PAST WEEK'S NEWS (Sep 27 – Oct 3, 2021)

Shares of Gogo soared 50% for the week. The provider of in-flight internet services provided a long-term outlook that has investors feeling better about the company after some turbulence in recent years. Shares climbed after the company raised the long-term financial targets announced during the Q4 2020 earnings.

Stocks Performance

Selling momentum returned to the stock market this week amid a host of concerns, including rising rates and valuations. Negative headlines about energy prices, Chinese property developer Evergrande, and gridlock in Washington also weighed on investor sentiment.

The U.S. Treasury market was a major source of discomfort, as the 10-year yield hit 1.56% early in the week amid expectations for sustained inflation pressures and eventual Fed tapering. Considering the 10-year yield flirted with 1.30% last week, this rate of change didn't sit well for the elevated valuations of the growth stocks.

Intensifying the situation were the continued uncertainty on the debt ceiling and infrastructure. The possibility that the U.S. federal government would experience another partial shutdown was averted late in the week when the Senate and the House of Representatives passed, and President Joe Biden signed, a short-term spending bill. No progress was made in raising the federal debt limit, however, and Treasury Secretary Janet Yellen warned again that the limit needed to be suspended or raised by October 18 for the Treasury to meet its obligations. While most observers agree that an actual default on the country’s debt is highly unlikely—especially given that Democrats may turn to tools to do it unilaterally—substantial market volatility followed previous episodes of brinkmanship a decade ago.

The outlook for the bipartisan, $1 trillion infrastructure bill also remained clouded. Democratic leaders abandoned plans for a vote on the bill on Thursday evening, following demands from progressives in the party to link its passage to a separate bill focusing on health care, education, climate measures, and other social policy priorities.

The retail trade, information technology and health care sectors dropped more than 3.0%, while the energy sector (+5.56%) was the only group that closed higher, rallied amid higher energy prices. The recent surge in oil prices also raised broader inflation worries.

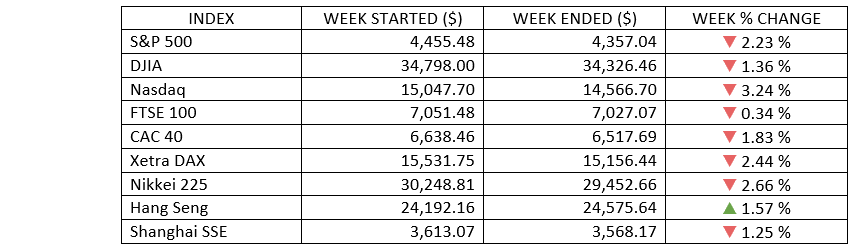

Indices Performance

The S&P finishing September with a 4.8% decline, just the second monthly loss of 2021 and the worst month since March 2020. Growth stocks fared worse than value shares, which was mirrored in the underperformance of the technology-heavy Nasdaq Composite Index. Nasdaq Composite index recorded their biggest weekly drops since February and rounded out the worst monthly declines since the onset of the pandemic, seemingly weighed down by inflation and interest rate fears.

Shares in the Europe also fell sharply amid fears that the economy might be sliding into a period of low growth and high inflation.

Japanese stocks followed the lead of U.S. markets and declined during the week. The Nikkei 225 Index losses were concentrated on Wednesday and Friday,

Chinese stocks ended a holiday-shortened week on a mixed note. China’s markets were closed Friday for the weeklong National Day holiday starting on October 1. Positive news concerning indebted property developer China Evergrande Group supported investor sentiment. On Wednesday, Evergrande said that one of its units would sell roughly 20% of its stake in Shengjing Bank Co. to a state-owned enterprise for $1.5 billion to help reduce its debt load. News of the asset sale came as Beijing is prodding government-owned companies and state-backed property developers to buy some of Evergrande’s assets.

Oil Sector Performance

Positive momentum in energy prices fed into the inflation narrative, as reports discussed fuel shortages in the UK and an energy crunch in China. Market sentiment also remained strong with tighter supply and recovering demand with the easing of COVID-19 pandemic restrictions.

