PAST WEEK'S NEWS (JANUARY 08 – JANUARY 12, 2024)

Headline inflation ticked up in December, although core inflation showed signs of cooling, leaving the Federal Reserve on the fence. While the market initially reacted negatively, expectations for rate cuts soon returned, with a 96% chance of easing by May. The biggest concern remains service inflation, driven by wage growth, which the Fed aims to bring down to 2%. The Conference Board predicts a limited recession in the first half of 2024 but expects a rebound later in the year due to planned Fed policy changes. Interest rate cuts are likely to begin in mid-2024, followed by quantitative easing, potentially reigniting inflation in 2025.

The SEC greenlit the first US Bitcoin ETFs, marking a pivotal moment for the volatile crypto asset and the broader industry. Despite concerns about manipulation and investor protection, 11 ETFs from giants like BlackRock and Fidelity are set to debut, potentially attracting billions, and boosting Bitcoin's legitimacy. This approval, however, doesn't signal a crypto free-for-all, as the SEC remains wary and emphasises Bitcoin's speculative nature and potential criminal misuse. Buckle up for a wild ride in the crypto arena, with increased access but continued regulatory scrutiny.

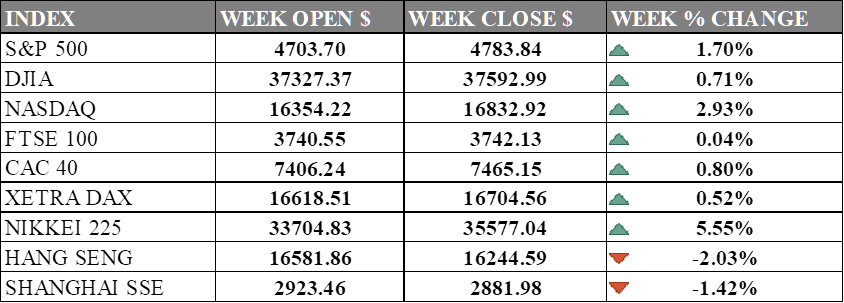

INDICES PERFORMANCE

The major U.S. stock indexes ended mostly higher last week with the Nasdaq surging the most while the DJIA and S&P 500 also climbed although less sharply. The S&P 500 advanced 1.70% to close at 4783.84, up from its open of 4703.70. The Dow Jones Industrial Average rose 0.71% to finish at 37592.99 compared to its starting point of 37327.37. The tech-heavy Nasdaq jumped 2.93% to 16832.92 after opening the week at 16354.22. While the gradual increase in consumer prices persisted, there was an unexpected decline in producer prices, raising optimism for a relief in cost pressures. The start of the earnings season was underwhelming, with bank profits falling short and possibly prolonging a period of sluggish growth.

In Europe, the major indexes were mixed. The UK's FTSE 100 was nearly unchanged ticking up 0.04% to close at 3742.13 compared to its open of 3740.55. France's CAC 40 climbed 0.80% to end the week at 7465.15 after opening at 7406.24. Germany's XETRA DAX advanced 0.52% to settle at 16704.56 from its starting point of 16618.51. Attention in Europe is focused on banking sector M&A speculation, particularly surrounding Deutsche Bank and Commerzbank, as well as corporate developments such as Atos appointing a new CEO and PageGroup trimming its annual profit forecast due to challenging market conditions.

Asian indexes were also mixed on the week. Japan's Nikkei 225 surged 5.55%, closing at 35577.04 versus its open of 33704.83 boosted by shippers and financials, with a retreat in U.S. bond yields and a stabilization in the yen exchange rate bolstering sentiment. Hong Kong's Hang Seng sank -2.03% to finish at 16244.59 from its starting level of 16581.86. China's Shanghai Composite slipped -1.42% to close at 2881.98 compared to its open of 2923.46. Chinese stocks dropped as uncertainty stemming from the People's Bank of China's decision to keep the medium-term lending facility (MLF) rate unchanged at 2.50%, despite expectations of a cut to support the economy. Concerns about deflation pressure, weak credit demand, and anticipation of forthcoming economic data also contributed to investor withdrawal from its economy.

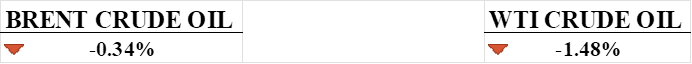

CRUDE OIL PERFORMANCE

Oil prices tread water as traders await clues from China and the Fed. Despite lingering concerns over the Middle East conflict, oil prices stalled, shackled by anxieties about slowing global demand. Weak economic data in China and sticky U.S. inflation cast a shadow over the market, overriding the jitters stemming from potential Houthi retaliation and the Israel-Gaza war. Focus now shifts to key economic readings from both countries this week, with China's GDP and U.S. retail sales holding the potential to sway the oil market's delicate balance.

OTHER IMPORTANT MACRO DATA AND EVENTS

Producer prices unexpectedly dipped in December, driven by falling diesel and food costs, suggesting inflation's retreat and potentially opening a door for the Fed to cut rates as early as March. Though consumer prices ticked up last month, the PPI's three-month decline hints at cooling pressures, bolstering hopes for a softer economic landing.

China's December trade data defied expectations, with a surging export rebound suggesting stabilizing global demand and a possible mild pickup in domestic consumption. However, lingering import weakness and limited fiscal support leave Beijing grappling with an uphill battle to rekindle robust economic growth.

What Can We Expect from The Market This Week

China GDP Q4: Economic growth grew at 4.9% YoY, a decline from 6.3% in Q2, mainly due to a higher comparison base last year. Despite this, the Q3 average growth rate was 4.4%, surpassing market expectations by 1.1 percentage points, indicating a month-on-month increase of 1.3% and a continued domestic economic recovery. The IMF anticipates a slowdown to 4.6% in 2024 due to property sector weakness and subdued external demand.

Eurozone CPI December: Inflation rises to 2.9% from 2.4% in November, driven by increased energy and food prices, as well as heightened demand in tourism and hospitality. Despite these factors, the European Central Bank has not signalled immediate changes in its monetary policy.

US Retail Sales: consumer spending, driving two-thirds of the US economy, unexpectedly increased by 0.3% in November 2023, surpassing predictions of a 0.1% decline. Holiday shopping, discounted offerings, and a surge in online transactions drove this broad-based rise, which encompassed sectors like building materials and food services. A positive outlook for consumer spending.

US Building Permits: Gauges in government-issued permits for new construction have seen a notable surge in permits for single-family home construction, which is a positive outlook for the housing market and the economy, prompting economists to revise growth estimates and anticipate economic resilience, although application for permits is a better leading index.

US Existing Home Sales: The annualised number of existing residential buildings sold saw a 0.8% increase in November 2023, reaching a seasonally adjusted annual rate of 3.82 million units with a median home price rise of 4.0%. Despite elevated mortgage rates, the unexpected surge in November suggests housing market resilience on a national scale.