Stocks Performance (U.S. Stocks)

Stocks Performance (U.S. Stocks)

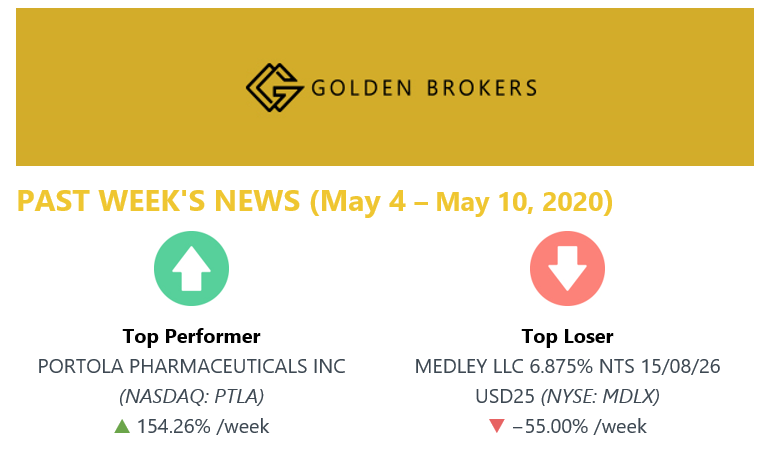

Stocks recorded solid gains for the week, as investors appeared to reconcile themselves to the depth of the economic downturn and focus instead on the reopening of parts of the economy along with possible therapeutic advances in the fight against the coronavirus. Hopes that treatments and a vaccine might bring an eventual end to the health and economic crisis seemed to continue to support stocks throughout the week.

The most outperformed weekly stocks by sectors was led by Consumer Durables at 7.92%, followed by Energy Minerals at 7.13%, Technology Services (7.03%) and Electronic Technology (6.11%).

Meanwhile, the weakest sectors were the Utilities sector (1.05%), Finance (1.60%), Consumer Non-Durables (1.74%) and Transportation sector (1.79%).

The S&P 500 has now recouped about half its losses from the record high earlier in the year on hopes that economic activity may be bottoming as restrictions ease and economies reopen.

Oil recorded its first back-to-back weekly gain since February, as oil companies are cutting production faster than expected and as signs of increased demand emerged. Global oil demand has plummeted by about 30% as the coronavirus pandemic curtailed movement across the world.

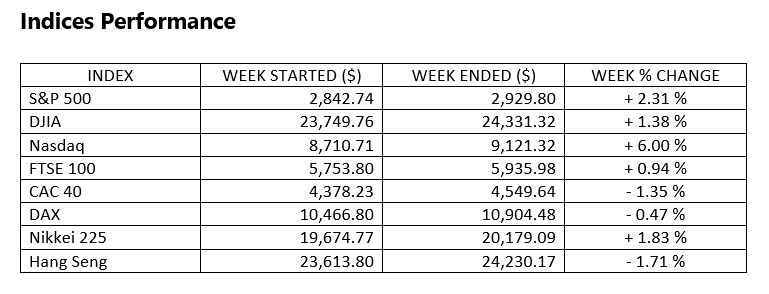

Market-Moving News Surging NASDAQThe NASDAQ’s 6% weekly gain extended its year-to-date outperformance relative to the other major U.S. indexes, and a rally on Thursday pushed it back into positive territory ytd. Strong performance from technology stocks has lifted the index 33% from a recent low on March 23.

Momentum shift

After two modestly negative weeks, the major U.S. stock indexes regained positive momentum, posting gains ranging from roughly 3% to 6%. Overall, however, stocks have largely been in a holding pattern since mid-April, when first-quarter earnings reports began coming out.

Crude awakening

While U.S. crude oil prices remained low at less than $25 per barrel, it surged nearly 18% for the week, extending a recent comeback. Prices were lifted by recent production cuts as well as rising demand, as some parts of the global economy began to reopen.

Calming down

A measure of investors’ expectations of short-term stock market volatility has pulled back sharply from the historic highs reached in March of this year. The Cboe Volatility Index recorded a 25% weekly decline, dropping to a level that’s 66% below its peak on March 16.

Small-cap comeback

Small-cap stocks outperformed the broader U.S. stock market by a wide margin for the second week in a row. A small-cap benchmark, the Russell 2000 Index, added nearly 6% for the week.

Dividend damage

From mid-March through the end of April, 44 companies in the S&P 500 either cut or suspended their dividends, according to S&P Dow Jones Indices. Those moves reduced the S&P 500’s overall dividend payment by 6.5%.

Historic job loss

Stocks rallied on Friday, as the monthly jobs report released that morning wasn’t quite as awful as some economists had predicted.

Other Important Macro Data and Events

The week brought a host of data showing an unprecedented contraction in economic activity, but investors seemed to take hope that the economy was bottoming. On Tuesday, several gauges showed a record contraction in both manufacturing and services activity in April, but the Institute for Supply Management’s non-manufacturing purchasing managers’ index fell much less than feared.

On Thursday, U.S.’s Labor Department’s report of another 3.2 million Americans filing for unemployment insurance in the week. The impact from COVID-19-related job losses was devastating: The unemployment rate spiked to 14.7% in April, and the 20.5 million jobs lost marked the largest decline on record. Payrolls fell by a massive 20.5 million in April, causing the unemployment rate to spike to 14.7%, the highest since the Great Depression.

However, despite the job losses report, stocks rose, with investors apparently reassured as it is not as bad as initially expected by analyst and experts.

The possibility of a resumption in the U.S.-China trade war added another layer of uncertainty to the outlook and seemed to result in periodic volatility. However, stock futures jumped Thursday morning on the back of a headline that top U.S. and China trade negotiators were expected to meet to work on implementation of the first phase of the trade agreement.

Hope that treatments and a vaccine might bring an eventual end to the health and economic crisis seemed to continue to support stocks throughout the week. Enthusiasm for Gilead Sciences’ remdesivir was bolstered Thursday after Japanese regulators granted approval for the use of the possible therapeutic. Thursday also brought news that the U.S. Food and Drug Administration had granted approval for the first phase two clinical trial of a possible vaccine, causing shares in its maker, Moderna Therapeutics, to surge on the news.

What We Can Expect from The Market This Week

The week expected to begin on a positive note, with investors seemingly encouraged by the partial lifting of lockdown orders in some states and the gradual reopening of major economies overseas. We think that a recovery will take shape, but there will be bumps along the way.

Important economic data being released include inflation on Tuesday and consumer sentiment and retail sales on Friday.