PAST WEEK'S NEWS (July 01 – July 05, 2024)

Nancy Pelosi's husband just made a big bet on AI, buying millions in Broadcom options and Nvidia stock while dumping Tesla and Visa shares, although he missed the recent rally. This moves towards AI fits with market trends but has reiterated debate about whether politicians should trade stocks at all. Given Pelosi's prominence and past performance, people are watching her finances closely, with one X’s user reportedly making 71% ytd just by copying her trade. The whole situation has even inspired ETFs that copy congressional trades, showing just how much attention these political stock moves get. It's a reminder of the tricky mix of politics and personal investing that keeps making headlines.

Tensions are high in the global bond market as it has been experiencing volatile price movement, with long-term treasuries particularly affected. Over the past year, the BofA 10+ Year U.S. Treasury Index has declined 5.1% on a total-return basis, with even worse performance over longer periods. Experts anticipate further challenges for the bond market, with some predicting the 10-year yield could reach 5% by the end of 2024. The recent presidential debate had also impacted bond market, with yields surging as investors began to price in the possibility of a second Trump presidency, attributing stronger economic growth, higher inflation, and increased Treasury supply under the Trump administration. Similarly, the UK bond market remains cautious, reminiscing about a crisis triggered by aggressive tax-cut plans in 2022.

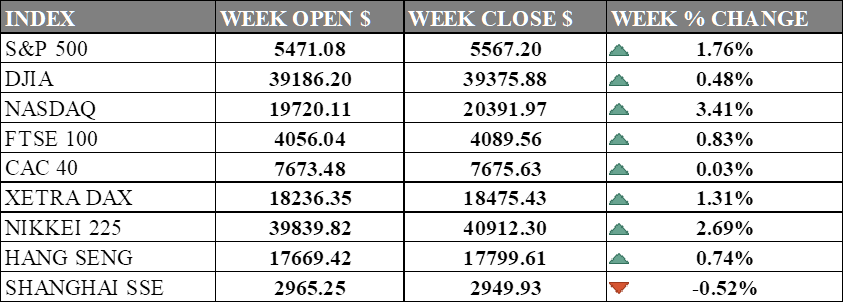

INDICES PERFORMANCE

The major U.S. stock indexes showed strong performance last week. The S&P 500 gained 1.76% to close at 5567.20 from its open of 5471.08. The Dow Jones Industrial Average (DJIA) increased 0.48% to finish at 39375.88 compared to its opening level of 39186.20. The Nasdaq showed the strongest performance among U.S. indexes, with a 3.41% increase to close at 20391.97 after opening the week at 19720.11.

In Europe, results were positive across the board. The UK's FTSE 100 rose 0.83% to close at 4089.56 compared to its open of 4056.04. Germany's XETRA DAX showed a robust performance, increasing 1.31% to close at 18475.43 from its starting point of 18236.35. France's CAC 40 showed the most modest gain among the European indexes mentioned, increasing just 0.03% to end the week at 7675.63 after opening at 7673.48.

Asian markets saw mixed performances. Japan's Nikkei 225 posted the strongest gain of all indexes in the table, rising 2.69% to close at 40912.30 versus its open of 39839.82. Hong Kong's Hang Seng increased by 0.74%, finishing off at 17799.61 from its starting level of 17669.42. China's Shanghai SSE posted the only loss among the indexes, declining 0.52% to end the week at 2949.93 compared to an opening figure of 2965.25.

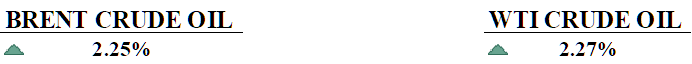

CRUDE OIL PERFORMANCE

The market saw its fourth consecutive weekly gain, with oil climbing 13% over the past month due to strong seasonal demand, falling U.S. inventories, and OPEC+ supply cuts. Hurricane Beryl, approaching Mexico's Yucatan peninsula, raised concerns about potential disruptions to Gulf of Mexico production and heightened worries about an active hurricane season. The U.S. Energy Information Administration reported a significant 12.2-million barrel draw in crude inventories, the largest in a year, further supporting prices. However, the growing likelihood of a Gaza ceasefire tempered gains, as efforts to mediate and release hostages gained momentum, potentially easing regional tensions. Despite Friday's drop, the overall market sentiment remains bullish, driven by a combination of geopolitical risks, supply constraints, and strong seasonal demand.

OTHER IMPORTANT MACRO DATA AND EVENTS

The U.S. economy added 206,000 jobs in June, exceeding expectations but lower than May's revised figure. While unemployment rose to 4.1% and wage growth slowed slightly, the data points to a possible easing of inflation.

British construction activity growth slowed in June, with the S&P Global UK Construction PMI falling to 52.2 from 54.7 in May, partly due to uncertainty ahead of the July 4 election. While commercial construction and civil engineering rose, residential building work declined, and new order growth slowed, though employment in the sector increased at its fastest rate since August last year.

What Can We Expect from The Market This Week

US CPI June: Consumer prices showed zero growth last month, figures not seen since November last year, reflecting a balanced economic state with a notable decline in gasoline prices offset by rising shelter costs. The market shows cautious optimism, with minor fluctuations in key indices and a keen eye on the Federal Reserve’s rate decisions.

UK GDP May: The UK’s economy grew flat in May and expects to make a comeback in June after reporting 0.6% growth in the first quarter, marking the fastest expansion in two years and confirming the country’s exit from recession. Strong performance in services, including retail and public transport contributed to the gains, and is expected to build momentum for the economy throughout the year.

German CPI June: Germany’s consumer price is expected to rise by 2.2% year on year, with a slight increase of 0.1% from May 2024. Core inflation, excluding food and energy, is anticipated to be at 2.9%, corresponding to lower price growth in the economy.

OPEC Monthly Report: The June 2024 OPEC Monthly Oil Market Report provides updates on global oil production, influencing market dynamics and expectations. Its analysis and forecasts are important for predicting changes in oil prices and shaping industry trends.

Fed Chair Powell testifies: Federal Reserve Chair Jerome Powell is scheduled to present his semi-annual Congressional testimony later this week. The testimony is set to cover the Fed’s monetary policy, economic outlook, and banking regulations.