PAST WEEK'S NEWS (March 11 – March 15, 2024)

Speculative bets are piling up that the Bank of Japan will soon scrap its negative interest rate policy, impacting Japanese money markets. Investors are aggressively shorting short-dated government bonds, expecting banks to dump them to park cash at the BoJ, earning positive rates. Futures contracts, on the other hand, are already pricing in an end to negative rates and a shift by the B0J to start using the overnight call rate as its main policy tool. Adding to these pressures, major manufacturers agreed to significant wage hikes this year, an inflationary move. With overnight rates likely turning positive, the BOJ would ditch its yield curve control framework for managing long-term bond yields. The intense positioning highlights speculation over an imminent historic monetary policy shift.

February's CPI report came in hotter, climbing unexpectedly to 3.2% from 3.1% in January, a setback for further progress towards the Fed's 2% target. Core inflation has also been reported to be higher at 3.8%, driven by service inflation, which stuck at 5.2% given strong wage growth. The hot data severely reduced the odds of a Fed rate cut at the next two meetings to near zero. Markets now see cuts more likely starting in June as the Fed aims to cool the tight labour market, which drives service inflation. However, cutting rates could be disruptive with inflation still exceeding targets and midterm elections approaching. The Federal Reserve faces a tricky balancing act to engineer a soft landing without harming the growing economy.

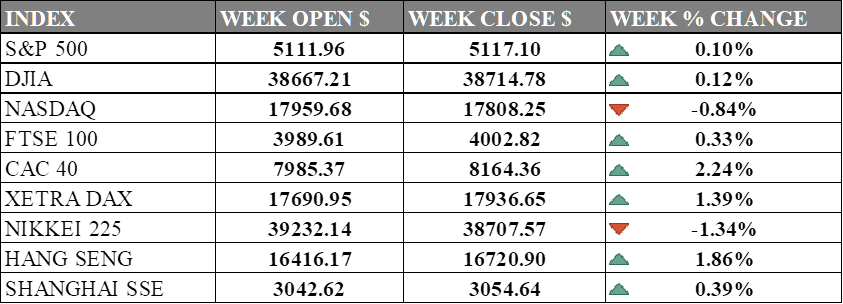

INDICES PERFORMANCE

The major U.S. stock indexes ended mixed last week with weaker market ahead as tech weigh down on market. The S&P 500 rose 0.10% to close at 5117.10, up from its open of 5111.96. The Dow Jones Industrial Average gained 0.12% to finish at 38714.78 compared to its opening level of 38667.21. The tech-heavy Nasdaq dropped 0.84% to 17808.25 after opening the week at 17959.68. Intermittent volatility driven by inflation concerns and weaker economic data particularly affecting the tech-heavy Nasdaq index, although expectations of interest-rate cut this year persisted.

In Europe, the major indexes were higher especially French market that is drive by strong performance of key sectors such as automotive, finance, and industrial, despite some setbacks in other sectors like technology and real estate. The UK's FTSE 100 increased 0.33% to close at 4002.82 compared to its open of 3989.61. France's CAC 40 rose 2.24% to end the week at 8164.36 after opening at 7985.37. Germany's XETRA DAX gained 1.39% to settle at 17936.65 from its starting point of 17690.95. European index marked its eighth consecutive week of growth, driven by positive corporate updates and expectations of ECB rate cuts, despite conflicting inflation trends between the euro zone and the United States.

Asian indexes were mixed on the week. Japan's Nikkei 225 fell 1.34%, closing at 38707.57 versus its open of 39232.14 as tech stocks mirrored declines in the US market, with semiconductor-related companies like Advantest and Tokyo Electron leading the downturn. Hong Kong's Hang Seng gained 1.86% to finish at 16720.90 from its starting level of 16416.17. China's Shanghai Composite rose 0.39%, closing at 3054.64 compared to its open of 3042.62. The Chinese market saw mixed performance as Hong Kong stocks, particularly in property shares, declined following the central bank's unchanged policy rate, while mainland China stocks edged up slightly, supported by ongoing policy measures.

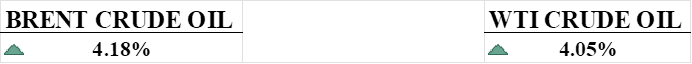

CRUDE OIL PERFORMANCE

Oil prices ended the week strong as it rallies on heightened demand, with traders now awaiting cues from a string of key central bank meetings this week led by the Federal Reserve. While tighter global supplies fuelled price gains recently, investors are now cautious about potential hawkish signals from central banks that could weigh on economic growth and oil demand. All eyes are on the Fed's rate decision on Wednesday, along with meetings by the Bank of Japan, Reserve Bank of Australia, and Bank of England. China's upcoming data on industrial output, retail sales and interest rates will also provide clues on the demand outlook. However, broader economic headwinds could limit oil's upside despite any short-term demand boost from China.

OTHER IMPORTANT MACRO DATA AND EVENTS

Business inventories remained flat in January, defying economists' expectations of a 0.2% increase. Despite a 0.4% year-on-year rise, private inventory investment cut 0.3 percentage points from GDP growth, with declines mostly in manufacturers' and wholesalers' stocks, while retail inventories, particularly excluding autos, managed to show modest gains.

Consumer price growth up in February, with the annualized reading of the consumer price index rising to 3.2%, exceeding expectations. Despite a slight dip in the core figure to 3.8%, reinflationary pressures remain a concern, potentially complicating Federal Reserve plans for interest rate cuts. While the Fed awaits sustained evidence of inflation easing towards their 2% target, it seems unlikely for a rate cut in the ever-ascending market.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: With inflation coming in hotter with little progress and multiple asset class exorbitant valuations despite the high interest rate environment, it remains uncertain as to the data-dependent reasoning for rate cuts. More clues are to come in Fed Chair Powell's speech on Friday rather than the meeting, unless the Fed takes a surprise stance, which is highly unlikely, as the market bets the cuts will be in June or July at the latest.

Eurozone CPI February: The early report's figures show consumer inflation decreased slightly to 2.6% from January's 2.8%, with notable declines in food, services, and energy prices, reflecting an improving cost of living in the region. Detailed insights are set for release, offering a deeper dive into the cost of livelihood for the Eurozone economy.

Philadelphia Manufacturing Index: a key indicator of manufacturing activity, showed signs of recovery in February, rising to a positive reading of 5.2 after a prolonged period of contraction. This improvement suggests a potential stabilisation in the sector, with new orders and shipments turning positive, although employment figures remain a concern.

US Existing Home Sales: home sales in the US rose 3.1% in January 2024 to a seasonally adjusted annualised rate of 4 million units, the highest level in five months, supported by somewhat higher listings and lower mortgage rates compared to late 2023. However, the median existing-home price reached an all-time high of $379,100 for the month of January.

UK CPI February: Consumer prices in the UK rose 4.0% year on year to January 2024, while CPIH inflation was 4.2% over the same period. The Bank of England expects inflation to fall towards its 2% target, though with some volatility along the way, as higher interest rates take effect.