PAST WEEK'S NEWS (August 12 – August 16, 2024)

The recent 13F filing revealed multiple legendary investor portfolio holdings, with more focus on Warren Buffett's Berkshire Hathaway, and Michael Burry's Scion Asset Management. Buffett opened new positions in Heico Corporation and Ulta Beauty, dramatically increased his stake in Sirius XM Holdings, and slightly added to companies like Occidental Petroleum and Chubb Limited. On the flip side, Buffett also made exits in Paramount Global and Snowflake Inc. and famously cut half of his stake in Apple Inc. Burry increased his stake in Alibaba Group Holding Ltd. and Baidu Inc. while opening new positions at Shift4 Payments Inc. and Molina Healthcare Inc. While there's a big shift happening in their portfolio, the most striking point is that they are both cash-heavy, with 30% for Buffet and 50% for Burry, with some speculating that they are preparing for a crash.

Markets cheered this week as U.S. inflation came in as expected and was lower year over year. The July consumer price index clocked in at 2.9% compared to last year, beating the 3.0% forecast. Investors took this as a sign that the Fed might ease up on interest rates soon, although it's far from the 2% target, and stocks went on a bit of a tear. Meanwhile, bonds picked up on the inflation news, with yields taking a dip, and the dollar lost some ground against other major currencies. Investor focus has now shifted to the Federal Reserve's forthcoming decisions, with some market participants anticipating rate cuts as early as September and as much as a 36% chance of a 50 bps cut.

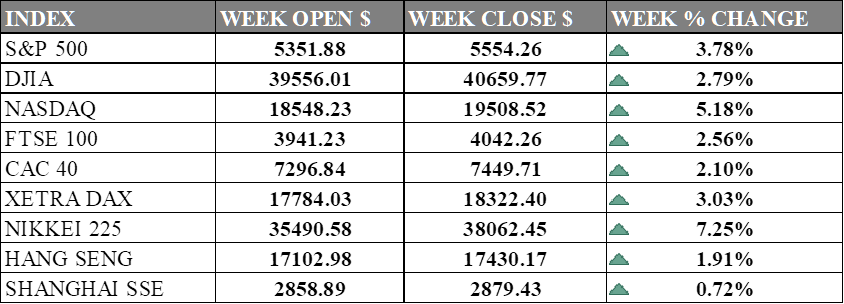

INDICES PERFORMANCE

Wall Street wrapped up an exceptionally strong week, with all major U.S. indexes ending in positive territory. The tech-heavy Nasdaq was the top performer, surging 5.18% to close at 19,508.52. The S&P 500 rose 3.78% to 5,554.26, while the Dow Jones Industrial Average saw a solid increase of 2.79%, finishing at 40,659.77. These market upturns are largely attributed to renewed optimism in the overall economic outlook, with investors showing strong confidence in top stocks resilience in surviving the turbulent market condition.

Across the pond, European markets also enjoyed positive momentum. Germany's DAX saw a 3.03% increase, closing at 18,322.40. The UK's FTSE 100 experienced a 2.56% gain, ending at 4,042.26, while France's CAC 40 rose 2.10% to close at 7,449.71. European markets benefited from the positive sentiment in global equities, with various sectors contributing to the overall gains.

Asian markets presented a mixed picture, though with generally positive results. Japan's Nikkei 225 saw a significant increase, rising 7.25% to 38,062.45, marking a strong recovery. Hong Kong's Hang Seng Index posted a gain of 1.91%, closing at 17,430.17. The Shanghai Composite in mainland China experienced a modest gain, rising 0.72% to close at 2,879.43. The overall global market sentiment remained largely positive, driven by strong performances across most major markets.

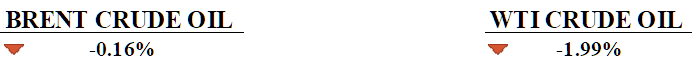

CRUDE OIL PERFORMANCE

Oil prices fell nearly 2% on Friday, with Brent settling below $80 per barrel. Weak Chinese economic data support concerns of declining oil demand from the world's top importer. OPEC and the IEA both cut their oil demand growth forecasts, betting on China's economic slowdown. Middle East tensions initially supported prices, but the lack of actual supply disruptions shifted focus back to demand worries. Positive U.S. economic data provided some support, but couldn't offset the bearish sentiment. Both Brent and WTI crude futures were on track for a losing week.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. consumer sentiment rose to 67.8 in August, driven by developments in the presidential race, particularly the shift in support among Democrats following Kamala Harris' nomination. Inflation expectations remained steady, with one-year and five-year outlooks unchanged at 2.9% and 3.0%, respectively.

U.S. unemployment claims dropped to a one-month low, indicating a stable labour market and lowering the chances of a significant interest rate cut by the Federal Reserve. Retail sales were also better, reinforcing economic resilience and easing recession fears.

What Can We Expect from The Market This Week

FOMC Meeting Minutes: The meeting minutes are expected to reveal ongoing concerns about inflation, which remains above the 2% target, and highlight a cautious approach to interest rate cuts that many investors may have already priced in. Policymakers emphasised the need for more favourable data before considering any rate cuts.

Eurozone CPI July: The Eurozone's annual inflation rate rose slightly to 2.6%, mainly due to higher energy prices. This growth has led to discussions about the European Central Bank’s waning effect of its monetary policy that could spark reinflation.

Fed Chair Powell Speech: The keynote address at the Jackson Hole Economic Policy Symposium is expected to focus on the Fed’s economic outlook and monetary policy direction. His speech is highly monitored to gauge insights into inflation control, interest rate adjustments, and the broader economic recovery.

US Existing Home Sales: The housing market saw a continued decline in existing home sales that went below 4 million in June, with affordability concerns and rising inventory contributing to the trend. The median sales price hit a record high, shifting the market dynamics from a seller’s market to a more buyer-friendly environment.

PBoC Loan Prime Rate: The People’s Bank of China last cut the Loan Prime Rate, with the one-year rate at 3.45% and the five-year rate at 3.95%. This decision reflects the central bank’s focus on maintaining economic stability during global economic fluctuations that saw its economy unaffected by yen carry trade unwinding.