Stocks performance (U.S. stocks)

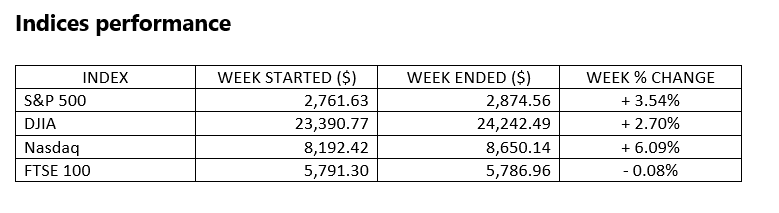

Stocks performance (U.S. stocks) The major indexes recorded mixed returns, as investors weighed record downturns in economic data against hopes that progress in containing the coronavirus pandemic might soon result in a partial reopening of the economy. The technology-heavy Nasdaq Composite Index outperformed by a wide margin, as did growth stocks relative to value shares and large-caps relative to small-caps. Relatedly, tech shares outperformed within the S&P 500 Index, helped by strong gains from chipmakers, as well as bellwethers Microsoft and Apple. A solid gain in Amazon.com boosted consumer discretionary shares, and gains among pharmaceutical and managed care companies helped health care stocks.

Much of the week’s gains came on Tuesday, as investors reacted positively to reports of slowing coronavirus infection rates and hospitalizations in some of the nation’s hardest-hit areas. Sentiment also seemed to get a boost from reports that governors were assembling regional coordinating committees to plan for the gradual reopening of their economies.

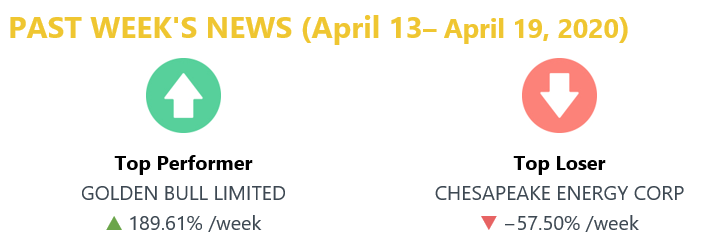

The most outperformed weekly stocks by sectors was led by Retail Trade sector at 25.16%, followed by Health Services (7.97%), Consumer Durables (6.41%) and Health Technology sector (6.27%). Meanwhile, the weakest sectors were the Finance sector (-3.47%), Process Industries (-2.25%), Energy Minerals (2.21%) and Producer Manufacturing sector (-1.32%).

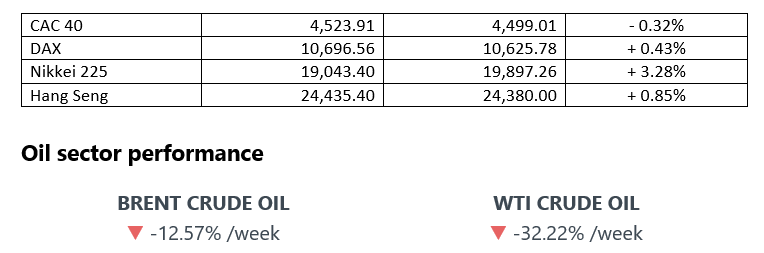

Oil prices dipped as meetings, agreements and reassurance by oil producers failed to give investors any cause for lasting optimism about the economic outlook.

Market-moving News Stocks Comeback ContinuesWhile stocks’ latest weekly gains were far short of the previous week’s double-digit surges, the major indexes recorded their first back-to-back positive weeks since the market sell-off began in mid-February. The Dow rose more than 2%, the S&P 500 added 3%, and the NASDAQ climbed 6% amid incremental progress in attempts to combat the pandemic.

Oil Slick

U.S. crude oil prices fell sharply for the second week in a row and briefly slipped below $18 per barrel on Friday, lowest level since 2002. Energy markets remained under pressure from an oil glut, despite a recent agreement among major oil-exporting countries to cut production levels.

Bad Indicators All Around

A monthly measure of U.S. leading economic indicators plunged by the most in its 60-year history. Retail sales dropped 8.7%—the biggest monthly decline on record— industrial production fell 5.4%—the worst since 1946—and manufacturing was down a record 6.3%. Moreover, for the first time since 1976, China’s quarterly GDP declined. China’s government reported on Friday that its economy—the world’s second largest—shrank 6.8%.

Jobless Surge

The coronavirus’ impact on the U.S. labour market deepened, with another 5.2 million Americans submitting unemployment claims in the latest weekly period. Over the last four weeks, jobless claims totalled nearly 22 million—a trend that is certain to trigger a huge jump in the unemployment rate in coming months.

Earnings Disappointment

With the opening week of earnings season now behind us, analysts expect companies in the S&P 500 will report an overall 14.5% decline by the time all first-quarter results have been reported, according to FactSet. That is worse than the 12.0% earnings drop that had been predicted before major U.S. banks kicked off earnings season in the latest week. Many of those banks reported profits that were below expectations.

Other important macro data and events

Wall Street finished the week on a strong note, helped by a report that some coronavirus patients were recovering quickly after receiving treatment with Gilead Sciences’ antiviral medication, Remdesivir. News that Boeing was planning to restart production of widebody jets in Washington over the following week boosted the company’s shares and seemed to support sentiment generally.

Treasury yields edged up early in the week on news of an agreement to cut oil production but fell back to end the week lower in response to the poor economic data.

Eurogroup finance ministers agreed on a EUR 500 billion package of measures supporting businesses, workers, and sovereigns through the coronavirus crisis. Some European countries extended their lockdowns while outlining plans to reopen economies amid signs that the coronavirus crisis was abating.

The IMF predicted that the eurozone economy will shrink by 7.5% this year before partly recovering and growing 4.7% next year. It also forecast in its April Fiscal Monitor that gross public debt will rise by around EUR800 billion from 2019 to 2020 and reach 97.4% of GDP, much higher than during the sovereign debt crisis. Greece and Italy will have the highest debt burdens this year among euro area countries, exceeding 150% of GDP. Some other states, including France, Spain, and Portugal, will have debt burdens of more than 100% of GDP.

What We Can Expect from The Market This Week

U.S. oil recent plunges of 20% to below US$15 with storage filling up as demand shrivels will surely influence fluctuation in the market.

Stock market is rising on hope for a pharma solution to coronavirus. Among major players including Johnson & Johnson, Pfizer, Moderna Inc, Gilead Sciences Inc, Novavax Inc, Inovio Pharmaceuticals, Regeneron Pharmaceuticals Inc, Sanofi S.A., and Eli Lilly.

Germany’s government on Sunday signalled further support for struggling businesses and consumers in the coronavirus crisis, focusing on hotels, restaurants and pay for short-time workers.

UK unveils $1.6 billion rescue package for tech start-ups hit by coronavirus outbreak. The package consists of £500 million in convertible loans and an additional £750 million in loans and grants for research and development.

Farmers could be winners as coffee prices spike and countries hoard during the pandemic. Prices of Arabica, the world’s most produced coffee, rose last month due to concerns over its availability. Coffee futures traded in New York surged 8.8% in March.

Report of:

- Existing home sales (March)

- Markit Purchasing Managers Indices (April)

- New home sales (March)

- Durable goods orders (March)

- Univ. of Michigan Consumer Sentiment Index (April)