PAST WEEK'S NEWS (May 13 – May 20, 2024)

The CPI inflation report shows a slight improvement, with headline inflation down to 3.4% from 3.5% last month, but still higher than January's 3.1%. This tiny change means the Federal Reserve is far from cutting interest rates in June, with odds dropping to just 2.7%. Core inflation, which excludes food and energy, fell from 3.8% to 3.6%, but remains well above the Fed's 2% target. Energy prices are among the biggest contributors, having increased by 7.2% this year, while food prices have been stuck at a 2.2% increase, raising doubts about the reported figures. Shelter inflation, now at 5.5%, is not accurate due to outdated lease data, masking the real impact on housing affordability. Although service inflation dropped slightly from 5.4% to 5.3%, it remains high, triggered by wage inflation in a labour market that appears weaker than official reports suggest.

With just a single tweet that is not even related to stock, Gamestop and AMC shares closed 80% higher on Monday, reigniting the meme stock frenzy of 2021. It was attributed to the re-emergence of Keith Gill, also known as RoaringKitty on X and DeepF***ingValue on Reddit, who posted cryptic images and GIFs on social media after a three-year hiatus, despite not mentioning Gamestop directly. Gill's infamous Reddit posts about Gamestop's potential and the excessive short positions against the stock sparked a retail buying frenzy in 2021, leading to a gamma squeeze in Gamestop, AMC, and other heavily shorted companies, erasing billions from shorts like Melvin Capital. The rally had little impact on the broader market, as investors focused on the upcoming inflation data and its implications for interest rates.

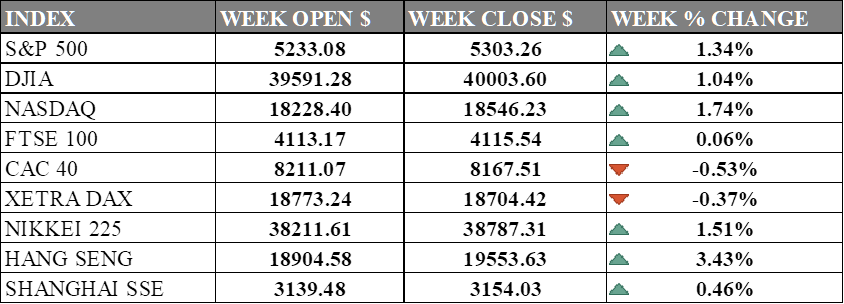

INDICES PERFORMANCE

The major U.S. stock indexes gained last week, hitting all time highs once again after dollar contracted, pushing equity higher. The S&P 500 rose 1.34% to close at 5303.26, up from its open of 5233.08. The Dow Jones Industrial Average (DJIA) gained 1.04% to finish at 40003.60 compared to its opening level of 39591.28. The Nasdaq also rose 1.74% to 18546.23 after opening the week at 18228.40. Comments from Federal Reserve officials indicating a potential for further interest rate hikes, or an extended restrictive monetary policy stance impacted market sentiment although VIX keep falling to 5 months lows.

In Europe, markets had a mixed performance. The UK's FTSE 100 rose a modest 0.06% to close at 4115.54 compared to its open of 4113.17. Germany's XETRA DAX declined 0.37% closing at 18704.42 from its starting point of 18773.24. France's CAC 40 fell 0.53% to end the week at 8167.51 after opening at 8211.07. European banks are among best performer, with the banking sector being the best performing in Europe year-to-date, rising over 20%.

Asian markets saw gains across the board. Japan's Nikkei 225 rose 1.51%, closing at 38787.31 versus its open of 38211.61. Hong Kong's Hang Seng surged by an impressive 3.43% finishing off at 19553.63 from its starting level of 18904.58. China's Shanghai Composite posted a 0.46% gain, ending the week on 3154.03 compared to an opening figure of 3139.48. Asian markets rallied after China announced "historic" steps on Friday to stabilize its property sector, including the central bank facilitating 1 trillion yuan ($138 billion) in extra funding and easing mortgage rules.

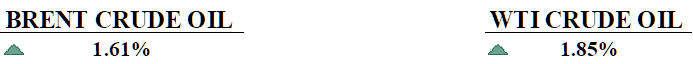

CRUDE OIL PERFORMANCE

Oil prices settled higher Friday, wrapping up the week with gains as signs of slowing U.S. inflation boosted rate cut hopes, while China rolled out more stimulus, giving a big boost to hopes for firmer demand. The April CPI reading battered the dollar and increased expectations that the Federal Reserve could begin trimming rates as soon as September, with looser monetary conditions boding well for crude demand; however, this notion was somewhat offset by a string of Fed officials warning that the central bank needed more convincing that inflation was coming down before it could begin trimming rates. Oilfield services firm Baker Hughes reported Friday its weekly U.S. rig count rose by one to 497.

OTHER IMPORTANT MACRO DATA AND EVENTS

Initial jobless claims in the U.S. fell to 222,000 for the week ending May 11, down from an upwardly revised 232,000 the previous week, though higher than the anticipated 219,000. This data comes as the Federal Reserve assesses labour market health amid signs of slowing job growth and wage increases.

Japan's economy shrank 0.5% quarter-on-quarter in Q1 2024, missing expectations and driven by a 0.7% drop in private consumption amid sticky inflation and sluggish wages. This decline, alongside a 0.8% fall in capital expenditure, signals challenges for the country's growth outlook as inflation persists and the yen remains weak.

What Can We Expect from The Market This Week

FOMC Meeting Minutes: Markets are awaiting the FOMC meeting minutes, seeking clues after the Federal Reserve kept rates unchanged in the last meeting, as Chair Jerome Powell had hinted that returning inflation to the 2% target could take longer than expected.

UK CPI April: Consumer inflation in the UK is expected to decline to 2.1% year on year after it rose 0.6% over the previous month, driven primarily by increases in prices for services like transport and insurance. Despite this, the pound sterling strengthened against the U.S. dollar as markets anticipated the Federal Reserve would start cutting interest rates later in the year.

RBNZ Interest Rate Decision: RBNZ is expected to hold interest rates as it has done due to inflation remaining elevated at 4.0% in Q1 2024 while the economy has just emerged from contraction, having shrunk 0.1% in Q4 2023 after a 0.3% decline in the prior quarter.

German GDP Q1: The German economy started 2024 with modest 0.2% growth in Q1 compared to Q4 2023, driven by increases in construction investment and exports but weighed down by declining household consumption. Despite the quarterly growth, Q1 growth was still down 0.9% compared to Q1 2023, although the year-over-year decline was a smaller 0.2% after adjusting for fewer working days.

US Initial Jobless Claims: The number of Americans filing for unemployment benefits jumped to 231,000 in the second week of May, the highest level in over eight months. Despite the rise in jobless claims following mostly strong hiring reports, the unemployment rate remained below 4% for 27 straight months, the longest such streak since the 1960s.