PAST WEEK'S NEWS (Aug 2 – Aug 8, 2021)

Worksport Ltd., a manufacturing company for light-duty trucks parts shares jumped on its debut trading on NASDAQ. As part of the process for meeting initial listing requirements, the Company completed a 1-for-20 reverse stock split. It priced its underwritten public offering of 3.3 million units at $5.50 per unit.

Meanwhile a Chinese based platform E-Home Household Service stock plummeted for the week. The recent fluctuation come at a time when both Chinese and U.S. regulators are cracking down the Asian nation’s firms that list on American markets. The company has been swinging wildly despite no apparent news since its IPO.

Stocks Performance (U.S. Stocks)

Major stocks recorded gains for the week, although started off on a down note early on, on ongoing concerns about “peaking” economic growth and profits, along with worries about the Delta variant of the COVID-19. Concerns over new regulatory measures in China also seemed to weigh on sentiment.

Some positive earnings surprises appeared to help the market to regain its footing. The risk sentiment was also supported by an encouraging round of economic data, with the latest jobs report reflecting the broadly favourable fundamental backdrop, on top of the manufacturing sector, the services sector, and trade activity that continued to paint a good recovery in the economy. Note, the employment report supported the case for the Fed to consider tapering asset purchases sooner rather than later.

Gains of the week helped the large-cap benchmarks and the technology-heavy Nasdaq Composite Index to new highs. A sharp rise in longer-term interest rates following Friday’s strong monthly payrolls report augured well for banks’ lending margins and boosted financials shares, and the utilities sector also outperformed. Energy shares lagged as oil prices dropped in its biggest weekly loss of this year.

Advancing sectors were led by Finance sector at 2.19%, followed by Health Technology at 1.85%, Utilities (1.75%), and Technology Services at 1.59%. Meanwhile, Energy shares fared worst to decline -2.02%, followed by Industrial Services at -1.17%, Distribution Services (-0.79%), and Health Services sector (-0.59%).

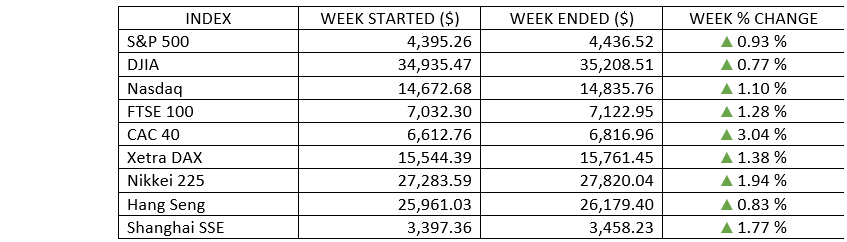

Indices Performance

The stock market muscled out another trio of record closing highs for the S&P 500, Nasdaq Composite and Dow Jones Industrial Average for the week, as risk sentiment was supported by an encouraging round of economic data.

Shares in Europe rose on strong growth in corporate earnings and optimism about an economic recovery.

Japan’s stock markets made gains over the week, buoyed by upbeat earnings reports. Although, gains were dented by a worsening in the country’s coronavirus situation, prompted the government to expand its quasi-state of emergency to eight more prefectures, where the highly contagious Delta variant is spreading rapidly.

Chinese stocks rose as the previous week’s steep declines attracted some buyers. Domestic investors appeared to avoid market sectors that have recently drawn criticism from the government in favour of areas with strong official support. Negative comments regarding online gaming from state media hurt investor sentiment and raised fears of tighter regulation for the industry. Investors also took profits in many property management companies following positive profit alerts and share buyback announcements.

Oil Sector Performance

Oil prices posted its biggest weekly loss this year as the spread of the Delta COVID-19 variant cast doubt on the continued recovery in demand. A surprise jump in U.S. stockpiles has also hurt prices, although worries over rising tensions between Israel and Iran limited the decline.

