PAST WEEK'S NEWS (May 17 – May 23, 2021)

Stocks Performance (U.S. Stocks)

Global equity markets swooned, as several inflation readings surprised to the upside. These mixed performance in the markets likely reflect strength in the U.S. economy, as well as concerns about inflation and the timing of when the Federal Reserve might begin to rein in its accommodative policies.

Minutes from the FOMC meeting in late April offered additional insight into policymakers’ thinking on the economy and inflationary pressures. Investors focused on a statement that “a number of participants” suggested that policymakers “begin discussing a plan” for tapering the Fed’s monthly asset purchase program, which stands at USD 120 billion.

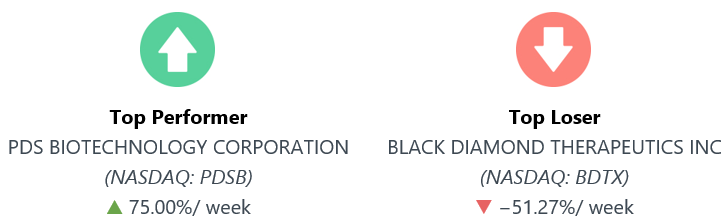

PDS Biotechnology Corporation led gains after the company announced publication of abstract regarding a clinical-stage immunotherapy in treating cancer. Another healthcare company, Black Diamond Therapeutics shares tumbled most after the company announced preliminary data in patients with advanced solid tumors.

Advancing sectors were led by Health Technology at 1.31%, Technology Services (1.18%), Health Services at 0.87%, and Electronic Technology at 0.60%. Meanwhile, the weakest sectors were from the Communications sector at -2.88%, followed by Non-Energy Minerals at -1.81%, Transportations (-1.67%), and Process Industries sector (-1.43%).

Indices Performance

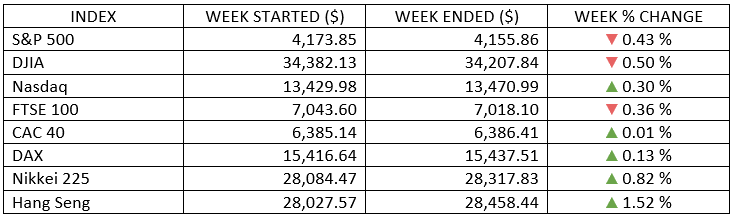

U.S. stocks posted a mixed result in a volatile week of trading, with the S&P 500 Index and Dow Jones ending modestly lower and the Nasdaq Composite Index gaining a little ground.

Shares in Europe rose on signs that the economy is rebounding as restrictions instituted to control the coronavirus’s spread begin to ease. Although worries about inflation still curbed gains. The UK’s FTSE 100 Index fell as strong economic data lifted the British pound versus the U.S. dollar.

Oil Sector Performance

Crude oil posted losses for the week, as it stays under pressure on worries about fresh COVID-19 curbs in Asia that was crimping demand, with traders also concerned after media reports the U.S. and Iran have made progress on reviving a deal restricting the OPEC country's nuclear weapons development, a development that could lead to increased supply from Iran.

Market-Moving News

No Clear Direction

The major stock indexes were mixed, with little overall change. Declines on the first three trading days of the week were largely offset by a rally on Thursday, leaving both the S&P 500 and the Dow around 1.5% below their record highs set two weeks earlier.

NASDAQ Comeback

For the first time in 6 weeks, the NASDAQ outperformed the S&P 500, and an index of U.S. large-cap growth stocks ended a dry spell by edging a large-cap value index. Technology stocks that had recently been hit by concerns about rising interest rates were among the latest week’s top performers.

Bond Turbulence

A midweek spike in government bond yields petered out amid mixed data about the economy, inflation, and the outlook for U.S. interest rates. The yield of the 10-year U.S. Treasury bond climbed to 1.69% in intraday trading on Wednesday before falling to around 1.62% on Friday—about where it had ended the previous week.