The price however, dropped a little on the prospect that the OPEC+ supplier alliance might step up a planned increase in output to ease supply concerns, with soaring gas prices spurring power producers to switch from gas to oil.

The Brent topped $80 a barrel earlier in the week for the first time in three years, before eased later in the week. The WTI also retreated toward $74 a barrel.

All eyes are now on a meeting of the OPEC+, led by Russia, on Monday, where producers will discuss whether to go beyond their existing deal to boost production by 400,000 bpd in November and December.

Market-Moving News

Another Choppy Week

After posting small gains in the previous week, the major U.S. stock indexes turned downward, continuing the bumpy path they’ve been on in the wake of a mostly positive summer.

September Setback

The S&P 500 saw its string of seven consecutive monthly gains snapped, as the index fell 4.8% in September—its biggest monthly decline since March 2020. Despite the pullback, the S&P 500 finished the Q3 with a small overall gain of 0.2% after rising 2.3% in July and 2.9% in August.

Small-Cap Standouts

Although it also posted a weekly decline, a benchmark of U.S. small-cap stocks outperformed its large-cap peer by a wide margin. After rallying on Monday and Tuesday, the Russell 2000 Index fell just 0.3% for the week, while its large-cap counterpart dropped 2.3%.

Earnings Optimism

Wall Street analysts have been lifting their expectations for Q3 results heading into earnings season, which opens in mid-October. Over the past three months, analysts raised their average earnings-per-share estimate for companies in the S&P 500 by 2.9%, according to FactSet. However, while analysts increased their estimates in July and August, they trimmed them in September.

Oil Recovery

U.S. crude oil prices climbed for the sixth week in a row, rising to nearly $76 per barrel on Friday. That’s up 23% from a recent low of around $62 on August 20, and above a recent peak of about $75 reached in July.

Washington Watch

Attempts to secure congressional approval for two infrastructure packages generated plenty of headlines, but Democratic leaders were unable to achieve intraparty consensus and scrapped a House vote that had been scheduled for Thursday. However, party leaders resumed efforts to bring the factions together—an uncertain process that could trigger volatility in financial markets.

Other Important Macro Data and Events

The yield on the benchmark 10-year U.S. Treasury note spiked to a three-month high at midweek, amid expectations for sustained inflation pressures and eventual Fed tapering. It eventually calmed down, settling at 1.47%, roughly where it started.

There was some mixed economic data throughout the week. The weekly initial claims were higher than expected at 362,000, the core PCE Price Index was up 3.6% year-over-year in August (a 30-year high), the Conference Board's Consumer Confidence Index dropped to 109.3 in September from 115.2 in August. The September U.S. ISM Manufacturing Index was better than expected with a reading of 61.1%. while China's September Manufacturing PMI entered contraction territory with a reading of 49.6.

In Fed news, Fed Chair Powell reiterated his view before the Senate Banking Committee that inflation pressures should remain elevated before moderating closer to the Fed's 2% longer-run goal.

In the European region, the core eurozone bond yields rose amid a sell-off in global developed market bonds and as hawkish Federal Reserve comments raised expectations of imminent U.S. monetary policy tightening. German inflation also reached a 29-year high of 4.1%, which contributed to the uptick in core bond yields. Peripheral and UK government bonds largely tracked core markets.

The ECB President Christine Lagarde acknowledged in testimony to the European Parliament that inflation in the eurozone could exceed the central bank’s forecasts, which have already been raised twice this year.

What Can We Expect from the Market this Week

A monthly jobs report for September that’s scheduled to be released on Friday will show whether August’s slowdown in jobs growth was a temporary setback or the start of a longer trend. In August, U.S. payroll growth slowed sharply, as the economy generated 235,000 new jobs, trailing gains of nearly 1.1 million in July and 962,000 in June.

Some important U.S. economic data being released this week include the factory orders, trade balance, consumer credit, wholesale inventories, unemployment rate and the PMI.