PAST WEEK'S NEWS (April 26 – May 2, 2021)

Stocks Performance (U.S. Stocks)

Global stock markets pushed to new highs but then retreated to finish the week mixed. This was amid solid corporate earnings reports, plans for massive additional U.S. policy stimulus, accelerating economic growth and a renewed pledge by the U.S. Federal Reserve to remain accommodative despite a pickup in inflation pressures.

The U.S. Fed strengthened its assessment of the U.S. economy, kept its policy interest rate and bond-buying programs steady, and dismissed concerns about inflation. On the fiscal front, President Joe Biden unveiled a new stimulus proposal, the American Families Plan that totalling of $1.8 trillion, which focuses on education, childcare and expanding the social safety net. This program follows the proposed $2.3 trillion infrastructure-focused American Jobs Plan and the $1.9 trillion American Rescue Plan that was signed into law in March.

Other data also supported the robust view of the economy. The U.S. GDP surged in the Q1, personal income in March posted its biggest-ever monthly increase, and unemployment insurance claims fell last week to a fresh pandemic low.

Last week saw almost half of the S&P 500 report earnings, including the five largest stocks — Apple Inc., Microsoft Corp., Amazon.com Inc., Alphabet Inc., and Facebook Inc. The overwhelmingly robust results lifted several of the tech and Internet giants to record highs.

The Vaxart Inc stock price led the weekly advance as it gained for 6 days in a row last week after the company introduced an oral tablet for COVID-19 vaccine, which its phase 1 study showed a positive candidates responses. Additionally, Vaxart has become increasingly popular among traders on Reddit and other social media platforms in recent weeks. Palisade Bio was the biggest laggard among the bunch.

Advancing sectors were led by Energy Minerals sector at 2.65%, followed by Transportations at 2.55%, Industrial Services (1.81%), and Finance at 1.79%. Meanwhile, the weakest sectors were from the Consumer Durables sector at -2.24%, followed by Electronic Technology at -1.78%, Producer Manufacturing (-1.41%), and Non-Energy Minerals sector (-1.06%).

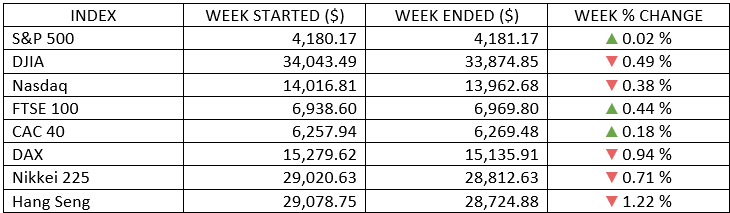

Indices Performance

The major indexes ended mostly lower. For the S&P 500 and the Dow, the modest setback snapped a 4-week string of gains that had pushed the indexes to record highs earlier in the week, before surrendering their gains on Friday.

European stock markets were mixed, as the eurozone officially re-entered recession. Germany’s DAX Index fell after reports said the country’s current lockdown may be extended until the end of May and confidence measures fell. Italy’s FTSE MIB slipped 1.00%, while France’s CAC 40 advanced 0.18% and the UK’s FTSE 100 Index gained 0.44%.

Asian markets all dipped at week’s end in response to weaker-than-expected PMI in China and a broadening antitrust crackdown on China’s technology giants. Japan’s stock markets also finished the week lower, with the Nikkei 225 Index down 0.71%. Declines were notable on Friday, as some firms’ worse-than-expected earnings releases exerted downward pressure on markets.

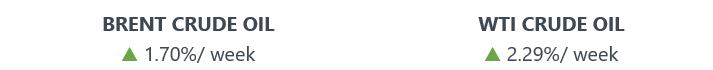

Oil Sector Performance

The oil prices had a strong week, as the WTI crude prices crept to 6-week highs high after the OPEC+ signalled confidence in the demand outlook from the U.S. to China, stoked optimism the recovery from the pandemic is accelerating.

Market-Moving News

Market Finished Flat

For the second week in a row, the major U.S. stock indexes were little changed overall, as the Dow and NASDAQ were slightly negative, and the S&P 500 posted a tiny gain. The lack of sustained movement follows a four-week string of gains that lifted indexes to record highs in mid-April.

