PAST WEEK'S NEWS (July 15 – July 19, 2024)

The market is in an uproar following a failed assassination attempt on Donald Trump, an act that might as well have cemented his presidency. This prospect has raised sentiments for a looser regulatory environment, extensions of tax cuts, and deregulation in various sectors that will not only boost the market environment, but also prioritise America's first. The assassination attempt appeared to improve Trump's chances of winning the election, with online betting site PredictIt showing increased odds for a Trump victory. Investors are also optimistic on potential Fed rate cuts, with some anticipating up to three cuts by the end of the year with this changing market condition.

In its latest meeting, the ECB decided to maintain its key interest rates in July. President Lagarde stated that a September rate cut is undecided, considering strong domestic price pressures and potential reinflation risks. Market expectations align with policymaker views, and it anticipates two more rate cuts this year. The euro briefly grew against the dollar but has pulled back to its initial level as a trope of risks remain, including U.S. election outcomes and trade policy expectations. The ECB is monitoring the recovery of the services sector and the weak investment climate. Financial markets showed mixed reactions to the ECB's decision, with bond yields softening while stocks lost some gains. Lagarde stressed the importance of fiscal policies and EU programmes for economic growth and that the ECB's inflation target and policy framework will remain constant during her tenure.

INDICES PERFORMANCE

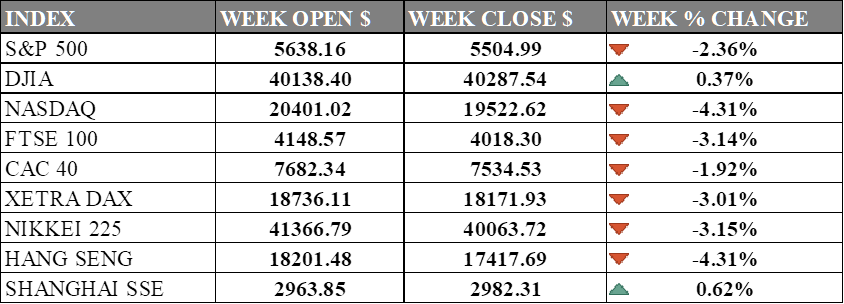

Wall Street wrapped up a rather mixed week, with the Dow being the only major U.S. index to end in positive territory. The blue-chip index climbed 0.37%, closing at 40,287.54. However, both the S&P 500 and the Nasdaq down significantly. The S&P 500 fell 2.36% to 5,504.99, while the tech-heavy Nasdaq saw a sharp drop of 4.31%, finishing at 19,522.62. These declines reflect a shift in investor sentiment toward smaller cap stock, possibly due to concerns over rate cut proposition and corporate earnings reports.

Across the pond, European markets also experienced a downturn. Germany's DAX fell 3.01%, closing at 18,171.93. The UK's FTSE 100 saw a substantial decline of 3.14%, ending at 4,018.30, while France's CAC 40 dropped 1.92% to close at 7,534.53. These is in line with the insistence of European Central Bank (ECB) to hold rate cuts until there is further confirmation from inflation data.

Asian markets have also presented a mixed picture. Hong Kong's Hang Seng Index, contrary to its previous surge, plummeted 4.31% to 17,417.69, mirroring the decline seen in the U.S. Nasdaq. Japan's Nikkei 225 also saw a significant drop of 3.15%, finishing at 40,063.72. This decline in the Japanese market could be related to the suspected currency intervention, which saw the dollar-yen exchange rate move rapidly in yen favour, pushing equity into the red. In contrast, the Shanghai Composite in mainland China managed to eke out a gain of 0.62%, closing at 2,982.31, bucking the trend seen in other major Asian markets possibly due to stimulus taking effect.

CRUDE OIL PERFORMANCE

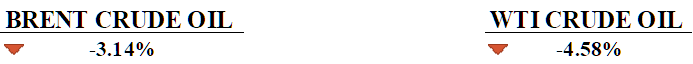

It’s one of the worst week for oil market as oil prices fell to their lowest point since mid-June, with Brent crude dropping to $82.63 and U.S. crude to $80.13 per barrel. The main reason for the drop was hope for a ceasefire in Gaza, which could ease tensions in the Middle East and lower oil prices although Yemen strike and Israel counterstrike may points toward escalation. A stronger U.S. dollar also pushed oil prices down by making it more expensive for buyers using other currencies. Worries about China's slowing economy added to the downward pressure on oil. However, a drop in the number of active U.S. oil rigs helped stop prices from falling even further.

OTHER IMPORTANT MACRO DATA AND EVENTS

Argentina reported primary fiscal and financial surpluses for the sixth consecutive month in June, showcasing the impact of President Milei's austerity measures implemented since taking office in December.

U.S. store sales stayed flat in June, with car sales down but other areas strong. This shows shoppers are still spending, which is good for the economy, even as inflation cools down.

What Can We Expect from The Market This Week

PCE Price Index June: data showed a continued trend of disinflation, with the headline inflation rate decreasing to 2.6% from 2.7% in May. This decline suggests easing price pressures, which could improve the Federal Reserve’s tight monetary policy decisions.

US GDP Q2: The US grew by 1.4% last quarter, severely underperforming the 3.4% in Q4 last year. However, this growth exceeded economists’ expectations and indicates the resilience of the US economy despite inflationary pressures and high borrowing costs relative to other economies.

BoC Interest Rate Decision: The Bank of Canada decided to cut its overnight rate to 4.75% at its last meeting, citing a slowing economy. The decision reflects the central bank’s inability to keep a tight monetary policy, which may lead other central banks to follow suit.

US Durable Goods Orders: US durable goods orders rose by 0.1% from -0.5% expected, marking the fourth consecutive monthly increase, albeit slowing, mostly attributed to strong demand for computers and transportation equipment. However, declines were noted in orders for communications equipment, capital goods, machinery, and electrical equipment.

Tokyo CPI July: Consumer prices in Tokyo increased by 2.3% year-on-year as there is ongoing inflationary pressure in Japan’s capital. This steady rise has led to questions about policy adjustments by the Bank of Japan and their impact on the Japanese yen.