PAST WEEK'S NEWS (May 20 – May 25, 2024)

The Federal Reserve's May meeting minutes showed that Fed members were disappointed by the lack of progress in fighting inflation, which remains well above the 2% target after a long period of tightening. They concluded achieving the inflation goal would take longer than previously expected, leading some members to mention their willingness for further policy tightening if inflation risks materialise. However, the minutes noted that medium- and longer-term inflation forecasts remained anchored. Overall, the hawkish tone underscores the Fed's firm commitment to ramp up inflation control through a data-dependent approach, leaving the door open for an additional hike if price pressures fail to moderate convincingly in the coming months.

The European Central Bank is moving towards an initial interest rate cut as inflation declines and conditions favour easing monetary policy. Policymaker Fabio Panetta confirmed a "fairly general consensus" for a possible rate reduction. Bundesbank President Joachim Nagel suggested the ECB should be ready to cut rates in June, noting that wage growth in the euro area is not particularly concerning. Panetta highlighted that inflation is decreasing in major economic regions and financial stability risks have diminished. He also urged Italian banks to exit Russia due to reputational issues, despite the challenges of finding buyers and obtaining necessary approvals amid sanctions. Western banks face complex regulatory hurdles in responsibly divesting their Russian operations.

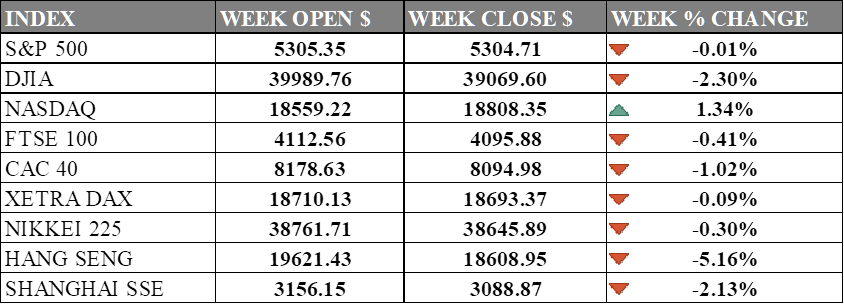

INDICES PERFORMANCE

The major U.S. stock indexes had a mixed performance last week. The S&P 500 closed nearly flat at 5304.71, down 0.01% from its open of 5305.35. The Dow Jones Industrial Average (DJIA) declined 2.30% to finish at 39069.60 compared to its opening level of 39989.76. However, the Nasdaq gained 1.34% to close at 18808.35 after opening the week at 18559.22. Technology stocks rallied but energy led most other sectors lower. While strong manufacturing data boosted expectations for economic growth and declining consumer sentiment raised concerns about potential rate cuts.

In Europe, most major indexes experienced losses. The UK's FTSE 100 fell 0.41% to close at 4095.88 compared to its open of 4112.56. Germany's XETRA DAX dipped 0.09% closing at 18693.37 from its starting point of 18710.13. France's CAC 40 declined 1.02% to end the week at 8094.98 after opening at 8178.63. analysts caution structural weaknesses could constrain a stronger rebound despite improving consumption and inventories.

Asian markets also saw a mix of losses and gains. Japan's Nikkei 225 dipped 0.30%, closing at 38645.89 versus its open of 38761.71 as inflation weighs normalizing monetary policy to contain imported inflation pressures against maintaining accommodative measures to boost sluggish wage growth, consumption, and economic recovery. Hong Kong's Hang Seng fell sharply by 5.16% finishing off at 18608.95 from its starting level of 19621.43. China's Shanghai Composite posted a loss of 2.13%, ending the week on 3088.87 compared to an opening figure of 3156.15. China market performance is mirroring global declines as robust U.S. economic data reinforced prospects of prolonged higher interest rates, while military drills around Taiwan and concerns over Alibaba's convertible bond sale further worsen investor sentiment

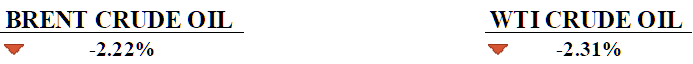

CRUDE OIL PERFORMANCE

Oil prices showed a slight recovery in Asian trade on Monday, following steep losses last week, as traders awaited cues on U.S. inflation data and the upcoming OPEC meeting. Trading volumes were expected to be limited due to market holidays in the U.S. and the UK. Brent and WTI crude futures rose marginally, but both contracts experienced over 2% weekly losses due to concerns about high interest rates impacting demand. The focus this week is on the PCE price index data, the Fed's preferred inflation gauge, and potential supply cues from the OPEC+ meeting on June 2.

OTHER IMPORTANT MACRO DATA AND EVENTS

New orders for key U.S.-manufactured capital goods rebounded more than expected in April, suggesting a moderate improvement in business spending on equipment early in the second quarter. Nonetheless, business investment on equipment continues to be hampered by higher borrowing costs due to the Federal Reserve's policy tightening, along with a strong dollar and weak global demand, keeping the manufacturing sector under pressure.

Japan's core inflation slowed for a second straight month in April, likely signalling that the Bank of Japan will be patient in raising interest rates as consumption remains fragile. While inflation is tracking comfortably above the central bank's 2% target, policymakers are keen to see Japan's price impulse bears the stamp of sustainable domestic demand.

What Can We Expect from The Market This Week

PCE Price Index: a measure of price changes in consumer goods and services, used by the Federal Reserve to assess inflation trends. The headline PCE price index had advanced at an annualised rate of 2.7% in March, up from 2.5%, and the core PCE price index stagnated at 2.8%, expecting another 0.3% increase for April figures.

Germany CPI May: Consumer inflation in Germany remained steady at an annual rate of 2.2%, with a slowdown in service inflation offset by a rebound in food prices and a smaller decrease in energy costs. The forecast for the inflation rate in May 2024 is higher at 2.4%, although energy prices have stabilised.

US GDP Q1: Economic growth in the US slowed to an annual rate of 1.6% from 3.4% growth in Q4 2023, with significant contributions from consumer spending, residential and non-residential fixed investment, and state and local government spending. However, the gently cooling demand growth is leading to easing inflationary pressures.

China Manufacturing PMI: Manufacturing index in China rose to 50.8 in March, marking the first growth since September 2023, driven by improvements in demand conditions and foreign sales. However, concerns over rising costs and increased competition led to weakened sentiment, reaching a four-month low.

Eurozone CPI May: Consumer inflation in Europe remained stable at 2.4%, with services being the main inflation component. Concurrently, surging German wage growth, the fastest in almost a decade, cast doubt on the timing of ECB rate cuts and propelled the inflation growth to 0.6% almost every month since February.