April Blossoms

April was the fifth positive month out of the past six for the S&P 500, which rose more than 5%. The NASDAQ also added about 5% while the Dow rose nearly 3%. All 11 S&P 500 sectors posted positive results in April.

Positive Surprises

As of Friday, 86% of the S&P 500 companies that had reported Q1 results exceeded analysts’ earnings estimates, according to FactSet. That so-called beat rate ranks above the 74% five-year average, and it’s currently the highest rate since FactSet began tracking that data in 2008. Results were in from 60% of S&P 500 companies.

GDP Comeback

The U.S. economy recording its third consecutive quarter of robust growth. GDP grew at a seasonally adjusted annual rate of 6.4% in the Q1, which put GDP within 1.0% of its historic peak reached in late 2019.

Fed Consistency

The U.S. Federal Reserve showed no signs of straying from its accommodative monetary policies in the short term. Fed Chair Jerome Powell attributed a recent rise in inflation to factors that he views as temporary―a statement that eased concerns about a possible Fed policy shift to fight inflation.

Yields Rebound

The yields of government debt began to pick up again as bond prices fell. After ending the previous week at 1.56%, the yield of the 10-year U.S. Treasury bond climbed as high as 1.68% on Thursday before closing the week around 1.63%.

Healing Labor Market

The new U.S. claims for unemployment benefits have fallen below 600,000 for third week in row. Initial claims fell to 553,000 in the latest weekly report; having fallen to the lowest levels since the pandemic took hold in early 2020.

Other Important Macro Data and Events

The solid economic data pushed the yield on the benchmark 10-year Treasury note higher for the week. The high yield market took the dovish tone of Powell’s statement in stride and remained focused on new deals and earnings releases.

The dollar turned higher for the week. Against a basket of major currencies, the index advanced 0.52% to stay at 91.29. EUR/USD slipped -0.65%, USD/JPY rose 1.35%, and GBP/USD declined -0.54%.

Boosted by two rounds of stimulus payments and the ongoing progress in vaccinations, the U.S. Q1 GDP grew 6.4% on an annualized basis, up from 4.3% in the Q4. Following the strong growth, the GDP is now on track to reclaim its pre-pandemic peak, only 1% below its peak. %.

Consumer spending, which accounts for about 70% of the U.S. economy, surged 10.7% as consumers spent a portion of their stimulus checks from the two COVID-19 relief bills and saved the rest. Personal income surged 21.1% m/m in March and PCE prices were relatively tame on a year-over-year basis. Weekly jobless claims fell to a pandemic-era low of 553,000, and the Conference Board reported that its index of U.S. consumer confidence in April hit its highest level (121.7) since February 2020.

Fed Chair Powell said it wasn't time to start talking about tapering asset purchases, reiterating it'll take substantial further progress until the Fed's employment and inflation goals are reached. The FOMC left the fed funds rate and pace of asset purchases unchanged, as expected.

President Biden outlined his $1.8 trillion American Families Plan to Congress. Some Senate Democrats were reportedly against the idea of significantly raising capital gains taxes to help fund the plan, but there was a view that some sort of additional infrastructure spending (traditional/social) will still get done.

Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOG), Facebook (FB), and Tesla (TSLA) exceeded expectations on strong revenue growth.

Core eurozone bond yields trended higher. Higher-than-expected German inflation data published also pushed up core yields. Yields in the UK and peripheral eurozone bond markets also climbed higher, largely tracking the movements in U.S. Treasuries and core eurozone bonds.

What Can We Expect from the Market this Week

As markets hit new heights, volatility will inevitably be more ever-present. Given the obstacles faced over the last year, investors will undoubtedly be more prepared for any unexpected downturn going forward.

Periodic pullbacks are expected to be a norm, affected by concerns ranging from tax issues, geopolitical tensions, and market imbalances, among others. This continues to support the case for a well-diversified portfolio allocation and a disciplined approach by investors.

Important economic data being released this week include construction spending, vehicle sales, trade balance, factory orders the PMI index, jobs and employment data, wholesale inventories and consumer credit.