Stocks Performance (U.S. Stocks)

The major indexes ended mostly higher for the week, as investors reacted to quarterly earnings reports and some prominent economic data. Large-caps and growth stocks outperformed, putting at least a temporary end to the rotation into small-caps and value shares over the previous two weeks.

Within the S&P 500 Index, real estate investment trusts fared best as longer-term bond yields fell, making their dividends more attractive in comparison. The much larger technology sector was also strong, helped by earnings beats from Apple and chipmakers AMD and Qualcomm. Energy stocks recorded the largest declines, dragged lower by Chevron and ExxonMobil following reports of steep Q2 losses. Materials shares were also weak. Corporate earnings were in the spotlight during the week, with 189 of the S&P 500 companies slated to post Q2 results.

By sectors, the most outperformed weekly stocks were led by Electronic Technology at 7.30%, followed by Transportations at 3.97%, Retail Trade at 3.09%, Technology Services at 2.80%, and Commercial Services (2.42%). Meanwhile, the weakest sectors were from the Energy Minerals sector (-4.47%), Process Industries (-1.11%), Producer Manufacturing (-0.40%), and Finance sector (-0.32%).

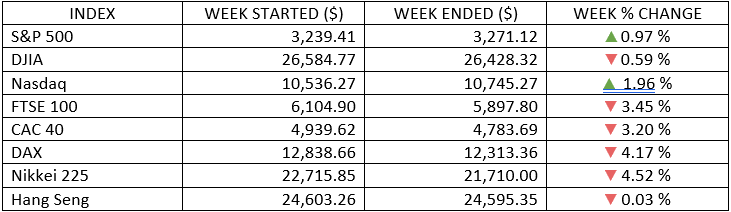

Indices Performance

Gains from mega-capitalization technology and Internet companies lifted the S&P 500 and tech-heavy Nasdaq Composite indices. However, the Dow Jones Industrial Average, which has less exposure to these groups, fell for the week.

Stock markets in Spain and Italy, whose economies are more sensitive to the tourist sector, performed poorest. Most Asian/Pacific markets were also down. Japan, which missed the global equity sell-off late last week due to a 2-day holiday, played catch-up with a steeper drop when it reopened the week.

Oil Sector Performance

Crude oil prices fell, despite a drop in stockpiles, as economic worries diminished the demand outlook.

Market-Moving News

Gold Record

Gold rocketed to new highs, topping a record that it had set the previous week. The precious metal soared to nearly $2,000 per ounce as mounting concerns about the coronavirus pandemic, the global economy, and a falling U.S. dollar helped to push prices higher.

Tech Ticks Upward

Technology stocks got a boost Thursday as Q2 earnings from Alphabet, Amazon, Apple, and Facebook all topped analysts' expectations.

Rise of Spending

U.S. consumer spending increased 5.6% in June after jumping more than 8.0% in May. The rise in spending makes up for the sharp declines in the early spring, but rising COVID-19 cases and slowed reopening in certain states point to a potentially gloomier outlook.

Fed Talks

The Fed concluded a two-day meeting Wednesday, reaffirming its commitment to supporting the U.S. economy using “its full range of tools.” It decided to keep interest rates unchanged at near zero, noting in a statement that “the path of the economy will depend significantly on the course of the virus.”

U.S. GDP Plunges

The U.S. economy shrank 32.9% on an annualized basis in the Q2, the steepest drop on record since the Commerce Department began tracking GDP data in 1947.

Dollar Decline

The U.S. dollar fell to its lowest point in a decade, as a resurgence in coronavirus numbers has resulted in slowing business activity and a sluggish economy contributing to the currency’s slide. The dollar lost more than 4% in July, its largest monthly decline since September 2010.

Other Important Macro Data and Events

Gold prices surged to an all-time high this week, surpassing the previous high-water mark set in 2011.

Congressional negotiations over a fifth coronavirus relief bill were stalled as Democrats and Republicans struggle to reach terms.

The resurgence of COVID-19 cases around the world has led to increasingly cautious economic expectations, a view that was reinforced by the U.S. Federal Reserve in its policy statement Wednesday. As expected, the Fed left its benchmark interest rate unchanged at close to zero.

In response, yields on 10-year government bonds yields touched new all-time lows, and the US dollar fell against nearly all other major currencies.

Q2 GDP was reported to have declined at the fastest pace in over seven decades.

Initial unemployment claims rose for a second straight week, and the Consumer Confidence Index fell more than forecast, especially the expectations component.

However, June durable goods orders have beaten expectations, as have S&P 500 Q2 earnings reports so far.

What We Can Expect from the Market this Week

In focus this week is going to be on the economy, earnings, and monetary policy – which will reveal that the fundamental backdrop, while fragile, is trending in the right direction. A rebound in economic activity and corporate earnings, along with ongoing monetary-policy stimulus, should provide broad support, but virus concerns and political uncertainties are likely to spark bouts of volatility along the way.

Important economic news coming out this week includes vehicle sales and construction spending on Monday, factory order on Tuesday, trade balance on Wednesday, weekly unemployment claims on Thursday, and jobs & unemployment data and consumer credit on Friday.