PAST WEEK'S NEWS (February 12 – February 16, 2024)

Nvidia CEO Jensen Huang questioned if Sam Altman's attempts to raise up to $7 trillion to increase GPU chip supply were even realistic. However, with OpenAI's new release of "Sora," Altman's pitch becomes more enticing for investors. Sora is their video-generation AI model capable of creating realistic scenes from text that demonstrates remarkable progress in using advanced AI for practical video applications that could be highly valuable commercially. The computing power needed to scale such models globally would be immense. Thus, Altman's proposal to substantially expand chip production, though extraordinarily ambitious, may now seem more pragmatic given Sora's demonstrated capabilities and the massive data centre demands ahead for advanced AI video and graphics.

After Germany, now Japan's economy has also fallen into recession, with a 0.4% annualised decline in Q4 2023, raising doubts about the prior central bank's plans to mess with its easy monetary policy. Weak domestic demand, with consumption and capital expenditure both falling, contributed to the recession despite positive external demand from exports. Japan, the world's third-largest economy behind Germany, moved from 0.9% growth to a 0.8% decline to another decline of 0.1%, casting doubt on the Bank of Japan's optimistic forecasts for wage-driven consumption growth. While business surveys and the tight labour market suggest a different story, negative growth and a negative savings rate remain the main concerns for Japan's economic outlook. The UK economy may follow suit if its growth hits the expected figure today.

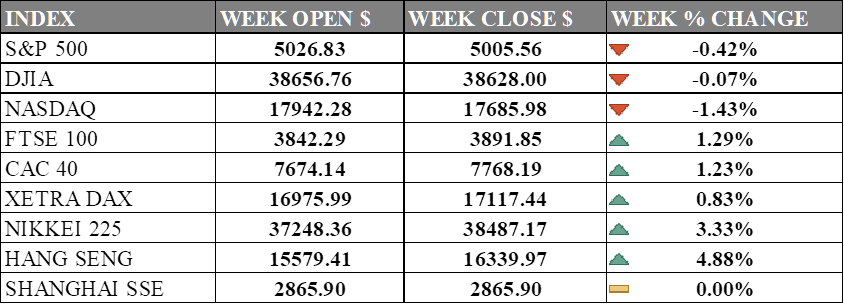

INDICES PERFORMANCE

The major U.S. stock indexes ended mostly lower last week, halting five consecutive weeks of gains. The S&P 500 slipped 0.42% to close at 5005.56, down from its open of 5026.83. The Dow Jones Industrial Average fell 0.07% to finish at 38628.00 compared to its starting point of 38656.76. The tech-heavy Nasdaq declined 1.43% to 17685.98 after opening the week at 17942.28. Despite this decline, the S&P 500 remains up 4.9% for the year, showcasing resilience amid concerns over inflation, bolstered by strong fourth-quarter earnings and a perceived downward trend in inflation despite recent data showing higher-than-expected wholesale prices.

In Europe, the major indexes were mostly higher. The UK's FTSE 100 advanced 1.29% to close at 3891.85 compared to its open of 3842.29. France's CAC 40 rose 1.23% to end the week at 7768.19 after opening at 7674.14. Germany's XETRA DAX climbed 0.83% to settle at 17117.44 from its starting point of 16975.99. The European blue-chip indices concluded the trading week positively, supported by encouraging data from France indicating a slowdown in consumer price growth. Despite concerns over inflation, particularly in Germany, with wholesale prices falling annually but showing a slight monthly increase, overall investor sentiment remained optimistic, despite Deutsche Bank facing regulatory scrutiny and implementing changes in its work-from-home policy.

Asian indexes were mixed on the week. Japan's Nikkei 225 jumped 3.33%, closing at 38487.17 versus its open of 37248.36 as foreign investors boosted Japanese stocks, amid eased BOJ policy concerns, while both non-native and Japanese investors showed increased activity in bonds and foreign equities. Hong Kong's Hang Seng advanced 4.88% to finish at 16339.97 from its starting level of 15579.41. China's Shanghai Composite was unchanged, closing at 2865.90 compared to its open of 2865.90. The Hong Kong stock market saw its third consecutive session of gains as investors anticipated the reopening of Chinese markets post-Lunar New Year. Optimism was surrounded by hopes for supportive measures from Chinese authorities.

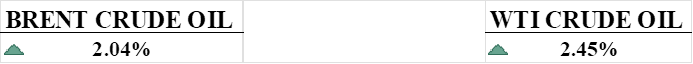

CRUDE OIL PERFORMANCE

Both WTI and Brent crude oil prices reached their highest levels in three months on Friday, driven by geopolitical tensions in the Middle East and the death of Russian activist Alexei Navalny. The oil market was well supplied by non-OPEC+ producers, but demand growth was slowing down, especially in China, the world’s largest oil consumer. The IEA lowered its global oil demand forecast for 2024 and expected a higher supply surplus this year, indicating a weaker outlook for the oil market. OPEC+ continued to limit its oil output to support prices but faced challenges from rising US shale production and Iranian exports. Oil prices also reacted to the US dollar movements, rising on Thursday after disappointing US retail sales data.

OTHER IMPORTANT MACRO DATA AND EVENTS

Americans are experiencing a rare economic phenomenon: a smooth transition to normal inflation levels without a recession, thanks to a surge in productivity growth. This surge, potentially driven by advancements like generative artificial intelligence and pre-emptive cost-cutting measures by companies, has supported wage gains, though its long-term impact remains uncertain.

Britain's economy entered a recession in late 2023, with GDP falling by 0.3% in the fourth quarter, raising fears about interest rate cuts and cries for government aid. Despite Prime Minister Rishi Sunak's promises to encourage growth, the economy's troubles have weakened his party's image for economic expertise, with Labour gaining trust in economic affairs after projections of slowing growth.

What Can We Expect from The Market This Week

FOMC Meeting Minutes: Meeting minutes are expected to note a cautious shift in the U.S. Federal Reserve's monetary policy outlook, with a growing consensus among members to potentially pause interest rate hikes if economic indicators continue to improve, fostering optimism and a more gradual approach to monetary tightening.

Eurozone CPI: Despite varied inflation rates among Eurozone countries, long-term inflation expectations remain stable in the 2%–3% range. It shows a decline in both headline and core inflation rates, attributed to decreasing energy prices, potentially influencing future ECB monetary policy decisions, although it is unlikely that a rate cut is in store unless the Fed does.

US Existing Home Sales: This gives insights into housing market health by tracking sales and prices of previously owned homes that are expected to build on. The figures reported a 1.0% drop to 3.78 million units in December 2023, the lowest level since August 2010. Although consensus points towards 5% higher, it is unlikely as equity euphoria is still going strong.

German GDP Q4: Germany's economy has been struggling recently with declining industrial production, exports, and GDP growth in the fourth quarter of 2023, raising concerns about a continued technical recession in 2024. However, easing inflation is a silver lining that could help improve the economic outlook in the coming quarters.

US Initial Jobless Claims: A weekly report that shows how many people filed for unemployment benefits for the first time reflects the state of the economy and the labour market. In February 2024, the report showed a drop in initial claims but a rise in continued claims and the four-week average, indicating a mixed picture of the US labour market.