PAST WEEK'S NEWS (DECEMBER 11 – DECEMBER 15, 2023)

November's inflation report threw the Fed a curveball: falling energy prices were countered by stubborn service and shelter costs, leaving core inflation stuck at 4%. Wage pressures keep the inflation fire smouldering, but a strong jobs report adds fuel to the economic growth engine. With mixed signals in hand, the central bank likely pauses, but the path forward remains shrouded in uncertainty. The next move hinges on whether the Fed prioritises taming inflation or keeping the economy floating. Investors and businesses hold their breath, waiting for tomorrow's FOMC announcement to clear the fog.

The Fed kept rates steady at 5.5% today, but many expect cuts could start as early as March. Some analysts think gradual easing begins then, others say aggressive cuts may hit in May. Either way, cheaper money looks inevitable in 2024. That likely means lower mortgage rates and could pump up assets. However, ongoing wage growth or commercial real estate troubles may delay cuts. Plus, the government's huge debts put pressure to act fast. Home buyers should get ready for a rollercoaster ride in 2024. Lower rates may lift demand and prices, but the timing is up in the air.

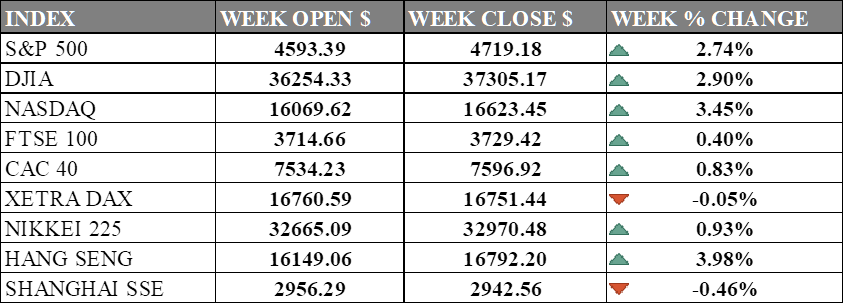

INDICES PERFORMANCE

The major U.S. stock indexes ended strong last week with the Nasdaq outperforming while the DJIA and S&P 500 edged up slightly. The S&P 500 rose 2.74% to close at 4719.18, up from its open of 4593.39. The Dow Jones Industrial Average ticked up 2.90% to finish at 37305.17 compared to its starting point of 36254.33. The tech-heavy Nasdaq posted a gain of 3.45% to 16623.45 after opening the week at 16069.62. Stocks rose as the Federal Reserve hinted at lower borrowing costs in 2024 with CME FedWatch seeing trader pricing in cuts as soon as March 2024. Although investor eagerly anticipating a Santa rally, the economic conditions as prosperous as it is right now suggested that optimism has ran out.

In Europe, the major indexes also moved higher. The UK's FTSE 100 advanced 0.40% to close at 3729.42 compared to its open of 3714.66. France's CAC 40 rose 0.83% to end the week at 7596.92 after opening at 7534.23. Germany's XETRA DAX declined -0.05% to settle at 16751.44 from its starting point of 16760.59. Europe indexes remained stagnant as business activity in the private sector contracted in December. The HCOB Flash PMI survey signals a potential second consecutive quarter of negative growth for Germany, while the Eurozone economy has contracted for six straight months, heightening recession concerns.

Asian indexes were mixed on the week. Japan's Nikkei 225 gained 0.93%, closing at 32970.48 versus its open of 32665.09 supported by modest increase in private-sector business activity although manufacturing sector contracted, posting the quickest deterioration in business conditions in ten months. Hong Kong's Hang Seng advanced 3.98% to finish at 16792.20 from its starting level of 16149.06. China's Shanghai Composite dropped -0.46% to close at 2942.56 compared to its open of 2956.29. China market propelled by the People's Bank of China's injection of CNY 800 billion in medium-term policy loans, reaching a two-week high, despite later paring gains due to mixed activity data in China for November.

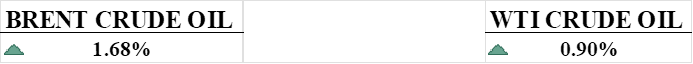

CRUDE OIL PERFORMANCE

Brent and WTI crude futures recovered slightly on the week as traders tried to weigh mixed demand signals for 2023, including a third straight monthly drop in New York Fed manufacturing orders indicating potentially weaker consumption next year against OPEC's more bullish demand forecast of 2.25 million bpd growth. Though the global crude benchmark pared losses after the dollar dipped to a 4-month low and Baker Hughes reported a declining U.S. oil rig count, prices remained pressured by hawkish signals from the Fed that interest rate cuts are premature given lingering inflationary pressures. Going forward, oil markets face precarious two-way risks on both upside potential if the global economy weathers financial tightening better versus further downside if recessionary forces intensify.

OTHER IMPORTANT MACRO DATA AND EVENTS

The euro zone's preliminary Composite PMI unexpectedly declined to 47.0 in December, indicating a deepening economic contraction with broad declines in the services and manufacturing sectors across Germany and France, suggesting the region is now in recession. Despite weak data and the Bundesbank warning of muted German growth next year from high borrowing costs, factory managers grew more optimistic about future output even as the ECB trimmed 2023-2024 forecasts while leaving rates unchanged.

U.S. retail sales unexpectedly rose 0.3% in November as consumers showed resilience amid deep holiday discounts, likely keeping economic growth on track and casting doubt on expectations for rate cuts as early as March by the Federal Reserve, which signalled an end to historic tightening at its latest meeting. Though business inventories dipped and jobless claims rose, initial claims remain low, indicating the labour market continues supporting the economy while GDP growth estimates for the fourth quarter were revised up on projections of solid consumer spending.

What Can We Expect from The Market This Week

Eurozone CPI: Eurozone inflation fell from 2.9% to 2.4% in November, easing pressure on the European Central Bank to immediately cut rates. The service inflation slowdown, compounded by early-stage declines in housing and labour markets, is contributing to a challenging disinflationary trend. This inflation trend may prompt the ECB's monetary policy to ease.

BoJ Interest Rate Decision: The BoJ is expected to maintain current policy settings, including a negative interest rate and a 0% target for the 10-year Japanese government bond yield. Investors anticipate that any rate hike may be delayed until at least April.

PBoC Loan Prime Rate: PBoC maintained its benchmark lending rates, with the one-year Loan Prime Rate (LPR) at 3.45% and the five-year LPR at 4.20%. Additionally, on December 15, 2023, the PBoC injected 1.45 trillion yuan in one-year medium-term lending facility (MLF) loans while keeping the MLF loan rate unchanged.

US PCE Price Index: key measure of inflation encompassing various consumer goods and services, recorded a 3.0% year-on-year increase in October 2023, marking the smallest gain since March 2021. Policymakers, particularly the Federal Reserve, closely monitor these figures, with a sustained monthly inflation rate of 0.2% deemed necessary to meet the central bank's 2% target and assess progress in controlling inflation.

UK Retail Sales: Sales of goods and services dropped 0.3% in October, reaching levels not seen since 2018. It is worse than consensus and aligned with a broader economic slowdown in Britain, marked by stagnant growth and persistent price pressures, prompting investors to anticipate an earlier interest rate cut by the Bank of England in the coming month.