Market-Moving News

Summer Doldrums

The major U.S. stock indexes rose around 1%, with the S&P 500 and the Dow pushing their records slightly higher and recouping the previous week’s modest declines. Stocks have traded in a narrow range lately, with a gap of just a single percentage point separating the S&P 500’s high and low points of the past two weeks.

Bond Reversal

Prices of U.S. government bonds fell, sending yields higher and breaking a string of five consecutive weekly yield declines. After slipping below 1.20% earlier in the week—the lowest in six months—the yield of the 10-year U.S. Treasury bond climbed on Friday to around 1.29%. Nevertheless, that’s down sharply from a recent peak of 1.74% in March.

Bitcoin Comeback

The price of Bitcoin extended its gains from the previous week, rising to nearly $43,000. As of Friday, the cryptocurrency’s price was up more than 40% from a recent low on July 21, although it remains far below the $63,000 record level that it breached in April.

Jobs Surge

A better-than-expected monthly jobs report on Friday may have eased concerns about the U.S. economic recovery’s resilience amid the recent spike in Delta variant cases. In July, the economy generated 943,000 new jobs—the largest monthly gain in 11 months—as the unemployment rate fell to 5.4%. Average hourly earnings grew 4.0% on a year-over-year basis.

Oil Volatility

U.S. crude oil prices fell to around $68 per barrel to record a weekly decline of nearly 8%—the biggest weekly drop in five months. Oil prices have fallen in part over concerns that the Delta variant’s spread could weigh on economic growth and reduce travel, particularly in China, where the government has imposed new travel restrictions.

Earnings Beat Rate

As of Friday, 87% of the S&P 500 companies that had reported Q2 results exceeded analysts’ earnings estimates, according to FactSet. That so-called beat rate ranks above the 75% 5-year average, and it’s currently the highest rate since FactSet began tracking that data in 2008.

Infrastructure Breakthrough?

After lengthy negotiations, the U.S. Senate prepared to vote on a $1.1 trillion plan to improve the nation’s physical infrastructure. The White House will try to move the package through the House as the Senate considers a broader measure sought by Democrats that extends to non-traditional forms of infrastructure.

Other Important Macro Data and Events

Recapping the key economic data:

The Employment Situation report for July was better than expected, featuring 943,000 additions to nonfarm payrolls (consensus 925,000).

July manufacturing activity (PMIs) in the U.S., Europe, and Asia remained in expansionary territory.

The July ISM Non-Manufacturing Index increased to a record high of 64.1% (consensus 60.5%).

The June trade balance report saw imports outstrip exports as the U.S. tried to meet the pent-up demand in the economy.

Weekly continuing claims dipped below 3.0 million for the first time since the pandemic began.

The U.S. 10-year yield traded as low as 1.13% last week amid peak growth/inflation expectations, and concerns about the Delta variant, but ended the week at 1.29% or five basis points above last Friday's settlement. This rebound aligned with a pro-growth mindset.

Core eurozone bond yields trended lower, as an increase in coronavirus cases fuelled doubts about the wider economic recovery. UK gilt yields also fell, broadly following core markets. However, this pullback in yields moderated later in the week due to hawkish messaging from the Bank of England.

Eurozone PPI rose 1.4% in June, from 1.3% in May, as energy prices surged. Excluding energy, producer prices ticked up 0.7% in June.

What Can We Expect from the Market this Week

Markets have been rather optimistic for much of this year, with U.S. stocks reaching a new record last week and interest rates still at historically low levels. While this does not suggest a correction is imminent, but pullbacks are a normal part of sustained bull markets.

Important U.S. economic data being released this week including the JOTLs job openings, CPI & PPI, Treasury budget, and imports/exports prices. Also scheduled for the week are the IEA oil market report and OPEC monthly report.

A CPI report scheduled on Wednesday will be the most awaited economic data, to show whether a monthly spike in prices in June carried over into July. The CPI released last month showed that prices surged 5.4% for the 12-month period that ended in June—the most in any 12-month period since 2008.