PAST WEEK'S NEWS (NOVEMBER 20 – NOVEMBER 24, 2023)

Binance, the world's largest cryptocurrency exchange, has pleaded guilty to anti-money laundering charges, resulting in a $4.3 billion penalty and the resignation of its founder, Changpeng Zhao. The company admitted to failing to report suspicious transactions from sanctioned entities and serving American customers illegally on its global exchange post-2019, even with a US-based arm. The Justice Department's enforcement action, along with the FTX collapse, highlights federal crackdowns on crypto violations. Despite public trust plummeting, the blockchain community remains optimistic about Binance's future, as evidenced by Bitcoin stabilizing around $37,000.

Sam Altman has returned as the CEO of OpenAI after being fired the previous Friday, as announced in a tweet on Tuesday night. The reinstatement follows an "agreement in principle" and the return of OpenAI President Greg Brockman, who resigned in solidarity with Altman. Altman, initially considering joining Microsoft, expressed commitment to OpenAI's mission and team, citing the best path forward with Microsoft's support and a new board. The tumultuous events also led to changes in the board of directors and positive responses from Microsoft's CEO, Satya Nadella, indicating optimism for stable governance and continued collaboration in advancing AI. Question remained as to the initial decision made by the board, gaining traction for concern on X as to its impact on AGI development and its potential danger in the face of unstable governance over it.

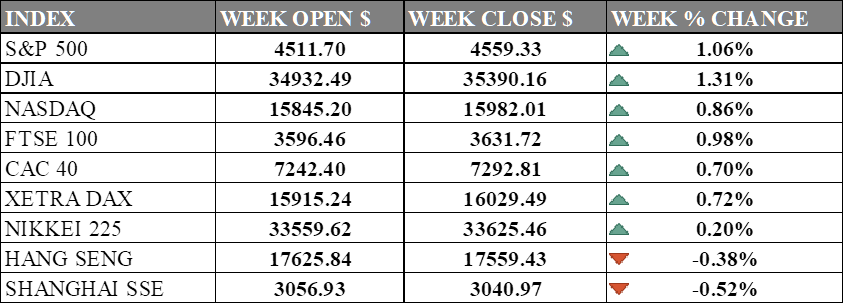

INDICES PERFORMANCE

The major U.S. stock indexes ended slightly higher last week amid slowing inflation and expectation of earlier rate cut. The S&P 500 climbed 1.06% to close at 4559.33, up from its open of 4511.70. The Dow Jones Industrial Average rose 1.31% to finish at 35390.16 compared to its starting point of 34932.49. The tech-heavy NASDAQ posted a gain of 0.86% to 15982.01 after opening the week at 15845.20. The U.S. stock market rally is spreading out from the big shots in mega-cap growth and tech. This is giving investors some hope that the rally will keep going strong until the end of the year.

In Europe, the major indexes also moved higher. The UK's FTSE 100 gained 0.98% to close at 3631.72 compared to its open of 3596.46. France's CAC 40 advanced 0.70% to end the week at 7292.81 after opening at 7242.40. Germany's XETRA DAX ticked up 0.72% to settle at 16029.49 from its starting point of 15915.24. European stock benefitted from a rise in a key business sentiment indicator from the Ifo research institute. Despite that, challenges persist for the German economy due to factors like the ECB policy, potential US economic slowdown, and uncertainties around fiscal stimulus, hindering strong growth drivers.

Asian indexes were mixed on the week. Japan's Nikkei 225 gained 0.20%, closing at 33625.46 versus its open of 33559.62 driven by profit taking and shortened trading session. Hong Kong's Hang Seng lost -0.38% to finish at 17559.43 from its starting level of 17625.84. China's Shanghai Composite declined -0.52% to close at 3040.97 compared to its open of 3056.93. The central bank of China declared its intention to promote the backing of private enterprises by financial institutions, including a higher acceptance of non-performing loans.

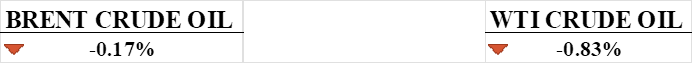

CRUDE OIL PERFORMANCE

Oil prices converged ahead of OPEC+ deciding production cuts next week after the group's meeting was unexpectedly delayed. Prices initially sank on the postponement before rebounding on hopes for an extension of existing cuts as the alliance moves closer toward supply compromises with African producers for 2024. However, oil faces uncertainty - factors like rising US stockpiles and sliding demand contrast improving China data, underscoring the haziness producers must navigate when officials reconvene Thursday. With mixed signals going forward, the path ahead relies on OPEC+ driving direction at next week's pivotal assembly.

OTHER IMPORTANT MACRO DATA AND EVENTS

German business morale rose for a third month in November, registering at 87.3, just below the forecast. However, concerns persist over a recent court ruling deeming the government's fund allocation unconstitutional, raising uncertainty and the possibility of a recession.

The Eurozone faces a labor market slowdown, evident in the PMI's first drop in employment subindex in years, challenging the ECB's inflation targets. Robust wage growth, currently around five percent, introduces complexity into future ECB policy, with Governor Pierre Wunsch suggesting unchanged interest rates during minor recessions if this pace is maintained.

Japan's core consumer prices rose 2.9% year-on-year in October, reinforcing expectations that the Bank of Japan may roll back monetary stimulus soon due to persistent inflation. The BOJ attributes the inflation to global factors, but speculation grows about ending negative interest rates and yield control policies.

What Can We Expect from The Market This Week

RBNZ Interest Rate Decision: It is set to announce a pause, with the current consensus at 5.5%, a rate maintained since October. RBNZ Deputy Governor Christian Hawkesby noted the country can handle higher rates of unemployment, while New Zealand's Q3 Consumer Price Index rose 5.6% YoY, slightly below the expected 5.9% increase.

US Building Permits: a key economic indicator reflecting housing market demand. A decline in building permits, as seen in the latest data for September 2023 in the United States, signals a potential economic slowdown.

CB Consumer Confidence: a key leading indicator in the United States, reveals a third consecutive monthly decline in October 2023. This drop reflects growing consumer concerns about rising prices, political instability, and higher interest rates, despite robust ongoing spending on goods and services.

US GDP Q3: The US Bureau of Economic Analysis reported 4.9% annualised growth for the third quarter of 2023, the fastest pace in almost two years. Consumer spending, private inventory investment, exports, and government spending drove this growth, among other factors, with economists predicting a "soft landing" for the economy.

US PCE Price Index: Consumer expenses inflated by 0.3% from the previous month and 3.4% from the same period last year. Notably, the US Bureau of Economic Analysis introduced two new PCE price indexes in September, one excluding energy and housing and another excluding food, energy, and housing categories.