 climbed 5.29% to close at 4358.35, up from its open of 4139.39. The Dow Jones Industrial Average rose 4.68% to finish at 34061.33 compared to its starting point of 32537.54. The tech-heavy NASDAQ posted the largest gain, surging 5.71% to 15099.49 after opening the week at 14283.98. The advance was fuelled by primarily driven by positive economic indicators and the Federal Reserve's indication of a potential pause in interest rate hikes, fostering optimism among investors. Additionally, a drop in bond yields and favourable company earnings reports further buoyed the market, leading to its best weekly performance since November 2022.

In Europe, the major indexes also booked weekly gains. The UK's FTSE 100 rose 2.69% to close at 3518.51 compared to its open of 3426.39. France's CAC 40 climbed 3.23% to end the week at 7047.51 after opening at 6826.95. Germany's DAX advanced 2.83% to settle at 15189.25 from its starting point of 14770.95. Positive expectations of central bank policy easing, with a focus on potential rate cuts next year put investors giddy. Additionally, optimism in response to corporate news and global market trends is contributing to the market's positive performance.

Asian indexes were mostly up on the week. Japan's Nikkei 225 gained 4.20%, closing at 31949.82 versus its open of 30663.48. Hong Kong's Hang Seng increased 2.55% to finish at 17664.13 from its starting level of 17225.65 amid optimism over China's reopening plans. China's Shanghai Composite rose 0.70% to close at 3030.80 compared to its open of 3009.61. Asian markets rallied on The Japanese government approving a 17 trillion-yen economic relief package, aiming to combat inflation, stimulate economic growth, and increase disposable incomes, with an expected overall size of 37.4 trillion yen.

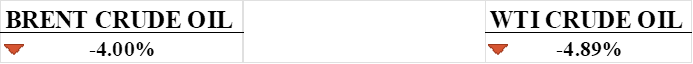

CRUDE OIL PERFORMANCE

Oil prices fell for the second straight week as worries about supply disruptions in the Middle East eased, offsetting a boost from the weaker U.S. dollar. Crude oil benchmarks dropped 4% over the past week despite escalating violence between Israel and Hamas as other OPEC nations did not join Iran's call for an oil embargo on Israel. Weaker than expected U.S. jobs data in October caused the dollar to fall over 1%, but this did not help crude prices stem losses. Oilfield services company Baker Hughes reported a decline in active U.S. rigs, while traders await CFTC data for clues about appetite for bullish oil bets. Overall, crude prices declined for a second consecutive week as the risk premium on Middle East supplies deflated, overshadowing other potentially supportive factors.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. job growth slowed in October, partly due to strikes by the United Auto Workers (UAW) union affecting Detroit's major car makers, leading to a decline in manufacturing payrolls and the smallest annual wage increase in almost 2.5 years. The unemployment rate also rose to 3.9%, the highest since January 2022, as the report signalled a potential easing in labour market conditions and suggested that the Federal Reserve may hold off on further interest rate increases.

U.S. manufacturing activity contracted more than expected, with the Institute for Supply Management's purchasing managers' index registering at 46.7, leading to decreased new orders and employment. Despite these challenges, other data from the Federal Reserve suggests solid growth in the production of durable goods in the third quarter, portraying a resilient U.S. economy in the face of various headwinds.

Asia's manufacturing sector saw declining factory activity, raising concerns about the region's export-driven recovery amid weaker global demand and higher prices. The slowdown in China's manufacturing is having a ripple effect on neighbouring countries, contributing to a challenging outlook for the Asian manufacturing sector.

What Can We Expect from The Market This Week

RBA Interest Rate Decision: The RBA is expected to raise the cash rate target by 25 basis points to 4.35%, marking the first rate hike under Governor Michele Bullock's leadership. This decision is made in response to the need for a more sustainable economic balance and may be further adjusted if inflation expectations rise, potentially affecting borrowing costs for households and businesses.

EIA Short-term Energy Outlook: The report offers forecasts and analysis of U.S. and global energy markets. Key points from the last report include predictions of a slight decrease in natural gas-fired electricity generation in 2024, record U.S. natural gas exports in 2023 with continued growth in 2024, and a decrease in U.S. liquid fuel consumption.

German CPI: It tracks changes in the prices of goods and services purchased by German consumers. The latest data from October 2023 reveals an expected inflation rate of 3.8%, the lowest since August 2021, where higher than expected readings can signify inflationary pressures in the economy.

US Initial Jobless Claims: Initial claims for state unemployment benefits rose slightly last week, but the tight labour market and strong economy were still evident, with more job openings than unemployed individuals. This report's data do not affect the October employment report scheduled for release, and the labour market remains robust despite a slight increase in jobless claims.

UK GDP Q3: GDP in Q3 is expected to contract by 0.1% due to declining output in major sectors, but Q2 2023 saw a 1.8% increase compared to pre-pandemic levels. Despite challenges like high inflation and the aftermath of the pandemic and Brexit, the UK economy is expected to avoid a recession, with some downside risks.