PAST WEEK'S NEWS (Aug 30 – Sep 5, 2021)

Katapult Holdings traded higher following its positive industry update and positive comments on the stock in the week. Katapult Holdings is an omnichannel lease-purchase platform company that provides alternative solutions for retailers and consumers. The platform offers an innovative lease purchase solution to consumers, enabling essential transactions at the merchant point of sale.

Forte Biosciences Inc. plummeted to an all-time low after its experimental treatment failed to have an effect on atopic dermatitis, a common skin disease.

Stocks Performance

The major indexes ended the week mixed after the renewed pandemic headwinds, slowing economic momentum and shifting Fed policy adding new wrinkles to the outlook.

The start of the new month brought the release of manufacturing and non-manufacturing surveys from major economies. Most of these surveys showed a deceleration in activity while China's Caixin manufacturing and non-manufacturing fell into contraction, prompting speculation about more easing. Meanwhile, manufacturing and non-manufacturing surveys from the U.S. remained in expansionary territory.

Final Eurozone and UK PMIs showed that business activity in August slowed more than indicated by preliminary estimates. UK composite activity fell to a 6-month low due to a decline in service sector activity that appeared to stem from normalizing demand, labor shortages, and supply chain obstacles.

From a sector perspective, Retail and Real Estate sector outperformed, as well as Health Services, Technology and Electronics. On the downside, Financials and Energy finished at the bottom of the leaderboard while Materials and Industrials recorded slimmer losses.

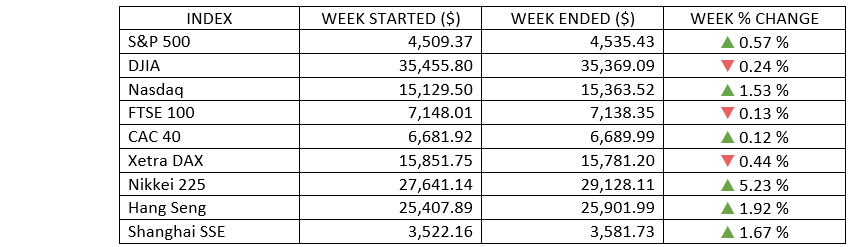

Indices Performance

The S&P 500 managed to post a modest gain for the second week in a row. The NASDAQ outperformed its peers for the second consecutive week while the Dow fell slightly.

Shares in Europe were little changed, as investors assessed signs of slowing economic momentum.

News of Prime Minister Yoshihide Suga’s resignation contributed to a strong rally in Japanese equities, removing some political uncertainty and raising expectations of increased economic stimulus. Gains were underpinned by Japan’s accelerating COVID-19 vaccination drive.

Chinese stocks rose for a second consecutive week.

Oil Sector Performance

Oil prices settled the week on a a back-to-back weekly gain, supported by signs that the global crude market is tightening, a weaker U.S. currency, and the fallout from Hurricane Ida.

Market-Moving News

Quiet August Finish

The major U.S. stock indexes traded in a narrow range all week, but the S&P 500 managed to post a modest gain for the second week in a row. The NASDAQ outperformed its peers for the second consecutive week while the Dow fell slightly.

August's Achievements

Despite sustaining a midmonth decline, the S&P 500 recovered to record its seventh positive month in a row, posting a return of about 3% in August. The index reached 12 record closing highs in the month versus 7 in July.

Growth Tops Value

An index of U.S. large-cap growth stocks outperformed a value stock index by a substantial margin for the third week in a row. The recent results have eroded the value style’s year-to-date performance edge over growth stocks.

Shrinking Jobs Growth

U.S. payroll growth slowed sharply in August, according to a monthly report released on Friday. The economy generated 235,000 new jobs last month, far short of economists’ expectations and trailing gains of nearly 1.1 million in July and 962,000 in June. The unemployment rate fell to 5.2% from 5.4% in July.

Shaken Confidence

Concerns about the Delta variant’s spread and its impact on the economy continue to weigh on U.S. consumers’ outlook. A consumer confidence survey fell in August to the lowest level in six months, which could lead to a slowdown in Q3 consumer spending after robust growth in the previous two quarters.

Growing Optimism

Wall Street analysts’ expectations for the earnings report season that opens in mid-October have been rising. Over July and August, forecasts for Q3 earnings of companies in the S&P 500 rose 3.8%, according to FactSet. That’s the fourth largest such increase during the first two months of a quarter since 2009.

Manufacturing Acceleration

A private report showed that the U.S. economy recorded its 15th consecutive monthly gain in manufacturing activity in August. The Institute for Supply Management’s manufacturing index rose 0.4% to 59.9. Any reading above 50 indicates growth in manufacturing activity.

Other Important Macro Data and Events

The August U.S. employment report released on Friday was consistent with a recovery enduring some growing pains. Monthly job gains totaled 235,000, well below expectations and a drop of 800,000 from July. Job growth in the leisure and hospitality sector stalled, highlighting the impact of renewed pandemic restrictions.

The Delta variant appeared to be taking a smaller toll on the manufacturing sector, although companies and suppliers surveyed by the ISM reported continued struggles with “record-long raw materials lead times, continued shortages of critical basic materials, rising commodities prices, and difficulties in transporting products.” The ISM’s gauges of both factory and service sector activity—released Wednesday and Friday, respectively—surprised on the upside. Housing market numbers were weaker, with pending home sales falling in July for the second consecutive month.

The benchmark 10-year U.S. Treasury note yield increased on Friday morning, leaving it modestly higher for the week.

Core eurozone government bond yields rose on higher-than-expected eurozone inflation and hawkish commentary from some ECB policymakers, who called for a reduction in the purchase pace of the Pandemic Emergency Purchase Program. Peripheral eurozone and UK government bond markets mostly tracked core markets.

Eurozone inflation accelerated more than forecast to 3% in August—up from 2.2% in July and well above the ECB's 2% target. Higher energy, food, and industrial goods prices drove the increase, according to the EU's statistics agency. The EC’s economic sentiment index fell to 117.5 in August from a record high of 119.0 in July, with optimism waning in all main sectors. France and the Netherlands posted the sharpest drops in sentiment.

Final eurozone and UK PMIs showed that business activity in August slowed more than indicated by preliminary estimates. IHS Markit said the UK composite activity fell to a six-month low due to a decline in service sector activity that appeared to stem from normalizing demand, labor shortages, and supply chain obstacles.

What Can We Expect from the Market this Week

The jump in volatility and any accompanying weakness in the market we expect to prove temporary, with the fundamental outlook supporting the case for equities to remain in fashion.

Markets in the U.S. were scheduled to be closed on Monday in observance of Labor Day. Some U.S. important economic data being released this week include the producer price index and consumer credit.