Inflation Chatter

Corporate executives clearly have rising prices on their minds, based on the large number who cited the term “inflation” in their conference calls with analysts during the nearly completed earnings season. As of mid-May, 175 companies in the S&P 500 had mentioned inflation, according to FactSet—the most since at least 2010.

Bitcoin Trouble

Concerns over the potential for tighter cryptocurrency regulation in the U.S., China, Turkey, and elsewhere weighed on the price of bitcoin, which dropped more than 20% for the week to around $37,000. As recently as mid-April, bitcoin was trading above $60,000.

Positive Indicators

An index of leading U.S. economic indicators recorded its strongest monthly gain since last July. The 1.6% April increase that was reported on Thursday by The Conference Board marked the second consecutive solid monthly gain for the index.

Labor Market Gains

New U.S. claims for unemployment benefits fell to 444,000 in the latest weekly count—the lowest during the pandemic. Claims have declined in five of the past six weeks at a time when many states are moving to cut off a federal benefit for unemployed workers.

Home Sales Slowdown

U.S. sales of existing homes fell 2.7% in April compared with the previous month, making it the third straight monthly decline at a time of year when sales typically pick up. Friday’s report from the National Association of Realtors followed a recent surge in home prices amid a low supply of available properties.

Other Important Macro Data and Events

The dollar edged slightly lower for the week. Against a basket of major currencies, the index shed -0.03% to stay at 90.028. EUR/USD rose 0.25%, USD/JPY slipped -0.29%, and GBP/USD rose 0.3%.

U.S. Treasury yields were roughly unchanged for the week, representing a view that the Treasury market isn't that concerned about inflation and is siding with the Fed's view that inflation will be transitory.

The FOMC Minutes from the April meeting revealed that some participants thought it might be appropriate to start talking about tapering asset purchases in future meetings if the economy continues to make rapid progress towards the Fed's goals on employment and inflation.

The preliminary estimates for the IHS Markit U.S. Composite PMI Index, which came in at a record 68.1 in May—a significant improvement from April’s 63.5 reading and above the consensus forecast. (PMI readings above 50 suggest an expansion in economic activity.) The service sector component of the survey was especially strong, with the flash PMI reading climbing to a record 70.1 from 64.7 in April. PMI for the manufacturing sector advanced to 61.5, a month-over-month improvement from 60.5. The preliminary PMI data also highlighted inflationary pressures in the U.S. economy, with the rate of input price increases surging to a record and output charges recording their sharpest rise since October 2009, when data collection began.

The Eurozone business activity also accelerated at the fastest pace in three years in May as virus containment measures eased, a survey of PMI by IHS Markit showed. The composite PMI reached 56.9 in May, an improvement from the 53.8 registered in the preceding month. The services sector index climbed to 55.1 from 50.5.

Core eurozone bond yields ended higher on expectations that the ECB could slow its bond purchases. Uncertainties over Italy’s economic reform plans and the potential slowing of ECB bond purchases initially drove yields higher, but markets began to stabilize, and peripheral yields ended lower. UK gilt yields fell on concerns about the spread of a new coronavirus strain and its potential to delay the full reopening of the UK economy.

The UK moved to phase two of its plan for lifting coronavirus restrictions—allowing social mixing indoors, greater physical contact, and foreign travel. UK consumer price inflation accelerated to 1.5% in April from 0.7% in March, driven by bigger regulated gas and electricity bills and higher clothing prices.

What Can We Expect from the Market this Week

Inflation is going to be a very popular word these past few weeks and expected to spill in the following week. With the economy picking up a head of steam and corporate profits surging, the foundation for stock-market performance is quite solid. So rising inflation represents the fly in the ointment, and while we don't think it will ruin the party, we do expect it to continue to scratch the record.

Cryptocurrencies also have captured plenty of attention. The heavy selling in the cryptocurrency market this week likely served as a reminder of volatility and liquidity in these areas has.

Important economic data being released this week including the Q1 GDP, several housing market data, durable goods orders, weekly unemployment claims and consumer sentiment, and personal income & spending.