PAST WEEK'S NEWS (NOVEMBER 27 – DECEMBER 01, 2023)

Over 160 world leaders have converged in Dubai ahead of the pivotal COP28 climate summit to accelerate global action on the escalating climate crisis. Bill Gates voiced optimism about encouraging climate solutions but stressed the need to rapidly scale promising technologies with robust government policies and private sector support. Africa and other fossil fuel-dependent nations are pushing for just transition assistance to adapt their vulnerable economies, while factions disagree on aggressive fossil fuel phase-out targets. With immense complexity and drama expected on the fate of fossil fuels, the talks ultimately hinge on urgent, equitable climate progress across all nations.

The Chinese fast-fashion juggernaut Shein, valued at $66 billion, has confidentially filed for a 2024 U.S. IPO to expand globally. However, the opaque retailer faces lawmakers' scrutiny over supply chain-forced labour and Beijing ties. Shein courts allies like Forever 21 and taps Goldman, JPMorgan, and Morgan Stanley to lead, working to sway regulators before its enigmatic CEO Xu takes the stage. If the controversial clothing giant can convince the SEC that its factories are forced labour-free and address national security concerns, its rock-bottom prices may soon dress American closets.

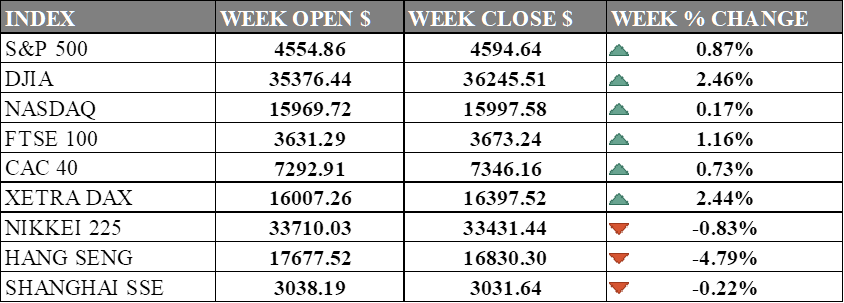

INDICES PERFORMANCE

The major U.S. stock indexes ended mixed last week with technology-rich Nasdaq weaken while DJIA gain on salesforce explosive gains. The S&P 500 climbed 0.87% to close at 4594.64, up from its open of 4554.86. The Dow Jones Industrial Average rose 2.46% to finish at 36245.51 compared to its starting point of 35376.44. The tech-heavy NASDAQ posted a gain of 0.17% to 15997.58 after opening the week at 15969.72. The U.S. stock market rally is spreading as falling bond yields, attributed to expectations of future rate cuts by the Federal Reserve, continued to drive market optimism despite Fed Chair Jerome Powell's cautionary remarks on premature rate cut discussions.

In Europe, the major indexes also moved higher. The UK's FTSE 100 gained 1.16% to close at 3673.24 compared to its open of 3631.29. France's CAC 40 advanced 0.73% to end the week at 7346.16 after opening at 7292.91. Germany's XETRA DAX ticked up 2.44% to settle at 16397.52 from its starting point of 16007.26. The improvement in Germany's manufacturing sector, indicated by a rising HCOB Germany Manufacturing PMI, contributed to the optimistic market sentiment, with the sector showing signs of recovery despite remaining in the contraction zone. Deutsche Bank indicates that eurozone inflation might be below the 2% target which could prompt an ECB rate cut in Q1.

Asian indexes were weak on the week. Japan's Nikkei 225 lost -0.83%, closing at 33431.44 versus its open of 33710.03 driven by weak Japan's manufacturing activity that contracted for the sixth consecutive month. Hong Kong's Hang Seng lost -4.79% to finish at 16830.30 from its starting level of 17677.52. China's Shanghai Composite declined -0.22% to close at 3031.64 compared to its open of 3038.19. China's economic outlook remains gloomy despite some positive signs. While its manufacturing sector shows growth and US inflation cools, dire projections around the property market, bad loans, and debts of local governments are weighing down forecasts for Chinese stocks.

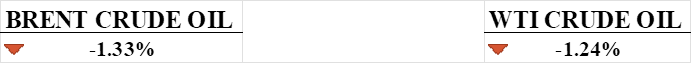

CRUDE OIL PERFORMANCE

Crude oil markets are being pulled between bullish and bearish forces with the bear winning last week even though supply risks increased as attacks on US and Israeli ships in the Red Sea potentially expand Middle East instability. However, high US oil output and stockpiles signal ample supply which become the main point of concern that drive prices lower. Meanwhile, weak economic data raises worries over soft demand. While geopolitical tensions may support prices, large inventories and concerns over slow demand growth could limit upside.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. consumer spending rose moderately in October, while inflation slowed to the lowest annual rate since March 2021, suggesting the Fed’s interest rate hikes were over. The labour market also showed signs of cooling, with more Americans applying for unemployment benefits and the number on jobless rolls hitting a two-year high in mid-November.

The economy grew at a robust 5.2% pace in the third quarter but is expected to slow down in the fourth quarter and avoid a recession in early 2024. The PCE price index, the Fed’s preferred inflation measure, was unchanged in October and rose 3.0% year-on-year, while the core PCE price index, which excludes food and energy, gained 0.2% and increased 3.5% year-on-year.

Euro zone inflation fell more than expected in November, raising doubts about the ECB’s view that price growth is persistent and increasing the chances of early rate cuts next year. Investors are betting on a first cut by April, while the ECB argues that inflation will rebound above 3% next year due to wage pressures and tight labour market conditions.

What Can We Expect from The Market This Week

ISM Non-Manufacturing PMI: measures the overall health of the non-manufacturing sector based on business activity, new orders, employment, and supplier deliveries. Slower growth was observed in business activity and employment, while inventories and new export orders contracted, which put the index slightly above stagnation.

JOLTs Job Openings: measure job vacancies based on a market survey conducted by the Bureau of Labour Statistics. Recent data indicates that job openings remained high at 9.553 million, while consensus is pessimistic at 9.350 million, even though the figures have risen two consecutive times.

US Trade Balance: reflects the balance between the value of goods and services exported and imported by the United States. The US trade deficit widened to $61.5 billion in September 2023, although it remains the third-lowest trade deficit since 2021.

Japan's GDP Q3: Japan’s economy contracted significantly in the third quarter, with a 2.1% decline year-on-year and a 0.5% contraction quarter-on-quarter. This downturn, driven by weaker domestic demand and rising inflation, poses policy challenges for Prime Minister Fumio Kishida and Bank of Japan Governor Kazuo Ueda.

US Nonfarm Payrolls: crucial insights into the employment landscape in the United States It increased by 150,000 in October, falling short of the consensus forecast of 170,000. The unemployment rate rose to 3.9%, the highest level since January 2022, primarily due to United Auto Workers strikes impacting the manufacturing industry.