PAST WEEK'S NEWS (March 25 – March 29, 2024)

The U.S. government issued a staggering $23 trillion in Treasury bonds in 2023, with nearly $7 trillion issued in just 3 months, putting the debt-to-GDP ratio near record highs of over 120% as spending reached World War II levels. This was driven by skyrocketing interest expenses and continued high levels of government spending. Concerns were raised about the unsustainability of the fiscal path, with the Congressional Budget Office projecting the debt-to-GDP ratio reaching 130.6% by 2034, a level at which 51 out of 52 countries have historically defaulted. Through last-minute contentious negotiations, Congress narrowly averted a government shutdown by passing the $1.2 trillion spending bill, though the House Speaker faced a revolt from hardlines Republicans over a lack of stronger border security provisions.

Fed Chair Jerome Powell in a speech said the latest U.S. inflation data was in line with expectations. He stated the central bank would not overreact to the numbers. Powell reaffirmed the Fed's baseline outlook for interest rate cuts this year remains intact at 3 cuts by the end year. He said the economy's strength means the Fed is not in a hurry to cut rates. Powell will give another speech next week at Stanford University to provide more guidance. Upcoming economic data in March will be key for the Fed's policy decision at the April/May meeting which is expecting another pause due to insufficient data that points toward a cut.

INDICES PERFORMANCE

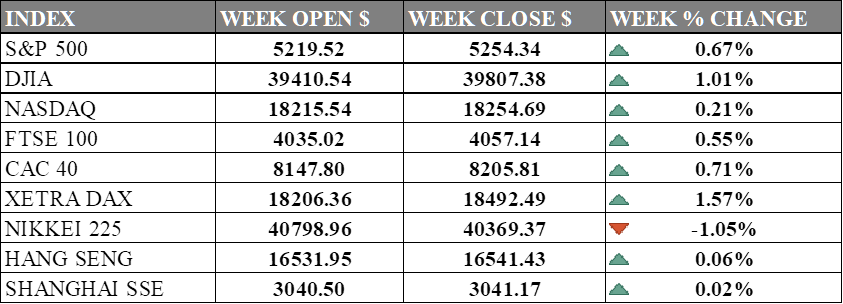

The major U.S. stock indexes hit another all-time-high last week with a positive market sentiment. The S&P 500 gained 0.67% to close at 5254.34, up from its open of 5219.52. The Dow Jones Industrial Average climbed 1.01% to finish at 39807.38 compared to its opening level of 39410.54. The tech-heavy Nasdaq advanced 0.21% to 18254.69 after opening the week at 18215.54. The gains were broad-based across sectors attributed to strong quarterly gains that were supported by elevated margins, a decent cash position for many firms, and the anticipation of falling borrowing costs in the second half of the year.

In Europe, the major indexes gain broadly. The UK’s FTSE 100 increased 0.55% to close at 4057.14 compared to its open of 4035.02. Germany’s XETRA DAX gained 1.57% to settle at 18492.49 from its starting point of 18206.36. However, France’s CAC 40 rose 0.71% to end the week at 8205.81 after opening at 8147.80. Stocks kept rising as the macroeconomic situation improved, with investors eagerly awaiting the release of important European inflation data.

Asian markets are also mixed. Japan’s Nikkei 225 declined -1.05%, closing at 40369.37 versus its open of 40798.96 after Investors sold stocks to lock in profits on the opening day of the country's fiscal year, Hong Kong’s Hang Seng saw a slight increase of 0.06% to finish at 16541.43 from its starting level of 16531.95. China’s Shanghai Composite rose marginally by 0.02%, closing at 3041.17 compared to its open of 3040.50. China market decelerate although accelerating manufacturing and service sector activity points toward potential gain, as indicated by rising PMI figures, along with stable yuan exchange rates maintained by the PBOC. Additionally, positive earnings from tech giant Huawei and official PMI data showing manufacturing expansion may solidify investor confidence.

CRUDE OIL PERFORMANCE

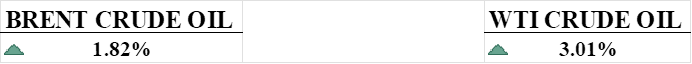

Oil prices extending recent gains on tighter supply from OPEC+ production cuts, attacks on Russian refineries, and Chinese manufacturing data. Brent crude added 1.82% last week, while WTI crude gained 3.01%. Both benchmarks finished higher for a third straight month in March as OPEC+ pledged to extend output cuts until end-June. Russian companies will focus on reducing production rather than exports in Q2 to comply with the cuts. Drone attacks have knocked out several Russian refineries, expected to reduce the country's fuel exports and production capacity. China's expanding manufacturing activity in March also supported oil demand prospects.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. goods and services prices rose less than expected in February, possibly prompting a June interest rate cut, while strong consumer spending showcased economic resilience despite higher borrowing costs. Consumer spending remained robust, supported by savings.

China's industrial profits rose by 10.2% in the first two months of the year, signalling a recovering economy. However, global demand uncertainties and supply chain disruptions from covid disruption remained, underscoring the need for continued supportive policies.

What Can We Expect from The Market This Week

ISM Manufacturing PMI: U.S. manufacturing sector showed signs of decline with a slight decrease in the ISM Manufacturing PMI, indicating contraction in new orders and production. The market is expecting higher figures than the previous report at 47.8 on the basis of higher GDP report last week.

JOLTs Job Openings: January figures revealed slightly fewer job openings at 8.863 million and an expectation of 8.79 million for February, suggesting less demand for workers and an expectation of a cooling market. While this could ease inflation, economists predict the Federal Reserve will be cautious about cutting interest rates just yet.

Eurozone CPI: Eurozone annual inflation rate was reported to be 2.6%, down from 2.8% in January, largely due to a decrease in energy prices. The core inflation rate, which excludes volatile food and energy prices, was confirmed at 3.1%, marking its lowest point since March 2022. Although it is closing in on the target, it is still not 2%, the ECB has signalled no rate cut anytime soon, and the economy is now in flat growth stage.

OPEC Meeting: The main focus will be on assessing the effectiveness of recent voluntary production cuts totalling 2.2 million barrels per day, aimed at supporting oil market stability and balance. Analysts expect discussions to revolve around potential adjustments to these measures in response to evolving global demand and supply dynamics as the commodity market regains interest.

Japan Household Spending: Household spending saw a significant drop of 6.3% from a year earlier after dropping 2.1% in January, marking the largest drop in 35 months. Despite this, some economists remain hopeful for a gradual recovery in consumer spending after multiple large corporations pledged to increase wages.