PAST WEEK'S NEWS (March 18 – March 22, 2024)

At the recent FOMC meeting, Fed Chair Powell issued another pause, although he acknowledged that inflation has "eased substantially" but remains above the 2% target. While avoiding specifics for upcoming meetings, Powell signalled a data-dependent approach, seeking more evidence before cutting rates. He dismissed concerns that a strong labour market would deter rate cuts, reiterating the Fed's determination to ease monetary policy. However, Powell's remarks downplayed the impact of recent hot inflation prints, which is a cause for doubts about the Fed's commitment to controlling rising prices. With plans to resume quantitative easing, aggressive rate cuts could reignite inflation in areas like housing and food prices.

Multiple central banks decided on their next path in fiscal policy. The Swiss National Bank cut interest rates for the first time since June 2022, marking the first among major central banks to do so. Turkey's central bank, on the other hand, hiked rates by 500 basis points to 50%, citing its inability to tackle inflation. The Bank of England kept rates on hold at 5.25% but signalled at least three cuts this year, seeing encouraging signs of falling inflation. Central banks are grappling with divergent inflation trajectories, with some easing policy while others tightening, reflecting differing economic conditions across regions.

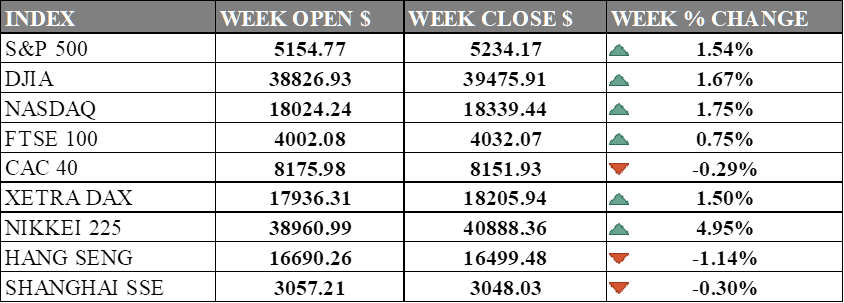

INDICES PERFORMANCE

The major U.S. stock indexes hit another all-time-high last week with a positive market sentiment. The S&P 500 gained 1.54% to close at 5234.17, up from its open of 5154.77. The Dow Jones Industrial Average climbed 1.67% to finish at 39475.91 compared to its opening level of 38826.93. The tech-heavy Nasdaq advanced 1.75% to 18339.44 after opening the week at 18024.24. The gains were broad-based across sectors, as optimism is high over potential interest rate cuts and resilient economic data and renewed enthusiasm for AI technology.

In Europe, the major indexes showed a mixed performance. The UK's FTSE 100 increased 0.75% to close at 4032.07 compared to its open of 4002.08. Germany's XETRA DAX gained 1.50% to settle at 18205.94 from its starting point of 17936.31. However, France's CAC 40 dipped 0.29% to end the week at 8151.93 after opening at 8175.98. German stocks saw gains as the ifo Business Climate Index surpassed expectations, while new German government's 3.2-billion-euro fiscal package aimed to ease taxation burdens and enhance competitiveness. However, concerns lingered over weak demand in the manufacturing sector.

Asian markets are also mixed. Japan's Nikkei 225 surged 4.95%, closing at 40888.36 versus its open of 38960.99, boosted by positive economic data and a weaker yen. Hong Kong's Hang Seng declined 1.14% to finish at 16499.48 from its starting level of 16690.26. China's Shanghai Composite fell 0.30%, closing at 3048.03 compared to its open of 3057.21. weaker yuan and consecutive outflows from foreign investors with notable losses across various sectors including energy, IT, finance, and property weigh on the market in addition to concerns about economic stability in the middle of changing global policy.

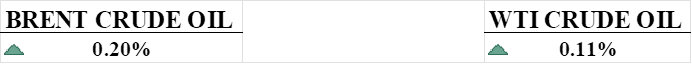

CRUDE OIL PERFORMANCE

Concerns over potential supply disruptions drove crude oil prices higher albeit slightly. Attacks on Russian oil refineries, affecting around 12% of the country's total processing capacity, raised demand for available crude cargoes. Indian refineries refusing Russian crude carried on Sovcomflot tankers due to U.S. sanctions also contributed to market tightness. Geopolitical tensions, including escalating conflicts in the Middle East and between Russia and Ukraine, added to supply worries. A lower U.S. rig count points toward lower future production, further supporting prices.

OTHER IMPORTANT MACRO DATA AND EVENTS

Fewer people filed for unemployment benefits last week, and there was a big jump in home sales, suggesting the economy is doing well. The Federal Reserve is holding off on changing interest rates, indicating they're optimistic about growth, but the housing market still faces challenges.

Japan's CPI inflation surpassed the Bank of Japan's target, reinforcing recent policy changes like rate hikes and the end of yield curve control programs. Strong wage hikes are expected to sustain consumption-driven inflation, potentially offsetting recession risks.

What Can We Expect from The Market This Week

US PCE Price Index: core PCE data slightly decreased to 2.8%, in line with the expected 2.4% PCE Price Index, indicating progress towards the Fed's inflation targets. Consensus is towards stagnant progress, as CPI was hotter than the previous month.

US Building Permits: figures rose by 1.9% in February 2024, hitting a high not seen since August, primarily in both multi-segment and single-family permits, with focused gains in the Midwest and Northeast regions. Considering a slight dip in construction starts in December, the housing market remains solid thanks to falling mortgage rates and a shortage of existing home inventory.

CB Consumer Confidence: consumer sentiment declined in February after three consecutive months of gains, presenting new uncertainty. This decline, reflected in both present conditions and future expectations, suggests potential implications for consumer spending behaviour and overall economic activity in the coming months.

UK GDP Q4: The UK entered a technical recession in preliminary Q4 data with a 0.3% contraction following a previous quarter of negative growth. Despite a slight annual rise in GDP, it marks the weakest growth since the 2009 financial crisis, raising alarms and calls for potential tax cuts to mitigate the economic downturn.

US Durable Goods Orders: key indicator of future production activity, dropped by a shocking 6.1%, marking the most major monthly decline since April 2020. This fall, particularly in transportation equipment, suggests a slowdown in economic momentum at the start of the year, although economists are not predicting a recession for the year, with US GDP at 4.9%.