PAST WEEK'S NEWS (February 1 – February 7, 2021)

Stocks Performance (U.S. Stocks)

Global stock indices were mixed as rising yields continue to dominate sentiment. Investors weighed the outlook for higher yields and borrowing costs against mostly better-than-expected economic data.

Investor confidence began the week on a positive note after the U.S. House of Representatives passed President Biden’s $1.9 trillion stimulus bill and sent it to the Senate for approval. The U.S. stocks later struggled to finish higher after Fed Chair Jerome Powell expressed concern about disorderly bond markets but stopped short of suggesting the Fed would take any action to address the turbulence.

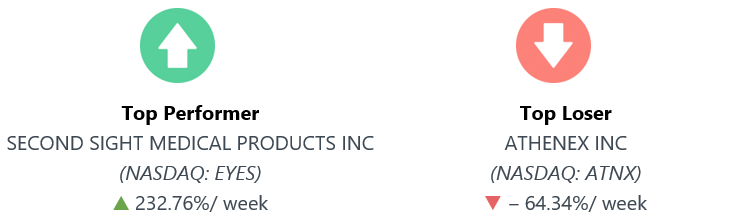

Shares of Second Sight Medical Products (NASDAQ: EYES) more than double during the trading session of Friday, after its Argus 2s retinal prosthesis system is approved by FDA. The last closing price of the share of Second Sight is $5.79. While the shares of Athenex trading lower After FDA.

declined to approve the biopharmaceutical company’s potential breast cancer treatment.

The energy sector led the gains as the price of crude oil climbed. The financial sector continued to climb in response to higher bond yields and in the wake of last week’s strong bank earnings reports. The consumer discretionary sector, which is dominated by Amazon.com Inc. and Tesla Inc., was lower. The sell-off in large technology and Internet companies led to a loss for in the Nasdaq Composite.

By sectors, the most outperformed weekly stocks were led by Energy Minerals sector at 9.23%, followed by Industrial Services at 5.97%, Communications (3.63%), and Health Services at 2.97%. Meanwhile, the weakest sectors were from the Consumer Durables at -3.62%, Retail Trade at -2.27%, Health Technology (-1.94%), and Electronic Technology sector (-1.78%).

Indices Performance

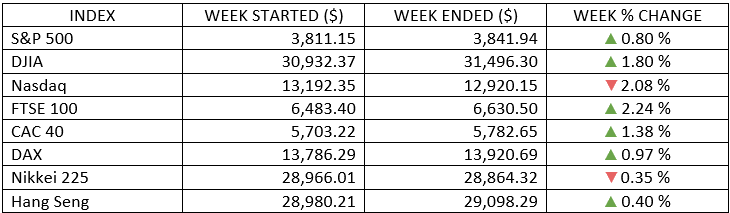

The S&P 500 and the Dow closed the week with modest gains for both indexes, while the NASDAQ slumped, briefly putting it in a correction on Friday.

All major European equity markets were higher on better-than-expected economic data. The DAX Index touched a new intraday high sometime of the week after Germany announced a gradual easing of restrictions starting next week.

Asian markets were also mostly higher after shaking off a brief retreat in response to words of caution about debt levels from China’s top banking regulator. However, Japanese equities were down slightly due to disappointing employment and capital spending data, and an extension of Tokyo’s COVID-19 state of emergency.

Oil Sector Performance

The improving economic optimism extended a boost in oil prices to their highest in more than two years. Oil also received further support when the OPEC+ unexpectedly decided to keep output unchanged, extending previous production cuts.

Market-Moving News

Choppy week

The S&P 500 and the Dow rose sharply on the opening week, tumbled on Thursday, and fell on Friday morning before staging an afternoon rally, leading to modest overall weekly gains for both indexes.

NASDAQ Nears A Correction

The NASDAQ slumped again, and on Friday, it was 10% below the record high it had set three weeks earlier, briefly putting it in a correction. The NASDAQ’s relatively high weighting in tech stocks has hurt the index’s recent results.

Yield Surge

Government bond prices were under pressure again, as the yield of the benchmark 10-year U.S. Treasury bond soared above 1.60% at one point on Friday, the highest in 13 months. As recently as late September, the yield was just 0.66%; at the end of last year, it was 0.92%.

Rise in Jobs Market Data

The U.S. economy generated 379,000 jobs in February, more than double the amount that most economists had expected. The bulk of the job growth came in leisure and hospitality, where hiring picked up in a segment of the economy that’s been hit hard by the pandemic.

Fed's Inflation Outlook

U.S. Federal Reserve Chair Jerome Powell on Thursday appeared to have triggered at least some of a steep market decline that afternoon. Powell suggested that inflation is likely to pick up in the coming months but that it would likely prove temporary—and not enough for the Fed to alter its current policy of maintaining ultralow interest rates.

Earnings Scorecard

Data from the recently concluded quarterly earnings season shows that companies in the S&P 500 recorded average earnings gain of 3.9% over the same quarter a year earlier, according to FactSet. Materials was the strongest among all 11 sectors, with earnings growth of 22.0%.

Crude Comeback

The price of U.S. crude on Friday climbed above $66 per barrel for the first time in nearly two years, owing in part to a new production agreement reached by OPE+. The countries agreed to keep production largely steady through April.

China's Outlook

China said on Friday that it’s targeting GDP growth of 6% or more this year—a goal that comes after the world’s second-largest economy withdrew specific numeric guidance last year because of uncertainty related to the pandemic. This year’s 6% target is below the expectations of most economists for growth of around 8%.

Other Important Macro Data and Events

The House passed the $1.9 trillion stimulus bill (handing it over to the Senate), manufacturing PMIs for February out of the U.S., Europe, and Japan exceeded expectations, and Warren Buffett reminded investors to "never bet against America" in his annual shareholder letter.

The approval of a vaccine from Johnson & Johnson and the President’s announcement that there would be enough vaccines for all American adults by the end of May added to the upbeat mood.

The spike in rates was catalysed by persistent expectations for economic growth and inflation, an acknowledgement from Fed Chair Powell that the Fed will not intervene in the Treasury market right now to control longer-dated yields, and by stronger-than-expected jobs growth in February.

Nonfarm payrolls increased by 379,000, and nonfarm private payrolls increased by 465,000. Both followed strong upwards revisions for January.

The improving economic optimism extended the retreat of gold prices from their high last August and boosted oil prices to their highest in more than two years.

In Sunak’s UK budget speech to Parliament, he pledged GBP 65 billion of additional fiscal spending in the short term and a temporary tax break for business investment. He extended welfare payments and the jobs-support program until September. But most individuals will have to pay more tax over time, and corporate taxes would rise to 25% in 2023 from 19% currently.

What Can We Expect from the Market this Week

The rise in bond yields over the last few weeks led to a sell-off in equities as investors expect excess return from equities to narrow over risk-free government bonds (equity risk premium). While this presents a short-term pain for equities, valuations are allowed to normalize gradually. This will be supported by better corporate earnings this year with room for positive surprises given the aggressive government spending and robust growth outlook.

With major economic sectors reopening, the equity markets have favoured a shift to cyclicals stocks from technology and defensive plays. While this is expected as global portfolios readjust their exposure, the tech sector remains highly profitable and continues to grow at a fast pace. For long-term investors with optimal diversification, short-term movements such as what we have seen recently are normal given the heightened volatility of the markets. In the long run, however, the growth of a diversified portfolio is expected to match the growth of the overall economy.

Important U.S. economic data being released this week include the wholesale inventories, inflation data, Federal budget, unemployment claims, JOLTs survey and consumer sentiment.