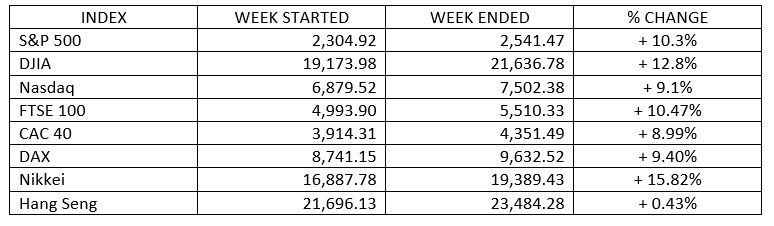

PAST WEEK’S NEWS

Indices performance

Stocks performance (U.S. stocks)

Top Gainers: IMAC HOLDINGS INC (331.28% in a week)

Top Losers: DIREXION SHARES ETF TRUST (−44.63% in a week)

U.S.’s health services surged through last week by 331.28%, mostly influenced by investor’s whom remain optimist that companies that provide health services could have tremendous upside potential as the COVID-19 epidemic continues to unfold. Airline shares also bounced back at midweek as news of a $60 billion bailout package for the industry as part of the stimulus bill, and a rebound in Boeing boosted the industrials sector. Utilities shares were also strong.

Real estate stocks slumped primarily as investors are set out to liquidate their funds, anticipating further losses. Other stocks that heavily affected is of course in the oil-related sector.

Oil sector performance

Brent crude: trading at $23.48. Down -18.32% in a week, $23.03 is lowest recorded on Tuesday.

WTI crude: trading at $20.48. Down -18.98% in a week. $19.92 is the lowest recorded on Wednesday.

Crude oil prices remained volatile as traders began to worry that the world will soon run out of places to store it. Demand for oil has plummeted due to the coronavirus outbreak and Russia-OPEC disagreement. Experts are suggesting available storage will run out by June, putting even more pressure on prices.

Others

Gold had a good week, which was taken as a positive sign for capital markets in general. The unusual selling pressure bullion prices experienced last week was attributed in part to investors forced to sell in order to cover losses in other, less liquid, assets.

MARKET-MOVING NEWS

Stimulus - As the pandemic continued to expand, stocks took their cues in part from the congressional debate over a $2 trillion emergency spending bill. The Senate unanimously passed the economic stimulus measure early Thursday and approved by the on Friday, sending the bill to President Trump to sign into law. The $2.2 trillion stimulus package, including $350 billion in support for small businesses, along with $1,200 direct payments to lower- and middle-income adults and $500 per child. The bill also expanded unemployment insurance and provided additional funding for providers of health care service.

Instant bull market - A 3-day midweek stock surge flipped the Dow from bear market territory back into bull market on Thursday, although the quick reversal likely did little to calm investors’ jangled nerves. The Dow’s closing level of 22,352 on Thursday marked a 21% gain from the index on Monday.

Under-priced oil - With U.S. crude prices recently suffering around $21 per barrel, most oil companies have been selling crude either at or below the cost of production - a situation that many analysts expect will persist through much of the year. On average, it currently costs U.S. producers nearly $36 to produce a barrel of oil, according to Rystad Energy. Demand for oil has plummeted due to the coronavirus outbreak and Russia-OPEC disagreement.

Sinking sentiment - U.S. consumer sentiment has rapidly shifted from modestly positive to decidedly negative amid the spread of COVID-19.

Bond rally resumes - After stabilizing the previous week, prices of government bonds rallied again, sending yields sharply lower. The yield of the 10-year U.S. Treasury note fell to around 0.73% and yields of 1-month and 3-month T-bills briefly slipped into slightly negative territory on Wednesday and Thursday last week.

Gold - Gold’s recovery is seen as a sign that the extraordinary actions of central banks to inject liquidity in markets is having the desired effect.

Other important macro data and events:

President Trump set Easter (April 12) as a goal for when he would want the economy to reopen for business, which drew some criticism for it being too soon given that the number of coronavirus infections is still rising. This week, the U.S. surpassed China for the most confirmed cases of COVID-19.

Thursday, Malaysia announces RM250billion ($83.6b) stimulus package to deal with coronavirus fallout. The package is among the largest in the world, 17% of its GDP.

Yesterday, Singapore’s MAS sets the Singapore dollar to a 0% per annum rate of appreciation.

Latest, China's central bank unexpectedly cuts reverse repo rates by 20 bp to support economy.

To date, number of confirmed worldwide cases for COVID-19 pandemic has now reached more than 722,000 today affecting 199 countries and territories around the world, recording more than 34,000 fatality globally.

WHAT CAN WE EXPECT FROM THE MARKET THIS WEEK?

Important economic data being released include consumer confidence on Tuesday, the manufacturing Purchasing Managers' Index on Wednesday and the March jobs report on Friday.

Federal Reserve expanded its own stimulus measures, boosting both equity and fixed income markets. On Monday morning, the Fed announced that it was setting no limit on its purchases of Treasuries and agency mortgage-backed securities while also beginning to purchase investment-grade corporate bonds.

In addition, the Fed revived the Term Asset-Backed Securities Loan Facility (TALF)—originally launched in 2008—which is designed to support bonds backed by student and auto loans as well as other types of asset-backed securities. The central bank also said that it was taking steps to assure the flow of credit to municipalities and announced plans for a lending program for small businesses.

How the government will tackle the jobless claims? More than three million Americans lost their jobs last week, the worst ever recorded, as the coronavirus shutdown hits the U.S. economy. The number shatters the Great Recession peak of 665,000 in March 2009 and the all-time mark of 695,000 in October 1982.