PAST WEEK'S NEWS (February 22 – February 28, 2021)

Stocks Performance (U.S. Stocks)

Most equity markets were lower for the week, as expectations of inflation and rising costs overweighted the outlook for corporate profitability and stock valuations. Within equities, a shift in momentum from defensive to cyclical groups led to substantial outperformance of value indices over growth indices, and of small capitalization stocks over large caps.

The mood briefly turned brighter midweek after the U.S. Federal Reserve Chair Jerome Powell, in a 2-day congressional testimony last week, reiterated that while the economy is showing continuing signs of rebounding, there was much work to do, and the Fed will be patient before even thinking about removing accommodation, explaining that it was expectations for economic growth and inflation that have contributed to the higher yields.

Nevertheless, it was the sharp rate of change that worked against risk sentiment and presumably functioned as an excuse to take profits. It was an ugly week for the Nasdaq Composite, which dropped 5% as long-term interest rates continued to rise sharply.

The yield on the 10-yr Treasury note briefly spiked to 1.61% last week, before settled at 1.46% or 11 basis points higher from last week. The 2-yr yield increased three basis points to 0.13%.

Pandion Therapeutics, Inc. shares surged for the week after the company announced it will be acquired by Merck for about $1.85 billion or $60 per share in cash, expanding its portfolio of drugs that target autoimmune diseases. Workhorse Group Inc. fell sharply to lead the weekly stock losses after the postal service awarded a contract to build new delivery trucks to rival Oshkosh (NYSE: OSK).

Strength in oil prices benefitted energy sector, while consumer discretionary ranked among the top decliners, partly dragged by Amazon.com Inc and Tesla.

By sectors, the most outperformed weekly stocks were led by Energy Minerals sector at 3.04%, followed by Consumer Services at 1.05%, Industrial Services (0.42%), and Transportation at -0.22%. Meanwhile, the weakest sectors were from the Consumer Durables at -7.69%, Retail Trade at -6.15%, Electronic Technology (-5.29%), and Technology Services sector (-4.94%).

Indices Performance

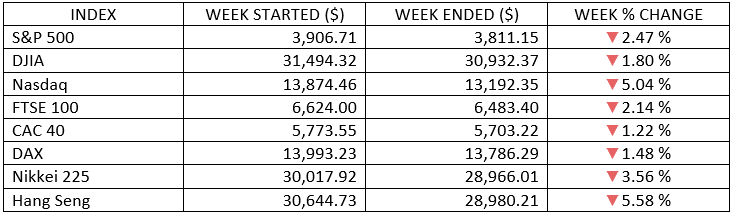

The S&P 500 Index recorded its biggest weekly decline in a month, while the Nasdaq Composite index suffered its worst drop since October. The shares in Europe and Chinese also fell in tandem with the global sell-off. Trading was volatile during the week as concerns grew that central banks might have to act sooner than expected to quell inflationary pressures that could accompany an economic recovery.

The UK’s FTSE 100 Index came under pressure from a stronger British pound. The currency rose to its highest level in almost three years, as the rapid rollout of coronavirus vaccines fuelled recovery hopes and investors priced in an interest rate hike over the next two to three years.

Japan’s stock markets tumbled on Friday, the last trading day of the month, ending sharply lower for the holiday-shortened trading week. Japan’s stock markets were closed on Tuesday, February 23, in observance of the Emperor’s Birthday.

Oil Sector Performance

The crude oil climbed for the fifth week in a row, with the U.S. crude ending just below $62 per barrel, its highest since 2019. The latest gain came ahead of a meeting scheduled to conclude Thursday, at which the OPEC consortium of oil-producing countries will discuss potential product curbs.

Market-Moving News

Tech-Driven Decline

The NASDAQ took its biggest weekly hit since last October, falling around 5%, with most of the decline coming on Thursday. The S&P 500 and the Dow both retreated around 2%.

International Indexes Retreat

Several equity indexes outside the U.S. tumbled on Friday in the wake of a sharp U.S. market pullback on Thursday. A Japanese index dropped 4%—the biggest one-day decline in about 10 months—while indexes in China, South Korea, and Australia each fell more than 2%.

Value Vs. Growth

For the second week in a row, U.S. value stocks outperformed growth stocks by a wide margin—a short-term shift that threatens to reverse the growth style’s run of outperformance in recent years. A value stock benchmark slipped 1% for the week while a growth benchmark dropped more than 4%.

Yield Spike

The year-to-date decline in prices of U.S. government bonds accelerated, sending yields sharply higher. On Thursday, the yield of the 10-year U.S. Treasury bond surged to as high as 1.54%, its highest level in more than a year, after closing at 1.38% the previous day. That marked the biggest daily yield increase in more than three months.

Fed Catalyst

U.S. Federal Reserve Chairman Jerome Powell congressional testimony on Wednesday helped to trigger the week’s only significant rally. Powell downplayed inflation concerns and said that the Fed continues to expect low interest rates will remain in place for a long time.

Stimulus Movement

The U.S. House of Representatives approved President Biden’s $1.9 trillion COVID-19 relief package, moving the measure to the Senate. Democratic congressional leaders hoped to finalize the package before March 14, when certain types of federal unemployment assistance are set to expire.

Crude Awakening

The price of U.S. crude oil climbed for the fifth week in a row, ending just below $62 per barrel, its highest since 2019. The latest gain came ahead of a meeting scheduled to conclude Thursday, at which the OPEC consortium of oil-producing countries will discuss potential product curbs.

Other Important Macro Data and Events

A plethora of U.S. economic data showed a mixed signals. Weekly jobless claims hit their lowest level (730,000) in three months and recorded their biggest decline since August. Personal incomes, reported Friday, jumped 10.1% in January, thanks largely to payments from the coronavirus relief package passed in December. It was the largest gain since April, following the passage of the first pandemic relief package. The manufacturing sector remained in solid shape, with core capital goods orders rising 0.5%.

Inflation worries, economic data, technical factors, and weak auction results combined to push the yield on the benchmark 10-year U.S. Treasury note to around 1.61% on Thursday afternoon, its highest level in over a year. (Bond prices and yields move in opposite directions.)

European economic data was mostly positive, especially confidence indicators. The eurozone Economic Sentiment Indicator rose to 93.4 in February from 91.5 the month before, the highest since March last year. Separate surveys showed consumer confidence improving in Germany and Italy, but sentiment remained little changed in France. Q4 German GDP data were revised up unexpectedly to a growth rate of 0.3% from an initial estimate of 0.1% on strong exports and solid construction activity. The full-year figure was increased to -4.9% from -5.0%.

UK Prime Minister Boris Johnson unveiled a plan for gradually and irreversibly lifting lockdown restrictions in England from March 8 and ending on June 21. Almost all sections of the economy and many social activities are likely to be reopened by May 17. British finance minister Rishi Sunak is expected to extend the jobs support program until at least May in his budget, expected to be presented later this week.

What We Can Expect from the Market this Week

The economic recovery remains on track supported by a larger fiscal stimulus package, continued easy monetary policy, progress in fighting the coronavirus, and gradual easing of restrictions. However, the equity markets may still endure periods of volatility as uncertainties emerge which may affect their performance in the shorter term.

Important U.S. economic data being released this week include the PMIs composite, vehicles sales, ADP national employment report, factory order, labour data, consumer credit levels and trade balance.