PAST WEEK'S NEWS (Aug 16 – Aug 22, 2021)

Regencell Bioscience Holdings Limited shares jumped after announced that the underwriter of its IPO had exercised its option to purchase 325,000 additional ordinary shares at the public offering price of $9.50 per share to cover over-allotments. The shares closed at $19.16 at the end of the week. Regencell Bioscience is an early-stage bioscience company that focuses on research, development, and commercialization of medicine for the treatment of neurocognitive disorders and degeneration, specifically ADHD and ASD.

Shares of Ontrak, a company using artificial intelligence to deliver outpatient care to those with chronic conditions, were plunged after the company disclosed a decision by a customer not to continue a program that was expected to yield millions of dollars over three years.

Stocks Performance (U.S. Stocks)

Stocks pulled back for the week but not before the S&P 500 Index and Dow Jones reached a new record high on Monday afternoon. Several factors seemed to weigh on sentiment over the middle of the week. Among the concerns surrounding including the 1) supply chain disruptions worsened by the Delta variant, 2) vaccine efficacy, 3) the Fed's taper timeline as the July FOMC minutes rehashed commentary about tapering sooner rather than later, 4) China's regulatory crackdown, 5) Afghanistan after it was overtaken by the Taliban, and 6) the potential for a larger pullback.

From a sector perspective, advancing sectors were led by the healthcare sector (2.40%), utilities (1.10%), real estate (+0.6%), consumer staples (+0.4%), and information technology (+0.4%) sector.

The damage was done mostly on cyclical stocks, with the energy shares performed worst. The energy sector (-7.02%) ended the week down lower as oil prices tumbled. The materials, consumer discretionary, financials, and industrials sectors declined between 2-4%.

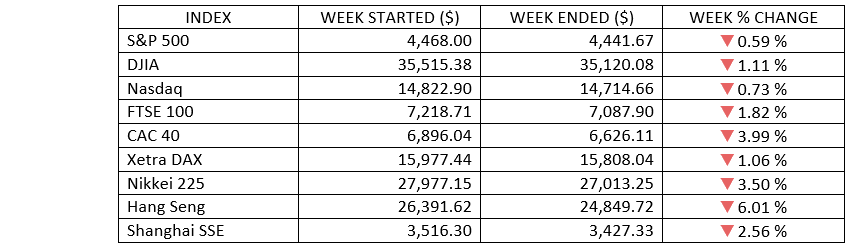

Indices Performance

The S&P 500 and Dow Jones Industrial Average started the week setting record highs, but the market got caught up in a myriad of concerns that left the major indices lower for the week.

European stock benchmarks also pulled back amid global concerns about the spread of the Delta variant of the coronavirus, the situation in Afghanistan, and slowing growth in China.

Chinese stocks slumped as Beijing’s regulatory clampdown on the technology sector stoked uncertainty about what other sectors the government might target next. Liquor stocks slumped after state media reported that the State Administration for Market Regulation was considering new regulations for liquor companies. Health care companies fell on concerns that industry profits would also be curbed by new regulations.

Oil Sector Performance

Federal Reserve looming move toward tapering asset purchases, and a rally in the U.S. dollar weighted on the crude prices.

A surprise build in U.S. gasoline inventories also added to pressure. According to data by the EIA, the U.S. crude inventories fell 3.2 million barrels last week to 435.5 million barrels, their lowest since January 2020. However, the gasoline stocks rose by 696,000 barrels to 228.2 million barrels, against analysts' expectations for a 1.7-million-barrel drop.

The approaching end of the U.S. peak gasoline demand season and end of summer holidays in Europe and the United States are also set to sap oil demand.

Market-Moving News

Markets Retreated

Despite gains made by all three major U.S. stock indexes on Friday, the indexes posted weekly declines, weighed down by losses among shares of economically sensitive companies such as banks and energy producers, and fears over the surge in COVID-19 infections.

Bond Reversal

Prices of U.S. government bonds fell, with U.S. Treasury yields rising slightly on Friday. The yield of the 10-year U.S. Treasury bond climbed on Friday to around 1.26%, although still lower from a recent peak of 1.74% in March.

Fed Minutes Release

Minutes of the U.S. Federal Reserve’s July 27–28 meeting revealed an emerging consensus to start reducing asset purchases before the end of the year. The minutes, which were released on August 18, also showed that Fed officials made it clear that a tapering isn’t a precursor to an imminent rate hike.

A Dip in Retail

U.S. retail sales fell 1.1% in July relative to June. The rise in COVID-19 cases related to the spread of the Delta variant could be one reason for the consumer demand pullback.

Oil volatility continues

U.S. crude oil prices continued to fall this week, closing around $62 per barrel. Even as more supply reached the market worldwide, investors remain worried over the continuing spread of COVID-19.

Record-Breaking Earnings

Nearly 91% of S&P 500 companies reported their earnings for the second quarter. Nearly 87% of the reported companies have actual revenues above the mean revenue estimate.

United States Exits Afghanistan

Evacuations and chaos continued following the U.S. withdrawal from Afghanistan. While the market impact has been muted, rising geopolitical risks in the region could be a future source of volatility.

Bitcoin Continues to Rally

Bitcoin continued to extend its gains from the previous week, rising to $48,713. Even as the cryptocurrency continued to rise after hitting a low on July 21, it remains far below the $63,000 record level that it hit in April.

Other Important Macro Data and Events

On the domestic policy front, recent signals from Fed policymakers that they would soon begin tapering the central bank’s monthly asset purchases also seemed to concern investors. On Wednesday, the Fed released the minutes of its latest policy meeting, in which most members indicated that they thought tapering could begin by the end of the year. Dallas Federal Reserve President Robert Kaplan may have helped spark a rally Friday, however, after he suggested that he might favour delaying tapering if the Delta variant takes a deeper toll on the economy.

Retail sales for July, total housing starts for July, and the Empire State Manufacturing Survey for August were each weaker than expected. Weekly initial and continuing claims both improved.

Longer-dated Treasuries rose in sympathy with growth concerns, leaving the 10-yr yield down four basis points to 1.26%. Core eurozone bond yields drifted lower in the week as investors favoured lower-risk assets. Germany’s 10-year bund yield was trading around -0.495% on Friday, compared with highs of -0.456% on Monday.

In currency markets, the British pound and the euro both weakened against the U.S. dollar as the greenback benefited from the risk-off environment.

What Can We Expect from the Market this Week

Last week's release of the minutes from the last Federal Reserve meeting revealed that discussions around reducing bond purchases have gained steam among Fed members. All eyes will be on the Fed's annual get together in Jackson Hole, Wyoming is awaited this week.

Chair Jerome Powell will address the "economic outlook" at 10 a.m. E.T. (1400 GMT) on Friday. The full symposium runs Thursday through Saturday. The Fed's last two meetings have shown that U.S. monetary policy is nearing a key turning point away from the crisis-era accommodation put in place in 2020, and Powell's speech could be the last hint at their next steps before the September policy meeting.

Another important data being released this week include the existing/new home sales, personal consumption and income, and U.S. Q2 GDP. A chance of a South Korean rate hike and a series of business surveys out of Europe top the main economic events are also to be covered this week.